The Case for Emerging Market Corporates - IndexUniverse.com

The Case for Emerging Market Corporates - IndexUniverse.com

The Case for Emerging Market Corporates - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

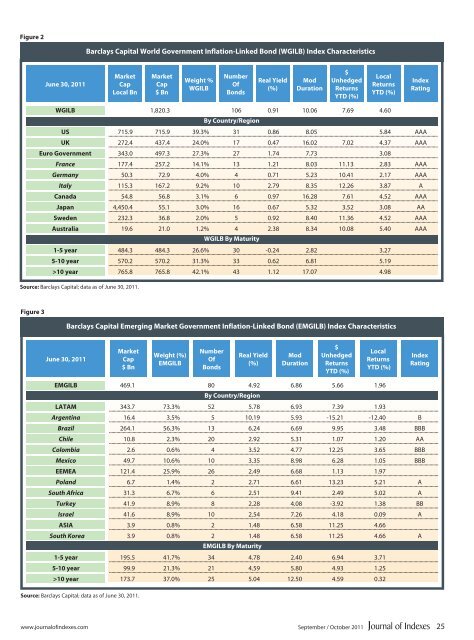

Figure 2<br />

Barclays Capital World Government Inflation-Linked Bond (WGILB) Index Characteristics<br />

June 30, 2011<br />

<strong>Market</strong><br />

Cap<br />

Local Bn<br />

<strong>Market</strong><br />

Cap<br />

$ Bn<br />

Weight %<br />

WGILB<br />

Number<br />

Of<br />

Bonds<br />

Real Yield<br />

(%)<br />

Mod<br />

Duration<br />

$<br />

Unhedged<br />

Returns<br />

YTD (%)<br />

Local<br />

Returns<br />

YTD (%)<br />

Index<br />

Rating<br />

WGILB<br />

US<br />

UK<br />

Euro Government<br />

France<br />

Germany<br />

Italy<br />

Canada<br />

Japan<br />

Sweden<br />

Australia<br />

1-5 year<br />

5-10 year<br />

>10 year<br />

1,820.3 106 0.91 10.06 7.69 4.60<br />

By Country/Region<br />

715.9 715.9 39.3% 31 0.86 8.05 5.84 AAA<br />

272.4 437.4 24.0% 17 0.47 16.02 7.02 4.37 AAA<br />

343.0 497.3 27.3% 27 1.74 7.73 3.08<br />

177.4 257.2 14.1% 13 1.21 8.03 11.13 2.83 AAA<br />

50.3 72.9 4.0% 4 0.71 5.23 10.41 2.17 AAA<br />

115.3 167.2 9.2% 10 2.79 8.35 12.26 3.87 A<br />

54.8 56.8 3.1% 6 0.97 16.28 7.61 4.52 AAA<br />

4,450.4 55.1 3.0% 16 0.67 5.32 3.52 3.08 AA<br />

232.3 36.8 2.0% 5 0.92 8.40 11.36 4.52 AAA<br />

19.6 21.0 1.2% 4 2.38 8.34 10.08 5.40 AAA<br />

WGILB By Maturity<br />

484.3 484.3 26.6% 30 -0.24 2.82 3.27<br />

570.2 570.2 31.3% 33 0.62 6.81 5.19<br />

765.8 765.8 42.1% 43 1.12 17.07 4.98<br />

Source: Barclays Capital; data as of June 30, 2011.<br />

Figure 3<br />

Barclays Capital <strong>Emerging</strong> <strong>Market</strong> Government Inflation-Linked Bond (EMGILB) Index Characteristics<br />

June 30, 2011<br />

<strong>Market</strong><br />

Cap<br />

$ Bn<br />

Weight (%)<br />

EMGILB<br />

Number<br />

Of<br />

Bonds<br />

Real Yield<br />

(%)<br />

Mod<br />

Duration<br />

$<br />

Unhedged<br />

Returns<br />

YTD (%)<br />

Local<br />

Returns<br />

YTD (%)<br />

Index<br />

Rating<br />

EMGILB<br />

LATAM<br />

Argentina<br />

Brazil<br />

Chile<br />

Colombia<br />

Mexico<br />

EEMEA<br />

Poland<br />

South Africa<br />

Turkey<br />

Israel<br />

ASIA<br />

South Korea<br />

1-5 year<br />

5-10 year<br />

>10 year<br />

469.1 80 4.92 6.86 5.66 1.96<br />

By Country/Region<br />

343.7 73.3% 52 5.78 6.93 7.39 1.93<br />

16.4 3.5% 5 10.19 5.93 -15.21 -12.40 B<br />

264.1 56.3% 13 6.24 6.69 9.95 3.48 BBB<br />

10.8 2.3% 20 2.92 5.31 1.07 1.20 AA<br />

2.6 0.6% 4 3.52 4.77 12.25 3.65 BBB<br />

49.7 10.6% 10 3.35 8.98 6.28 1.05 BBB<br />

121.4 25.9% 26 2.49 6.68 1.13 1.97<br />

6.7 1.4% 2 2.71 6.61 13.23 5.21 A<br />

31.3 6.7% 6 2.51 9.41 2.49 5.02 A<br />

41.9 8.9% 8 2.28 4.08 -3.92 1.38 BB<br />

41.6 8.9% 10 2.54 7.26 4.18 0.09 A<br />

3.9 0.8% 2 1.48 6.58 11.25 4.66<br />

3.9 0.8% 2 1.48 6.58 11.25 4.66 A<br />

EMGILB By Maturity<br />

195.5 41.7% 34 4.78 2.40 6.94 3.71<br />

99.9 21.3% 21 4.59 5.80 4.93 1.25<br />

173.7 37.0% 25 5.04 12.50 4.59 0.32<br />

Source: Barclays Capital; data as of June 30, 2011.<br />

www.journalofindexes.<strong>com</strong><br />

September / October 2011 25