Download Annual Report PDF - Heinz

Download Annual Report PDF - Heinz

Download Annual Report PDF - Heinz

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

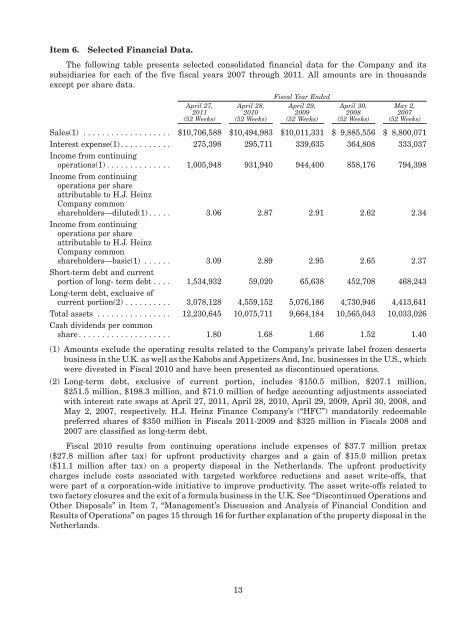

Item 6. Selected Financial Data.<br />

The following table presents selected consolidated financial data for the Company and its<br />

subsidiaries for each of the five fiscal years 2007 through 2011. All amounts are in thousands<br />

except per share data.<br />

April 27,<br />

2011<br />

(52 Weeks)<br />

April 28,<br />

2010<br />

(52 Weeks)<br />

Fiscal Year Ended<br />

April 29,<br />

2009<br />

(52 Weeks)<br />

April 30,<br />

2008<br />

(52 Weeks)<br />

May 2,<br />

2007<br />

(52 Weeks)<br />

Sales(1) ................... $10,706,588 $10,494,983 $10,011,331 $ 9,885,556 $ 8,800,071<br />

Interest expense(1) ........... 275,398 295,711 339,635 364,808 333,037<br />

Income from continuing<br />

operations(1) .............. 1,005,948 931,940 944,400 858,176 794,398<br />

Income from continuing<br />

operations per share<br />

attributable to H.J. <strong>Heinz</strong><br />

Company common<br />

shareholders—diluted(1) ..... 3.06 2.87 2.91 2.62 2.34<br />

Income from continuing<br />

operations per share<br />

attributable to H.J. <strong>Heinz</strong><br />

Company common<br />

shareholders—basic(1) ...... 3.09 2.89 2.95 2.65 2.37<br />

Short-term debt and current<br />

portion of long- term debt .... 1,534,932 59,020 65,638 452,708 468,243<br />

Long-term debt, exclusive of<br />

current portion(2) .......... 3,078,128 4,559,152 5,076,186 4,730,946 4,413,641<br />

Total assets . . .............. 12,230,645 10,075,711 9,664,184 10,565,043 10,033,026<br />

Cash dividends per common<br />

share .................... 1.80 1.68 1.66 1.52 1.40<br />

(1) Amounts exclude the operating results related to the Company’s private label frozen desserts<br />

business in the U.K. as well as the Kabobs and Appetizers And, Inc. businesses in the U.S., which<br />

were divested in Fiscal 2010 and have been presented as discontinued operations.<br />

(2) Long-term debt, exclusive of current portion, includes $150.5 million, $207.1 million,<br />

$251.5 million, $198.3 million, and $71.0 million of hedge accounting adjustments associated<br />

with interest rate swaps at April 27, 2011, April 28, 2010, April 29, 2009, April 30, 2008, and<br />

May 2, 2007, respectively. H.J. <strong>Heinz</strong> Finance Company’s (“HFC”) mandatorily redeemable<br />

preferred shares of $350 million in Fiscals 2011-2009 and $325 million in Fiscals 2008 and<br />

2007 are classified as long-term debt.<br />

Fiscal 2010 results from continuing operations include expenses of $37.7 million pretax<br />

($27.8 million after tax) for upfront productivity charges and a gain of $15.0 million pretax<br />

($11.1 million after tax) on a property disposal in the Netherlands. The upfront productivity<br />

charges include costs associated with targeted workforce reductions and asset write-offs, that<br />

were part of a corporation-wide initiative to improve productivity. The asset write-offs related to<br />

two factory closures and the exit of a formula business in the U.K. See “Discontinued Operations and<br />

Other Disposals” in Item 7, “Management’s Discussion and Analysis of Financial Condition and<br />

Results of Operations” on pages 15 through 16 for further explanation of the property disposal in the<br />

Netherlands.<br />

13