CITY OF GREATER GEELONG 2012-2013 Rating StRategy

CITY OF GREATER GEELONG 2012-2013 Rating StRategy

CITY OF GREATER GEELONG 2012-2013 Rating StRategy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

or<br />

can demonstrate that they are of low income status with a maximum income of $31,755 or less (Statement<br />

of Earnings SOE - Centrelink or most recent tax assessment notice).<br />

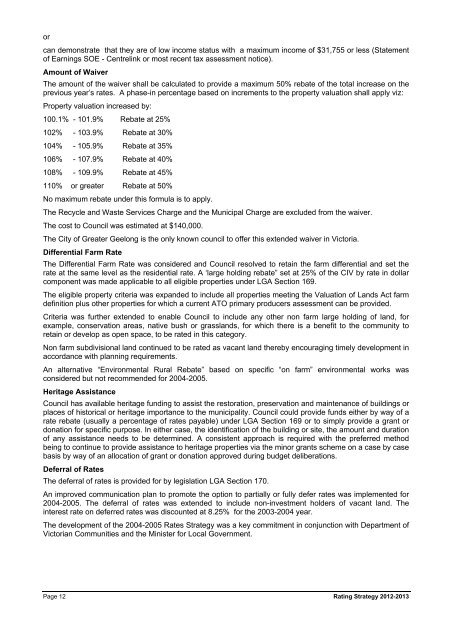

Amount of Waiver<br />

The amount of the waiver shall be calculated to provide a maximum 50% rebate of the total increase on the<br />

previous year’s rates. A phase-in percentage based on increments to the property valuation shall apply viz:<br />

Property valuation increased by:<br />

100.1% - 101.9% Rebate at 25%<br />

102% - 103.9% Rebate at 30%<br />

104% - 105.9% Rebate at 35%<br />

106% - 107.9% Rebate at 40%<br />

108% - 109.9% Rebate at 45%<br />

110% or greater Rebate at 50%<br />

No maximum rebate under this formula is to apply.<br />

The Recycle and Waste Services Charge and the Municipal Charge are excluded from the waiver.<br />

The cost to Council was estimated at $140,000.<br />

The City of Greater Geelong is the only known council to offer this extended waiver in Victoria.<br />

Differential Farm Rate<br />

The Differential Farm Rate was considered and Council resolved to retain the farm differential and set the<br />

rate at the same level as the residential rate. A ‘large holding rebate” set at 25% of the CIV by rate in dollar<br />

component was made applicable to all eligible properties under LGA Section 169.<br />

The eligible property criteria was expanded to include all properties meeting the Valuation of Lands Act farm<br />

definition plus other properties for which a current ATO primary producers assessment can be provided.<br />

Criteria was further extended to enable Council to include any other non farm large holding of land, for<br />

example, conservation areas, native bush or grasslands, for which there is a benefit to the community to<br />

retain or develop as open space, to be rated in this category.<br />

Non farm subdivisional land continued to be rated as vacant land thereby encouraging timely development in<br />

accordance with planning requirements.<br />

An alternative “Environmental Rural Rebate” based on specific “on farm” environmental works was<br />

considered but not recommended for 2004-2005.<br />

Heritage Assistance<br />

Council has available heritage funding to assist the restoration, preservation and maintenance of buildings or<br />

places of historical or heritage importance to the municipality. Council could provide funds either by way of a<br />

rate rebate (usually a percentage of rates payable) under LGA Section 169 or to simply provide a grant or<br />

donation for specific purpose. In either case, the identification of the building or site, the amount and duration<br />

of any assistance needs to be determined. A consistent approach is required with the preferred method<br />

being to continue to provide assistance to heritage properties via the minor grants scheme on a case by case<br />

basis by way of an allocation of grant or donation approved during budget deliberations.<br />

Deferral of Rates<br />

The deferral of rates is provided for by legislation LGA Section 170.<br />

An improved communication plan to promote the option to partially or fully defer rates was implemented for<br />

2004-2005. The deferral of rates was extended to include non-investment holders of vacant land. The<br />

interest rate on deferred rates was discounted at 8.25% for the 2003-2004 year.<br />

The development of the 2004-2005 Rates Strategy was a key commitment in conjunction with Department of<br />

Victorian Communities and the Minister for Local Government.<br />

Page 12 <strong>Rating</strong> Strategy <strong>2012</strong>-<strong>2013</strong>