Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

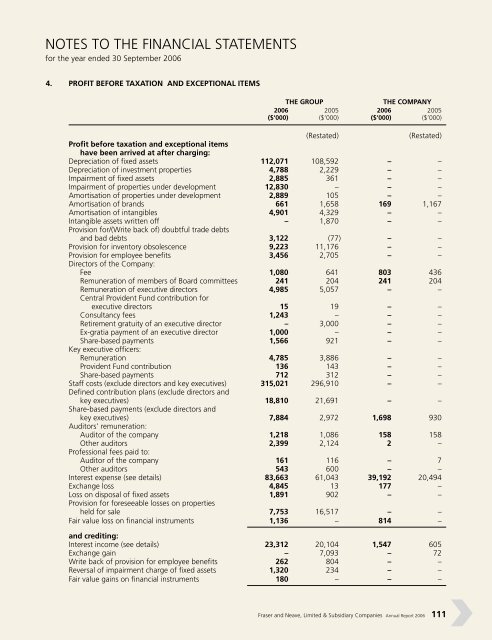

NOTES TO THE FINANCIAL STATEMENTS<br />

for the year ended 30 September 2006<br />

4. PROFIT BEFORE TAXATION AND EXCEPTIONAL ITEMS<br />

THE GROUP THE COMPANY<br />

2006 2005 2006 2005<br />

($’000) ($’000) ($’000) ($’000)<br />

(Restated) (Restated)<br />

Profit before taxation <strong>and</strong> exceptional items<br />

have been arrived at after charging:<br />

Depreciation of fixed assets 112,071 108,592 – –<br />

Depreciation of investment properties 4,788 2,229 – –<br />

Impairment of fixed assets 2,885 361 – –<br />

Impairment of properties under development 12,830 – – –<br />

Amortisation of properties under development 2,889 105 – –<br />

Amortisation of br<strong>and</strong>s 661 1,658 169 1,167<br />

Amortisation of intangibles 4,901 4,329 – –<br />

Intangible assets written off – 1,870 – –<br />

Provision for/(Write back of) doubtful trade debts<br />

<strong>and</strong> bad debts 3,122 (77) – –<br />

Provision for inventory obsolescence 9,223 11,176 – –<br />

Provision for employee benefits<br />

Directors of the Company:<br />

3,456 2,705 – –<br />

Fee 1,080 641 803 436<br />

Remuneration of members of Board committees 241 204 241 204<br />

Remuneration of executive directors<br />

Central Provident Fund contribution for<br />

4,985 5,057 – –<br />

executive directors 15 19 – –<br />

Consultancy fees 1,243 – – –<br />

Retirement gratuity of an executive director – 3,000 – –<br />

Ex-gratia payment of an executive director 1,000 – – –<br />

Share-based payments<br />

Key executive officers:<br />

1,566 921 – –<br />

Remuneration 4,785 3,886 – –<br />

Provident Fund contribution 136 143 – –<br />

Share-based payments 712 312 – –<br />

Staff costs (exclude directors <strong>and</strong> key executives)<br />

Defined contribution plans (exclude directors <strong>and</strong><br />

315,021 296,910 – –<br />

key executives)<br />

Share-based payments (exclude directors <strong>and</strong><br />

18,810 21,691 – –<br />

key executives)<br />

Auditors’ remuneration:<br />

7,884 2,972 1,698 930<br />

Auditor of the company 1,218 1,086 158 158<br />

Other auditors<br />

Professional fees paid to:<br />

2,399 2,124 2 –<br />

Auditor of the company 161 116 – 7<br />

Other auditors 543 600 – –<br />

Interest expense (see details) 83,663 61,043 39,192 20,494<br />

Exchange loss 4,845 13 177 –<br />

Loss on disposal of fixed assets<br />

Provision for foreseeable losses on properties<br />

1,891 902 – –<br />

held for sale 7,753 16,517 – –<br />

Fair value loss on financial instruments 1,136 – 814 –<br />

<strong>and</strong> crediting:<br />

Interest income (see details) 23,312 20,104 1,547 605<br />

Exchange gain – 7,093 – 72<br />

Write back of provision for employee benefits 262 804 – –<br />

Reversal of impairment charge of fixed assets 1,320 234 – –<br />

Fair value gains on financial instruments 180 – – –<br />

<strong>Fraser</strong> <strong>and</strong> <strong>Neave</strong>, <strong>Limited</strong> & Subsidiary Companies Annual <strong>Report</strong> 2006 111