Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

for the year ended 30 September 2006<br />

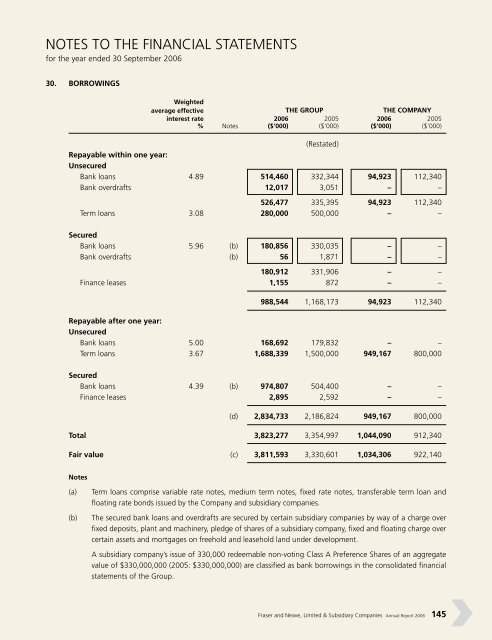

30. BORROWINGS<br />

Weighted<br />

average effective THE GROUP THE COMPANY<br />

interest rate 2006 2005 2006 2005<br />

% Notes ($’000) ($’000) ($’000) ($’000)<br />

(Restated)<br />

Repayable within one year:<br />

Unsecured<br />

Bank loans 4.89 514,460 332,344 94,923 112,340<br />

Bank overdrafts 12,017 3,051 – –<br />

526,477 335,395 94,923 112,340<br />

Term loans 3.08 280,000 500,000 – –<br />

Secured<br />

Bank loans 5.96 (b) 180,856 330,035 – –<br />

Bank overdrafts (b) 56 1,871 – –<br />

180,912 331,906 – –<br />

Finance leases 1,155 872 – –<br />

988,544 1,168,173 94,923 112,340<br />

Repayable after one year:<br />

Unsecured<br />

Bank loans 5.00 168,692 179,832 – –<br />

Term loans 3.67 1,688,339 1,500,000 949,167 800,000<br />

Secured<br />

Bank loans 4.39 (b) 974,807 504,400 – –<br />

Finance leases 2,895 2,592 – –<br />

(d) 2,834,733 2,186,824 949,167 800,000<br />

Total 3,823,277 3,354,997 1,044,090 912,340<br />

Fair value (c) 3,811,593 3,330,601 1,034,306 922,140<br />

Notes<br />

(a) Term loans comprise variable rate notes, medium term notes, fixed rate notes, transferable term loan <strong>and</strong><br />

floating rate bonds issued by the Company <strong>and</strong> subsidiary companies.<br />

(b) The secured bank loans <strong>and</strong> overdrafts are secured by certain subsidiary companies by way of a charge over<br />

fixed deposits, plant <strong>and</strong> machinery, pledge of shares of a subsidiary company, fixed <strong>and</strong> floating charge over<br />

certain assets <strong>and</strong> mortgages on freehold <strong>and</strong> leasehold l<strong>and</strong> under development.<br />

A subsidiary company’s issue of 330,000 redeemable non-voting Class A Preference Shares of an aggregate<br />

value of $330,000,000 (2005: $330,000,000) are classified as bank borrowings in the consolidated financial<br />

statements of the Group.<br />

<strong>Fraser</strong> <strong>and</strong> <strong>Neave</strong>, <strong>Limited</strong> & Subsidiary Companies Annual <strong>Report</strong> 2006 145