Download Annual Report PDF - Heinz

Download Annual Report PDF - Heinz

Download Annual Report PDF - Heinz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

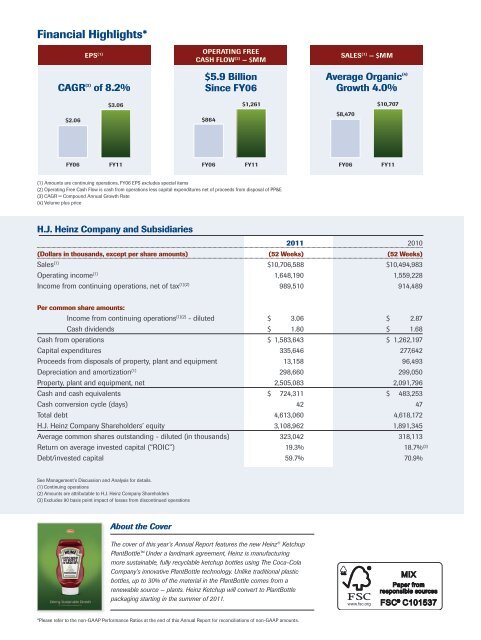

Financial Highlights*<br />

EPS (1)<br />

CAGR (3) of 8.2%<br />

OPERATING FREE<br />

CASH FLOW (2) — $MM<br />

$5.9 Billion<br />

Since FY06<br />

SALES (1) — $MM<br />

Average Organic (4)<br />

Growth 4.0%<br />

$3.06<br />

$1,261<br />

$10,707<br />

$2.06<br />

$864<br />

$8,470<br />

FY06<br />

FY11<br />

FY06<br />

FY11<br />

FY06<br />

FY11<br />

(1) Amounts are continuing operations, FY06 EPS excludes special items<br />

(2) Operating Free Cash Flow is cash from operations less capital expenditures net of proceeds from disposal of PP&E<br />

(3) CAGR = Compound <strong>Annual</strong> Growth Rate<br />

(4) Volume plus price<br />

H.J. <strong>Heinz</strong> Company and Subsidiaries<br />

2011 2010<br />

(Dollars in thousands, except per share amounts) (52 Weeks) (52 Weeks)<br />

Sales (1) $10,706,588 $10,494,983<br />

Operating income (1) 1,648,190 1,559,228<br />

Income from continuing operations, net of tax (1)(2) 989,510 914,489<br />

Per common share amounts:<br />

Income from continuing operations (1)(2) - diluted $ 3.06 $ 2.87<br />

Cash dividends $ 1.80 $ 1.68<br />

Cash from operations $ 1,583,643 $ 1,262,197<br />

Capital expenditures 335,646 277,642<br />

Proceeds from disposals of property, plant and equipment 13,158 96,493<br />

Depreciation and amortization (1) 298,660 299,050<br />

Property, plant and equipment, net 2,505,083 2,091,796<br />

Cash and cash equivalents $ 724,311 $ 483,253<br />

Cash conversion cycle (days) 42 47<br />

Total debt 4,613,060 4,618,172<br />

H.J. <strong>Heinz</strong> Company Shareholders’ equity 3,108,962 1,891,345<br />

Average common shares outstanding - diluted (in thousands) 323,042 318,113<br />

Return on average invested capital (“ROIC”) 19.3% 18.7%<br />

Debt/invested capital 59.7% 70.9%<br />

(3)<br />

See Management’s Discussion and Analysis for details.<br />

(1) Continuing operations<br />

(2) Amounts are attributable to H.J. <strong>Heinz</strong> Company Shareholders<br />

(3) Excludes 90 basis point impact of losses from discontinued operations<br />

About the Cover<br />

The cover of this year’s <strong>Annual</strong> <strong>Report</strong> features the new <strong>Heinz</strong> ® Ketchup<br />

PlantBottle. Under a landmark agreement, <strong>Heinz</strong> is manufacturing<br />

more sustainable, fully recyclable ketchup bottles using The Coca-Cola<br />

Company’s innovative PlantBottle technology. Unlike traditional plastic<br />

bottles, up to 30% of the material in the PlantBottle comes from a<br />

renewable source — plants. <strong>Heinz</strong> Ketchup will convert to PlantBottle<br />

packaging starting in the summer of 2011.<br />

*Please refer to the non-GAAP Performance Ratios at the end of this <strong>Annual</strong> <strong>Report</strong> for reconciliations of non-GAAP amounts.