Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

for the year ended 30 September 2006<br />

2. ACCOUNTING POLICIES (cont’d)<br />

2.13 Intangible Assets (cont’d)<br />

Internally generated goodwill <strong>and</strong> internally generated intangible asset arising from research are not<br />

capitalised <strong>and</strong> the expenditure is charged to the profit statement when it is incurred. Internally generated<br />

intangible asset arising from development is capitalised only when its future recoverability can reasonably be<br />

regarded as assured.<br />

Intangible assets are tested for impairment annually or more frequently if events or changes in circumstances<br />

indicate that the carrying value might be impaired. Useful lives are also examined on an annual basis <strong>and</strong><br />

adjustments, where applicable, are made on a prospective basis.<br />

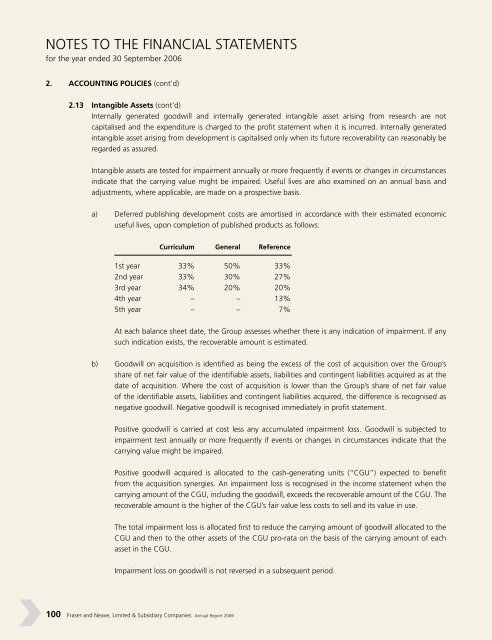

a) Deferred publishing development costs are amortised in accordance with their estimated economic<br />

useful lives, upon completion of published products as follows:<br />

Curriculum General Reference<br />

1st year 33% 50% 33%<br />

2nd year 33% 30% 27%<br />

3rd year 34% 20% 20%<br />

4th year – – 13%<br />

5th year – – 7%<br />

At each balance sheet date, the Group assesses whether there is any indication of impairment. If any<br />

such indication exists, the recoverable amount is estimated.<br />

b) Goodwill on acquisition is identified as being the excess of the cost of acquisition over the Group’s<br />

share of net fair value of the identifiable assets, liabilities <strong>and</strong> contingent liabilities acquired as at the<br />

date of acquisition. Where the cost of acquisition is lower than the Group’s share of net fair value<br />

of the identifiable assets, liabilities <strong>and</strong> contingent liabilities acquired, the difference is recognised as<br />

negative goodwill. Negative goodwill is recognised immediately in profit statement.<br />

Positive goodwill is carried at cost less any accumulated impairment loss. Goodwill is subjected to<br />

impairment test annually or more frequently if events or changes in circumstances indicate that the<br />

carrying value might be impaired.<br />

Positive goodwill acquired is allocated to the cash-generating units (“CGU”) expected to benefit<br />

from the acquisition synergies. An impairment loss is recognised in the income statement when the<br />

carrying amount of the CGU, including the goodwill, exceeds the recoverable amount of the CGU. The<br />

recoverable amount is the higher of the CGU’s fair value less costs to sell <strong>and</strong> its value in use.<br />

The total impairment loss is allocated first to reduce the carrying amount of goodwill allocated to the<br />

CGU <strong>and</strong> then to the other assets of the CGU pro-rata on the basis of the carrying amount of each<br />

asset in the CGU.<br />

Impairment loss on goodwill is not reversed in a subsequent period.<br />

100 <strong>Fraser</strong> <strong>and</strong> <strong>Neave</strong>, <strong>Limited</strong> & Subsidiary Companies Annual <strong>Report</strong> 2006