CITY OF GREATER GEELONG 2012-2013 Rating StRategy

CITY OF GREATER GEELONG 2012-2013 Rating StRategy

CITY OF GREATER GEELONG 2012-2013 Rating StRategy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Deferral of Rates - LGA Section 170<br />

The option to defer rates is a legislative provision – LGA Section 170.<br />

Council has determined that the deferral of rates be extended to include both residential and non-investment<br />

vacant land ratepayers.<br />

Promotion of this option will occur on the rate notice, rate brochures and web site.<br />

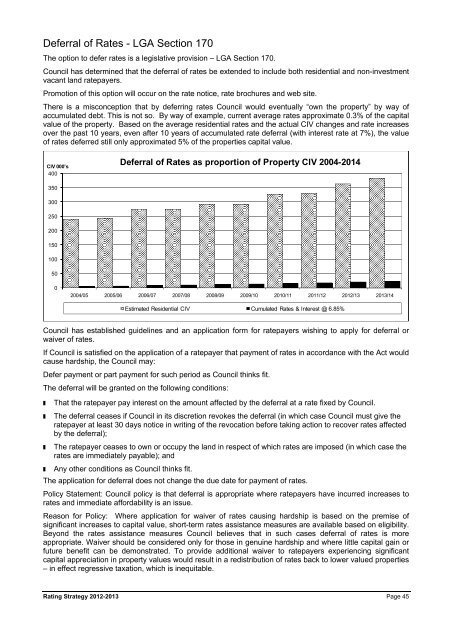

There is a misconception that by deferring rates Council would eventually “own the property” by way of<br />

accumulated debt. This is not so. By way of example, current average rates approximate 0.3% of the capital<br />

value of the property. Based on the average residential rates and the actual CIV changes and rate increases<br />

over the past 10 years, even after 10 years of accumulated rate deferral (with interest rate at 7%), the value<br />

of rates deferred still only approximated 5% of the properties capital value.<br />

CIV 000's<br />

Deferral of Rates as proportion of Property CIV 2004-2014<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2004/05 2005/06 2006/07 2007/08 2008/09 2009/10 2010/11 2011/12 <strong>2012</strong>/13 <strong>2013</strong>/14<br />

Estimated Residential CIV Cumulated Rates & Interest @ 6.85%<br />

Council has established guidelines and an application form for ratepayers wishing to apply for deferral or<br />

waiver of rates.<br />

If Council is satisfied on the application of a ratepayer that payment of rates in accordance with the Act would<br />

cause hardship, the Council may:<br />

Defer payment or part payment for such period as Council thinks fit.<br />

The deferral will be granted on the following conditions:<br />

That the ratepayer pay interest on the amount affected by the deferral at a rate fixed by Council.<br />

The deferral ceases if Council in its discretion revokes the deferral (in which case Council must give the<br />

ratepayer at least 30 days notice in writing of the revocation before taking action to recover rates affected<br />

by the deferral);<br />

The ratepayer ceases to own or occupy the land in respect of which rates are imposed (in which case the<br />

rates are immediately payable); and<br />

Any other conditions as Council thinks fit.<br />

The application for deferral does not change the due date for payment of rates.<br />

Policy Statement: Council policy is that deferral is appropriate where ratepayers have incurred increases to<br />

rates and immediate affordability is an issue.<br />

Reason for Policy: Where application for waiver of rates causing hardship is based on the premise of<br />

significant increases to capital value, short-term rates assistance measures are available based on eligibility.<br />

Beyond the rates assistance measures Council believes that in such cases deferral of rates is more<br />

appropriate. Waiver should be considered only for those in genuine hardship and where little capital gain or<br />

future benefit can be demonstrated. To provide additional waiver to ratepayers experiencing significant<br />

capital appreciation in property values would result in a redistribution of rates back to lower valued properties<br />

– in effect regressive taxation, which is inequitable.<br />

<strong>Rating</strong> Strategy <strong>2012</strong>-<strong>2013</strong> Page 45