Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

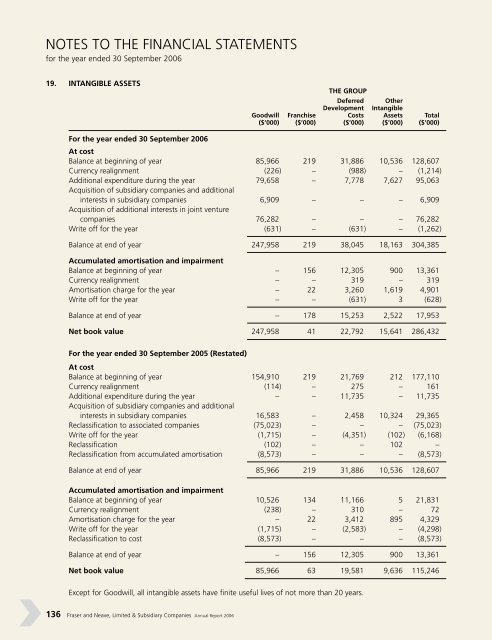

NOTES TO THE FINANCIAL STATEMENTS<br />

for the year ended 30 September 2006<br />

19. INTANGIBLE ASSETS<br />

For the year ended 30 September 2006<br />

136 <strong>Fraser</strong> <strong>and</strong> <strong>Neave</strong>, <strong>Limited</strong> & Subsidiary Companies Annual <strong>Report</strong> 2006<br />

THE GROUP<br />

Deferred Other<br />

Development Intangible<br />

Goodwill Franchise Costs Assets Total<br />

($’000) ($’000) ($’000) ($’000) ($’000)<br />

At cost<br />

Balance at beginning of year 85,966 219 31,886 10,536 128,607<br />

Currency realignment (226) – (988) – (1,214)<br />

Additional expenditure during the year 79,658 – 7,778 7,627 95,063<br />

Acquisition of subsidiary companies <strong>and</strong> additional<br />

interests in subsidiary companies 6,909 – – – 6,909<br />

Acquisition of additional interests in joint venture<br />

companies 76,282 – – – 76,282<br />

Write off for the year (631) – (631) – (1,262)<br />

Balance at end of year 247,958 219 38,045 18,163 304,385<br />

Accumulated amortisation <strong>and</strong> impairment<br />

Balance at beginning of year – 156 12,305 900 13,361<br />

Currency realignment – – 319 – 319<br />

Amortisation charge for the year – 22 3,260 1,619 4,901<br />

Write off for the year – – (631) 3 (628)<br />

Balance at end of year – 178 15,253 2,522 17,953<br />

Net book value 247,958 41 22,792 15,641 286,432<br />

For the year ended 30 September 2005 (Restated)<br />

At cost<br />

Balance at beginning of year 154,910 219 21,769 212 177,110<br />

Currency realignment (114) – 275 – 161<br />

Additional expenditure during the year – – 11,735 – 11,735<br />

Acquisition of subsidiary companies <strong>and</strong> additional<br />

interests in subsidiary companies 16,583 – 2,458 10,324 29,365<br />

Reclassification to associated companies (75,023) – – – (75,023)<br />

Write off for the year (1,715) – (4,351) (102) (6,168)<br />

Reclassification (102) – – 102 –<br />

Reclassification from accumulated amortisation (8,573) – – – (8,573)<br />

Balance at end of year 85,966 219 31,886 10,536 128,607<br />

Accumulated amortisation <strong>and</strong> impairment<br />

Balance at beginning of year 10,526 134 11,166 5 21,831<br />

Currency realignment (238) – 310 – 72<br />

Amortisation charge for the year – 22 3,412 895 4,329<br />

Write off for the year (1,715) – (2,583) – (4,298)<br />

Reclassification to cost (8,573) – – – (8,573)<br />

Balance at end of year – 156 12,305 900 13,361<br />

Net book value 85,966 63 19,581 9,636 115,246<br />

Except for Goodwill, all intangible assets have finite useful lives of not more than 20 years.