CITY OF GREATER GEELONG 2012-2013 Rating StRategy

CITY OF GREATER GEELONG 2012-2013 Rating StRategy

CITY OF GREATER GEELONG 2012-2013 Rating StRategy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

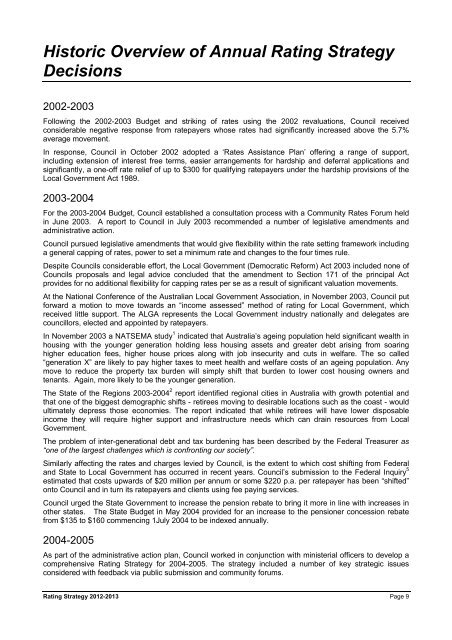

Historic Overview of Annual <strong>Rating</strong> Strategy<br />

Decisions<br />

2002-2003<br />

Following the 2002-2003 Budget and striking of rates using the 2002 revaluations, Council received<br />

considerable negative response from ratepayers whose rates had significantly increased above the 5.7%<br />

average movement.<br />

In response, Council in October 2002 adopted a ‘Rates Assistance Plan’ offering a range of support,<br />

including extension of interest free terms, easier arrangements for hardship and deferral applications and<br />

significantly, a one-off rate relief of up to $300 for qualifying ratepayers under the hardship provisions of the<br />

Local Government Act 1989.<br />

2003-2004<br />

For the 2003-2004 Budget, Council established a consultation process with a Community Rates Forum held<br />

in June 2003. A report to Council in July 2003 recommended a number of legislative amendments and<br />

administrative action.<br />

Council pursued legislative amendments that would give flexibility within the rate setting framework including<br />

a general capping of rates, power to set a minimum rate and changes to the four times rule.<br />

Despite Councils considerable effort, the Local Government (Democratic Reform) Act 2003 included none of<br />

Councils proposals and legal advice concluded that the amendment to Section 171 of the principal Act<br />

provides for no additional flexibility for capping rates per se as a result of significant valuation movements.<br />

At the National Conference of the Australian Local Government Association, in November 2003, Council put<br />

forward a motion to move towards an “income assessed” method of rating for Local Government, which<br />

received little support. The ALGA represents the Local Government industry nationally and delegates are<br />

councillors, elected and appointed by ratepayers.<br />

In November 2003 a NATSEMA study 1 indicated that Australia’s ageing population held significant wealth in<br />

housing with the younger generation holding less housing assets and greater debt arising from soaring<br />

higher education fees, higher house prices along with job insecurity and cuts in welfare. The so called<br />

“generation X” are likely to pay higher taxes to meet health and welfare costs of an ageing population. Any<br />

move to reduce the property tax burden will simply shift that burden to lower cost housing owners and<br />

tenants. Again, more likely to be the younger generation.<br />

The State of the Regions 2003-2004 2 report identified regional cities in Australia with growth potential and<br />

that one of the biggest demographic shifts - retirees moving to desirable locations such as the coast - would<br />

ultimately depress those economies. The report indicated that while retirees will have lower disposable<br />

income they will require higher support and infrastructure needs which can drain resources from Local<br />

Government.<br />

The problem of inter-generational debt and tax burdening has been described by the Federal Treasurer as<br />

“one of the largest challenges which is confronting our society”.<br />

Similarly affecting the rates and charges levied by Council, is the extent to which cost shifting from Federal<br />

and State to Local Government has occurred in recent years. Council’s submission to the Federal Inquiry 5<br />

estimated that costs upwards of $20 million per annum or some $220 p.a. per ratepayer has been “shifted”<br />

onto Council and in turn its ratepayers and clients using fee paying services.<br />

Council urged the State Government to increase the pension rebate to bring it more in line with increases in<br />

other states. The State Budget in May 2004 provided for an increase to the pensioner concession rebate<br />

from $135 to $160 commencing 1July 2004 to be indexed annually.<br />

2004-2005<br />

As part of the administrative action plan, Council worked in conjunction with ministerial officers to develop a<br />

comprehensive <strong>Rating</strong> Strategy for 2004-2005. The strategy included a number of key strategic issues<br />

considered with feedback via public submission and community forums.<br />

<strong>Rating</strong> Strategy <strong>2012</strong>-<strong>2013</strong> Page 9