Lessons from the Texas Homeowners Insurance Crisis Bob Puelz ...

Lessons from the Texas Homeowners Insurance Crisis Bob Puelz ...

Lessons from the Texas Homeowners Insurance Crisis Bob Puelz ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

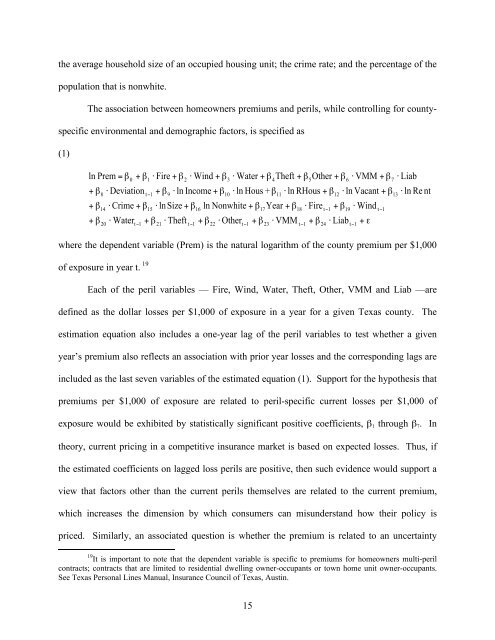

<strong>the</strong> average household size of an occupied housing unit; <strong>the</strong> crime rate; and <strong>the</strong> percentage of <strong>the</strong><br />

population that is nonwhite.<br />

The association between homeowners premiums and perils, while controlling for county-<br />

specific environmental and demographic factors, is specified as<br />

(1)<br />

ln Prem<br />

+ #<br />

+ #<br />

+ #<br />

8<br />

14<br />

20<br />

= #<br />

0<br />

" Deviation<br />

" Crime + #<br />

" Water<br />

+ # " Fire + # " Wind + #<br />

t$<br />

1<br />

1<br />

t$<br />

1<br />

15<br />

+ #<br />

+ #<br />

" ln Income + #<br />

" ln Size + #<br />

21<br />

9<br />

2<br />

" Theft<br />

t$<br />

1<br />

16<br />

ln Nonwhite + #<br />

+ #<br />

22<br />

3<br />

10<br />

" O<strong>the</strong>r<br />

" Water<br />

" ln Hous + #<br />

t$<br />

1<br />

15<br />

+ #<br />

+ #<br />

17<br />

Year + #<br />

23<br />

4<br />

Theft<br />

11<br />

" ln RHous + #<br />

" VMM<br />

+ #<br />

18<br />

t$<br />

1<br />

5<br />

O<strong>the</strong>r<br />

" Fire<br />

+ #<br />

t$<br />

1<br />

24<br />

+ #<br />

12<br />

+ #<br />

6<br />

" Liab<br />

" VMM<br />

" ln Vacant + #<br />

19<br />

" Wind<br />

t$<br />

1<br />

+ !<br />

+ #<br />

t$<br />

1<br />

7<br />

" Liab<br />

13<br />

" ln Re nt<br />

where <strong>the</strong> dependent variable (Prem) is <strong>the</strong> natural logarithm of <strong>the</strong> county premium per $1,000<br />

of exposure in year t. 19<br />

Each of <strong>the</strong> peril variables — Fire, Wind, Water, Theft, O<strong>the</strong>r, VMM and Liab —are<br />

defined as <strong>the</strong> dollar losses per $1,000 of exposure in a year for a given <strong>Texas</strong> county. The<br />

estimation equation also includes a one-year lag of <strong>the</strong> peril variables to test whe<strong>the</strong>r a given<br />

year’s premium also reflects an association with prior year losses and <strong>the</strong> corresponding lags are<br />

included as <strong>the</strong> last seven variables of <strong>the</strong> estimated equation (1). Support for <strong>the</strong> hypo<strong>the</strong>sis that<br />

premiums per $1,000 of exposure are related to peril-specific current losses per $1,000 of<br />

exposure would be exhibited by statistically significant positive coefficients, β1 through β7. In<br />

<strong>the</strong>ory, current pricing in a competitive insurance market is based on expected losses. Thus, if<br />

<strong>the</strong> estimated coefficients on lagged loss perils are positive, <strong>the</strong>n such evidence would support a<br />

view that factors o<strong>the</strong>r than <strong>the</strong> current perils <strong>the</strong>mselves are related to <strong>the</strong> current premium,<br />

which increases <strong>the</strong> dimension by which consumers can misunderstand how <strong>the</strong>ir policy is<br />

priced. Similarly, an associated question is whe<strong>the</strong>r <strong>the</strong> premium is related to an uncertainty<br />

19 It is important to note that <strong>the</strong> dependent variable is specific to premiums for homeowners multi-peril<br />

contracts; contracts that are limited to residential dwelling owner-occupants or town home unit owner-occupants.<br />

See <strong>Texas</strong> Personal Lines Manual, <strong>Insurance</strong> Council of <strong>Texas</strong>, Austin.