Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Full Report - Fraser and Neave Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DIRECTORS’ REPORT<br />

5. SHARE OPTIONS (cont’d)<br />

Statutory <strong>and</strong> other information regarding the Options (cont’d)<br />

(iii) Options expire 119 months after the Offer Date unless an option has previously lapsed by reason of the<br />

resignation of the grantee from employment with the group after the grant of an option <strong>and</strong> before<br />

its exercise.<br />

(iv) The number of shares which may be acquired by a grantee <strong>and</strong> the Exercise Price are subject to<br />

adjustment, as confirmed by the auditors of the Company that such adjustment is fair <strong>and</strong> reasonable,<br />

by reason of any issue of additional shares in the Company by way of rights or capitalisation of profits<br />

or reserves, or repayment <strong>and</strong> reduction of capital, made while an option remains unexercised.<br />

(v) The persons to whom the options have been issued have no right to participate by virtue of the options<br />

in any share issue of any other company.<br />

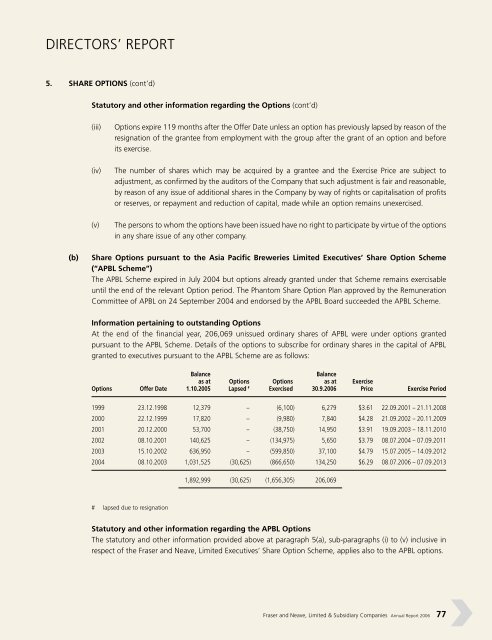

(b) Share Options pursuant to the Asia Pacific Breweries <strong>Limited</strong> Executives’ Share Option Scheme<br />

(“APBL Scheme”)<br />

The APBL Scheme expired in July 2004 but options already granted under that Scheme remains exercisable<br />

until the end of the relevant Option period. The Phantom Share Option Plan approved by the Remuneration<br />

Committee of APBL on 24 September 2004 <strong>and</strong> endorsed by the APBL Board succeeded the APBL Scheme.<br />

Information pertaining to outst<strong>and</strong>ing Options<br />

At the end of the financial year, 206,069 unissued ordinary shares of APBL were under options granted<br />

pursuant to the APBL Scheme. Details of the options to subscribe for ordinary shares in the capital of APBL<br />

granted to executives pursuant to the APBL Scheme are as follows:<br />

Balance Balance<br />

as at Options Options as at Exercise<br />

Options Offer Date 1.10.2005 Lapsed # Exercised 30.9.2006 Price Exercise Period<br />

1999 23.12.1998 12,379 – (6,100) 6,279 $3.61 22.09.2001 – 21.11.2008<br />

2000 22.12.1999 17,820 – (9,980) 7,840 $4.28 21.09.2002 – 20.11.2009<br />

2001 20.12.2000 53,700 – (38,750) 14,950 $3.91 19.09.2003 – 18.11.2010<br />

2002 08.10.2001 140,625 – (134,975) 5,650 $3.79 08.07.2004 – 07.09.2011<br />

2003 15.10.2002 636,950 – (599,850) 37,100 $4.79 15.07.2005 – 14.09.2012<br />

2004 08.10.2003 1,031,525 (30,625) (866,650) 134,250 $6.29 08.07.2006 – 07.09.2013<br />

# lapsed due to resignation<br />

1,892,999 (30,625) (1,656,305) 206,069<br />

Statutory <strong>and</strong> other information regarding the APBL Options<br />

The statutory <strong>and</strong> other information provided above at paragraph 5(a), sub-paragraphs (i) to (v) inclusive in<br />

respect of the <strong>Fraser</strong> <strong>and</strong> <strong>Neave</strong>, <strong>Limited</strong> Executives’ Share Option Scheme, applies also to the APBL options.<br />

<strong>Fraser</strong> <strong>and</strong> <strong>Neave</strong>, <strong>Limited</strong> & Subsidiary Companies Annual <strong>Report</strong> 2006 77