Download Annual Report PDF - Heinz

Download Annual Report PDF - Heinz

Download Annual Report PDF - Heinz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

H. J. <strong>Heinz</strong> Company and Subsidiaries<br />

Notes to Consolidated Financial Statements — (Continued)<br />

performance. The amendment also requires additional disclosures about a reporting entity’s<br />

involvement with variable interest entities and any significant changes in risk exposure due to<br />

that involvement. A reporting entity is required to disclose how its involvement with a variable<br />

interest entity affects the reporting entity’s financial statements. The Company adopted this<br />

amendment on April 29, 2010, the first day of Fiscal 2011. This adoption did not have a material<br />

impact on the Company’s financial statements.<br />

3. Discontinued Operations and Other Disposals<br />

During the third quarter of Fiscal 2010, the Company completed the sale of its Appetizers And,<br />

Inc. frozen hors d’oeuvres business which was previously reported within the U.S. Foodservice<br />

segment, resulting in a $14.5 million pre-tax ($10.4 million after-tax) loss. Also during the third<br />

quarter of Fiscal 2010, the Company completed the sale of its private label frozen desserts business in<br />

the U.K., resulting in a $31.4 million pre-tax ($23.6 million after-tax) loss. During the second quarter<br />

of Fiscal 2010, the Company completed the sale of its Kabobs frozen hors d’oeuvres business which<br />

was previously reported within the U.S. Foodservice segment, resulting in a $15.0 million pre-tax<br />

($10.9 million after-tax) loss. The losses on each of these transactions have been recorded in<br />

discontinued operations.<br />

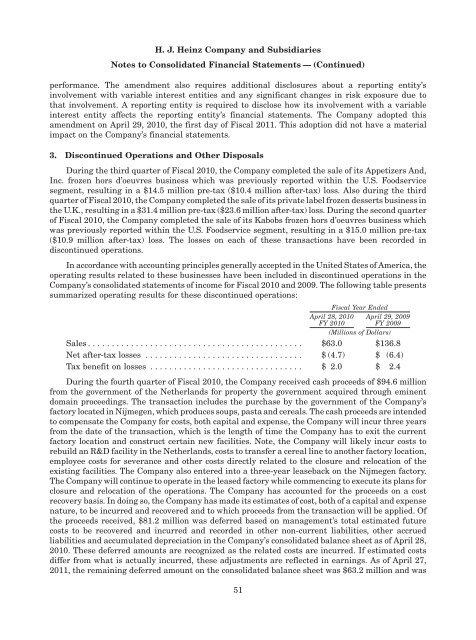

In accordance with accounting principles generally accepted in the United States of America, the<br />

operating results related to these businesses have been included in discontinued operations in the<br />

Company’s consolidated statements of income for Fiscal 2010 and 2009. The following table presents<br />

summarized operating results for these discontinued operations:<br />

Fiscal Year Ended<br />

April 28, 2010 April 29, 2009<br />

FY 2010 FY 2009<br />

(Millions of Dollars)<br />

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $63.0 $136.8<br />

Net after-tax losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (4.7) $ (6.4)<br />

Tax benefit on losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.0 $ 2.4<br />

During the fourth quarter of Fiscal 2010, the Company received cash proceeds of $94.6 million<br />

from the government of the Netherlands for property the government acquired through eminent<br />

domain proceedings. The transaction includes the purchase by the government of the Company’s<br />

factory located in Nijmegen, which produces soups, pasta and cereals. The cash proceeds are intended<br />

to compensate the Company for costs, both capital and expense, the Company will incur three years<br />

from the date of the transaction, which is the length of time the Company has to exit the current<br />

factory location and construct certain new facilities. Note, the Company will likely incur costs to<br />

rebuild an R&D facility in the Netherlands, costs to transfer a cereal line to another factory location,<br />

employee costs for severance and other costs directly related to the closure and relocation of the<br />

existing facilities. The Company also entered into a three-year leaseback on the Nijmegen factory.<br />

The Company will continue to operate in the leased factory while commencing to execute its plans for<br />

closure and relocation of the operations. The Company has accounted for the proceeds on a cost<br />

recovery basis. In doing so, the Company has made its estimates of cost, both of a capital and expense<br />

nature, to be incurred and recovered and to which proceeds from the transaction will be applied. Of<br />

the proceeds received, $81.2 million was deferred based on management’s total estimated future<br />

costs to be recovered and incurred and recorded in other non-current liabilities, other accrued<br />

liabilities and accumulated depreciation in the Company’s consolidated balance sheet as of April 28,<br />

2010. These deferred amounts are recognized as the related costs are incurred. If estimated costs<br />

differ from what is actually incurred, these adjustments are reflected in earnings. As of April 27,<br />

2011, the remaining deferred amount on the consolidated balance sheet was $63.2 million and was<br />

51