The Case for Emerging Market Corporates - IndexUniverse.com

The Case for Emerging Market Corporates - IndexUniverse.com

The Case for Emerging Market Corporates - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Figure 4<br />

Figure 5<br />

Per<strong>for</strong>mance Of Various Indexes,<br />

Cap-Weight, 1957–2010<br />

Per<strong>for</strong>mance Of Various Indexes,<br />

Equal-Weight, 1957–2010<br />

$100,000<br />

$10,000<br />

Growth of $100, from various<br />

cap-weighted indexes<br />

$100,000<br />

$10,000<br />

Growth of $100, from various<br />

equal-weighted indexes<br />

$1,000<br />

$1,000<br />

$100<br />

$100<br />

Source: Research Affiliates, LLC<br />

Figure 6<br />

$0<br />

Jun<br />

’57<br />

Jun<br />

’62<br />

Jun<br />

’67<br />

Jun<br />

’72<br />

Jun<br />

’77<br />

Jun<br />

’82<br />

Jun<br />

’87<br />

Jun<br />

’92<br />

Jun<br />

’97<br />

Jun<br />

’02<br />

N Fortune Not S&P (Cap Weighted) N Fortune 500 (Cap Weighted)<br />

N Overlaps (Cap Weighted) N S&P 500 (Cap Weighted)<br />

N S&P Not Fortune (Cap Weighted) N US 1-Month Treasury Bill<br />

Per<strong>for</strong>mance Of Various Indexes,<br />

Revenue-Weight, 1957–2010<br />

Jun<br />

’07<br />

Figure 7<br />

$0<br />

Jun<br />

’57<br />

Jun<br />

’62<br />

Jun<br />

’67<br />

Source: Research Affiliates, LLC<br />

Jun<br />

’72<br />

Jun<br />

’77<br />

Jun<br />

’82<br />

Jun<br />

’87<br />

Jun<br />

’92<br />

Jun<br />

’97<br />

Jun<br />

’02<br />

N Fortune Not S&P (Equal Weighted) N Fortune 500 (Equal Weighted)<br />

N Overlaps (Equal Weighted) N S&P 500 (Equal Weighted)<br />

N S&P Not Fortune (Equal Weighted) N US 1-Month Treasury Bill<br />

Relative Per<strong>for</strong>mance Of Various<br />

Equal-Weight Indexes, 1957–2010<br />

Jun<br />

’07<br />

$100,000<br />

$10,000<br />

Growth of $100, from various<br />

revenue-weighted indexes<br />

$100,000<br />

$10,000<br />

Relative returns, <strong>for</strong><br />

various index <strong>com</strong>parisons<br />

$1,000<br />

$1,000<br />

$100<br />

$100<br />

$0<br />

Jun<br />

’57<br />

Jun<br />

’62<br />

Jun<br />

’67<br />

Source: Research Affiliates, LLC<br />

Jun<br />

’72<br />

Jun<br />

’77<br />

Jun<br />

’82<br />

Jun<br />

’87<br />

Jun<br />

’92<br />

Jun<br />

’97<br />

Jun<br />

’02<br />

Jun<br />

’07<br />

N Fortune Not S&P (Revenue Weighted) N Fortune 500 (Revenue Weighted)<br />

N Overlaps (Revenue Weighted) N Matched S&P (Revenue Weighted)<br />

N S&P Not Fortune (Revenue Weighted) N US 1-Month Treasury Bill<br />

$0<br />

Jun<br />

’57<br />

Jun<br />

’62<br />

Jun<br />

’67<br />

Source: Research Affiliates, LLC<br />

Jun<br />

’72<br />

Jun<br />

’77<br />

Jun<br />

’82<br />

Jun<br />

’87<br />

Jun<br />

’92<br />

Jun<br />

’97<br />

Jun<br />

’02<br />

Jun<br />

’07<br />

N Fortune Not S&P (Equal Weighted) N Fortune 500 (Equal Weighted)<br />

N Overlaps (Equal Weighted) N S&P 500 (Equal Weighted)<br />

N S&P Not Fortune (Equal Weighted) N Fortune x-S&P (EW) vs. S&P x-Fortune (CW)<br />

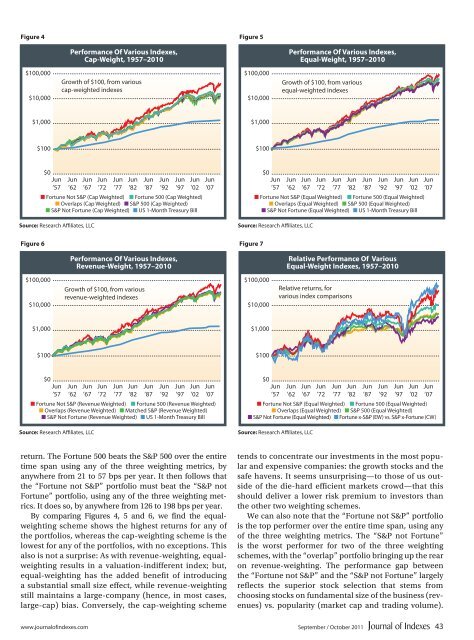

return. <strong>The</strong> Fortune 500 beats the S&P 500 over the entire<br />

time span using any of the three weighting metrics, by<br />

anywhere from 21 to 57 bps per year. It then follows that<br />

the “Fortune not S&P” portfolio must beat the “S&P not<br />

Fortune” portfolio, using any of the three weighting metrics.<br />

It does so, by anywhere from 126 to 198 bps per year.<br />

By <strong>com</strong>paring Figures 4, 5 and 6, we find the equalweighting<br />

scheme shows the highest returns <strong>for</strong> any of<br />

the portfolios, whereas the cap-weighting scheme is the<br />

lowest <strong>for</strong> any of the portfolios, with no exceptions. This<br />

also is not a surprise: As with revenue-weighting, equalweighting<br />

results in a valuation-indifferent index; but,<br />

equal-weighting has the added benefit of introducing<br />

a substantial small size effect, while revenue-weighting<br />

still maintains a large-<strong>com</strong>pany (hence, in most cases,<br />

large-cap) bias. Conversely, the cap-weighting scheme<br />

tends to concentrate our investments in the most popular<br />

and expensive <strong>com</strong>panies: the growth stocks and the<br />

safe havens. It seems unsurprising—to those of us outside<br />

of the die-hard efficient markets crowd—that this<br />

should deliver a lower risk premium to investors than<br />

the other two weighting schemes.<br />

We can also note that the “Fortune not S&P” portfolio<br />

is the top per<strong>for</strong>mer over the entire time span, using any<br />

of the three weighting metrics. <strong>The</strong> “S&P not Fortune”<br />

is the worst per<strong>for</strong>mer <strong>for</strong> two of the three weighting<br />

schemes, with the “overlap” portfolio bringing up the rear<br />

on revenue-weighting. <strong>The</strong> per<strong>for</strong>mance gap between<br />

the “Fortune not S&P” and the “S&P not Fortune” largely<br />

reflects the superior stock selection that stems from<br />

choosing stocks on fundamental size of the business (revenues)<br />

vs. popularity (market cap and trading volume).<br />

www.journalofindexes.<strong>com</strong> September / October 2011 43