Download Annual Report PDF - Heinz

Download Annual Report PDF - Heinz

Download Annual Report PDF - Heinz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

As of April 27, 2011, the Company was a party to two operating leases for buildings and<br />

equipment under which the Company has guaranteed supplemental payment obligations of<br />

approximately $135 million at the termination of these leases. The Company believes, based on<br />

current facts and circumstances, that any payment pursuant to these guarantees is remote.<br />

The Company acted as servicer for $29 million and $84 million of U.S. trade receivables sold<br />

through an accounts receivable securitization program that are not recognized on the balance sheet<br />

as of April 27, 2011 and April 28, 2010, respectively. In addition, the Company acted as servicer for<br />

approximately $146 million and $126 million of trade receivables which were sold to unrelated third<br />

parties without recourse as of April 27, 2011 and April 28, 2010, respectively.<br />

No significant credit guarantees existed between the Company and third parties as of April 27,<br />

2011.<br />

Market Risk Factors<br />

The Company is exposed to market risks from adverse changes in foreign exchange rates,<br />

interest rates, commodity prices and production costs. As a policy, the Company does not engage in<br />

speculative or leveraged transactions, nor does the Company hold or issue financial instruments for<br />

trading purposes.<br />

Foreign Exchange Rate Sensitivity: The Company’s cash flow and earnings are subject to<br />

fluctuations due to exchange rate variation. Foreign currency risk exists by nature of the Company’s<br />

global operations. The Company manufactures and sells its products on six continents around the<br />

world, and hence foreign currency risk is diversified.<br />

The Company may attempt to limit its exposure to changing foreign exchange rates through both<br />

operational and financial market actions. These actions may include entering into forward contracts,<br />

option contracts, or cross currency swaps to hedge existing exposures, firm commitments and<br />

forecasted transactions. The instruments are used to reduce risk by essentially creating<br />

offsetting currency exposures.<br />

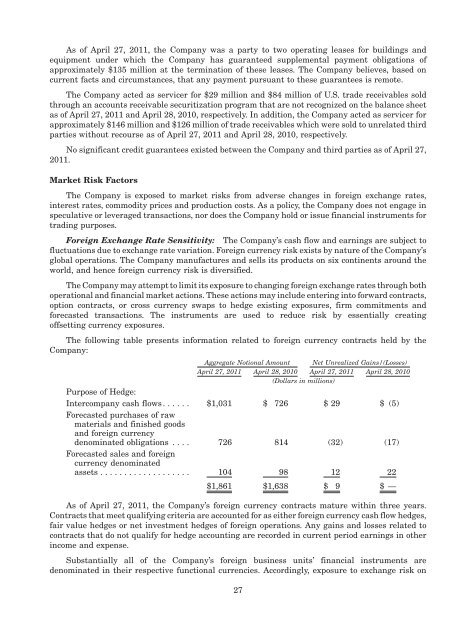

The following table presents information related to foreign currency contracts held by the<br />

Company:<br />

Aggregate Notional Amount Net Unrealized Gains/(Losses)<br />

April 27, 2011 April 28, 2010 April 27, 2011 April 28, 2010<br />

(Dollars in millions)<br />

Purpose of Hedge:<br />

Intercompany cash flows. . . . . . $1,031 $ 726 $ 29 $ (5)<br />

Forecasted purchases of raw<br />

materials and finished goods<br />

and foreign currency<br />

denominated obligations . . . . 726 814 (32) (17)<br />

Forecasted sales and foreign<br />

currency denominated<br />

assets . . . . . . . . . . . . . . . . . . . 104 98 12 22<br />

$1,861 $1,638 $ 9 $ —<br />

As of April 27, 2011, the Company’s foreign currency contracts mature within three years.<br />

Contracts that meet qualifying criteria are accounted for as either foreign currency cash flow hedges,<br />

fair value hedges or net investment hedges of foreign operations. Any gains and losses related to<br />

contracts that do not qualify for hedge accounting are recorded in current period earnings in other<br />

income and expense.<br />

Substantially all of the Company’s foreign business units’ financial instruments are<br />

denominated in their respective functional currencies. Accordingly, exposure to exchange risk on<br />

27