US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

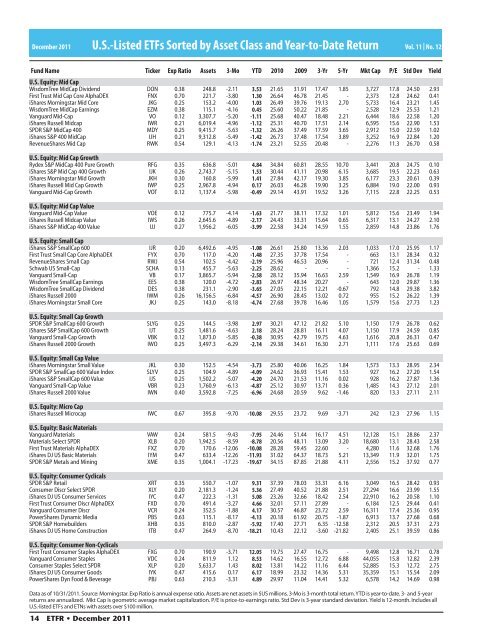

December 2011 U.S.-<strong>Listed</strong> <strong>ETFs</strong> <strong>Sorted</strong> <strong>by</strong> <strong>Asset</strong> <strong>Class</strong> <strong>and</strong> <strong>Year</strong>-<strong>to</strong>-<strong>Date</strong> <strong>Return</strong><br />

Vol. 11 | No. 12<br />

Fund Name Ticker Exp Ratio <strong>Asset</strong>s 3-Mo YTD 2010 2009 3-Yr 5-Yr Mkt Cap P/E Std Dev<br />

U.S. Equity: Mid Cap<br />

WisdomTree MidCap Dividend DON 0.38 248.8 -2.11 3.53 21.65 31.91 17.47 1.85 3,727 17.8 24.50 2.93<br />

First Trust Mid Cap Core AlphaDEX FNX 0.70 221.7 -3.80 1.30 26.64 46.78 21.45 - 2,373 12.8 24.62 0.41<br />

iShares Morningstar Mid Core JKG 0.25 153.2 -4.00 1.03 26.49 39.76 19.13 2.70 5,733 16.4 23.21 1.45<br />

WisdomTree MidCap Earnings EZM 0.38 115.1 -4.16 0.45 25.60 50.22 21.85 - 2,528 12.9 25.53 1.21<br />

Vanguard Mid-Cap VO 0.12 3,307.7 -5.20 -1.11 25.68 40.47 18.48 2.21 6,444 18.6 22.58 1.20<br />

iShares Russell Midcap IWR 0.21 6,019.4 -4.96 -1.12 25.31 40.70 17.51 2.14 6,595 15.6 22.90 1.53<br />

SPDR S&P MidCap 400 MDY 0.25 9,415.7 -5.63 -1.32 26.26 37.49 17.59 3.65 2,912 15.0 22.59 1.02<br />

iShares S&P 400 MidCap IJH 0.21 9,312.8 -5.49 -1.42 26.73 37.48 17.54 3.89 3,252 16.9 22.84 1.20<br />

RevenueShares Mid Cap RWK 0.54 129.1 -4.13 -1.74 23.21 52.55 20.48 - 2,276 11.3 26.70 0.58<br />

U.S. Equity: Mid Cap Growth<br />

Rydex S&P MidCap 400 Pure Growth RFG 0.35 636.8 -5.01 4.84 34.84 60.81 28.55 10.70 3,441 20.8 24.75 0.10<br />

iShares S&P Mid Cap 400 Growth IJK 0.26 2,743.7 -5.15 1.53 30.44 41.11 20.98 6.15 3,685 19.5 22.23 0.63<br />

iShares Morningstar Mid Growth JKH 0.30 160.8 -5.99 1.41 27.84 42.17 19.30 3.85 6,177 23.3 20.61 0.39<br />

iShares Russell Mid Cap Growth IWP 0.25 2,967.8 -4.94 0.17 26.03 46.28 19.90 3.25 6,884 19.0 22.00 0.93<br />

Vanguard Mid-Cap Growth VOT 0.12 1,137.4 -5.98 -0.49 29.14 43.91 19.52 3.26 7,115 22.8 22.25 0.53<br />

U.S. Equity: Mid Cap Value<br />

Vanguard Mid-Cap Value VOE 0.12 775.7 -4.14 -1.63 21.77 38.11 17.32 1.01 5,812 15.6 23.49 1.94<br />

iShares Russell Midcap Value IWS 0.26 2,645.6 -4.89 -2.17 24.43 33.31 15.64 0.65 6,317 13.1 24.27 2.10<br />

iShares S&P MidCap 400 Value IJJ 0.27 1,956.2 -6.05 -3.99 22.58 34.24 14.59 1.55 2,859 14.8 23.86 1.76<br />

U.S. Equity: Small Cap<br />

iShares S&P SmallCap 600 IJR 0.20 6,492.6 -4.95 -1.08 26.61 25.80 13.36 2.03 1,033 17.0 25.95 1.17<br />

First Trust Small Cap Core AlphaDEX FYX 0.70 117.0 -4.20 -1.48 27.35 37.78 17.54 - 663 13.1 28.34 0.32<br />

RevenueShares Small Cap RWJ 0.54 102.5 -4.42 -2.19 25.96 46.53 20.96 - 721 12.4 31.34 0.48<br />

Schwab <strong>US</strong> Small-Cap SCHA 0.13 455.7 -5.63 -2.25 28.62 - - - 1,366 15.2 - 1.33<br />

Vanguard Small-Cap VB 0.17 3,865.7 -5.94 -2.58 28.12 35.94 16.63 2.59 1,549 16.9 26.78 1.19<br />

WisdomTree SmallCap Earnings EES 0.38 120.0 -4.72 -2.83 26.97 48.34 20.27 - 643 12.0 29.87 1.36<br />

WisdomTree SmallCap Dividend DES 0.38 231.1 -2.90 -3.65 27.05 22.15 12.21 -0.67 792 14.8 29.38 3.82<br />

iShares Russell 2000 IWM 0.26 16,156.5 -6.84 -4.57 26.90 28.45 13.02 0.72 955 15.2 26.22 1.39<br />

iShares Morningstar Small Core JKJ 0.25 143.0 -8.18 -4.74 27.68 39.78 16.46 1.05 1,579 15.6 27.73 1.23<br />

U.S. Equity: Small Cap Growth<br />

SPDR S&P SmallCap 600 Growth SLYG 0.25 144.5 -3.98 2.97 30.21 47.12 21.82 5.10 1,150 17.9 26.78 0.62<br />

iShares S&P SmallCap 600 Growth IJT 0.25 1,481.6 -4.63 2.18 28.24 28.81 16.11 4.07 1,150 17.9 24.59 0.85<br />

Vanguard Small-Cap Growth VBK 0.12 1,873.0 -5.85 -0.38 30.95 42.79 19.75 4.63 1,616 20.8 26.31 0.47<br />

iShares Russell 2000 Growth IWO 0.25 3,497.3 -6.29 -2.14 29.38 34.61 16.30 2.71 1,111 17.6 25.63 0.69<br />

U.S. Equity: Small Cap Value<br />

iShares Morningstar Small Value JKL 0.30 152.5 -4.54 -3.73 25.80 40.06 16.25 1.84 1,573 13.3 28.95 2.34<br />

SPDR S&P SmallCap 600 Value Index SLYV 0.25 104.9 -4.89 -4.09 24.62 36.93 15.41 1.53 927 16.2 27.20 1.54<br />

iShares S&P SmallCap 600 Value IJS 0.25 1,502.2 -5.07 -4.20 24.70 21.53 11.16 0.02 928 16.2 27.87 1.36<br />

Vanguard Small-Cap Value VBR 0.23 1,760.9 -6.13 -4.87 25.12 30.97 13.71 0.36 1,485 14.3 27.12 2.01<br />

iShares Russell 2000 Value IWN 0.40 3,592.8 -7.25 -6.96 24.68 20.59 9.62 -1.46 820 13.3 27.11 2.11<br />

U.S. Equity: Micro Cap<br />

iShares Russell Microcap IWC 0.67 395.8 -9.70 -10.08 29.55 23.72 9.69 -3.71 242 12.3 27.96 1.15<br />

U.S. Equity: Basic Materials<br />

Vanguard Materials VAW 0.24 581.5 -9.43 -7.95 24.46 51.44 16.17 4.51 12,128 15.1 28.86 2.37<br />

Materials Select SPDR XLB 0.20 1,942.5 -8.59 -8.78 20.56 48.11 13.09 3.20 18,680 13.1 28.43 2.58<br />

First Trust Materials AlphaDEX FXZ 0.70 170.6 -12.06 -10.08 28.28 59.45 22.60 - 4,280 11.6 32.68 1.76<br />

iShares DJ <strong>US</strong> Basic Materials IYM 0.47 633.4 -12.26 -11.93 31.02 64.37 18.73 5.21 13,349 11.9 32.01 1.75<br />

SPDR S&P Metals <strong>and</strong> Mining XME 0.35 1,004.1 -17.23 -19.67 34.15 87.85 21.88 4.11 2,556 15.2 37.92 0.77<br />

U.S. Equity: Consumer Cyclicals<br />

SPDR S&P Retail XRT 0.35 550.7 -1.07 9.31 37.39 78.03 33.31 6.16 3,049 16.5 28.42 0.93<br />

Consumer Discr Select SPDR XLY 0.20 2,181.3 -1.24 5.36 27.49 40.52 21.88 2.51 27,294 16.6 23.99 1.55<br />

iShares DJ <strong>US</strong> Consumer Services IYC 0.47 222.3 -1.31 5.08 23.26 32.66 18.42 2.54 22,910 16.2 20.58 1.10<br />

First Trust Consumer Discr AlphaDEX FXD 0.70 491.4 -3.27 4.66 32.01 57.11 27.89 - 6,184 12.5 29.44 0.41<br />

Vanguard Consumer Discr VCR 0.24 352.5 -1.88 4.17 30.57 46.87 23.72 2.59 16,311 17.4 25.36 0.95<br />

PowerShares Dynamic Media PBS 0.63 115.1 -8.17 -4.13 20.18 61.92 20.75 -1.87 6,913 13.7 27.68 0.68<br />

SPDR S&P Homebuilders XHB 0.35 810.0 -2.87 -5.92 17.40 27.71 6.35 -12.58 2,312 20.5 37.31 2.73<br />

iShares DJ <strong>US</strong> Home Construction ITB 0.47 264.9 -8.70 -18.21 10.43 22.12 -3.60 -21.82 2,405 25.1 39.59 0.86<br />

U.S. Equity: Consumer Non-Cyclicals<br />

First Trust Consumer Staples AlphaDEX FXG 0.70 190.9 -3.71 12.05 19.75 27.47 16.75 - 9,498 12.8 16.71 0.78<br />

Vanguard Consumer Staples VDC 0.24 811.9 1.12 8.53 14.62 16.55 12.72 6.88 44,055 15.8 12.82 2.39<br />

Consumer Staples Select SPDR XLP 0.20 5,633.7 1.43 8.02 13.81 14.22 11.16 6.44 52,885 15.3 12.72 2.75<br />

iShares DJ <strong>US</strong> Consumer Goods IYK 0.47 415.6 0.17 6.17 18.99 23.32 14.36 5.31 35,359 15.1 15.54 2.09<br />

PowerShares Dyn Food & Beverage PBJ 0.63 210.3 -3.31 4.89 29.97 11.04 14.41 5.32 6,578 14.2 14.69 0.98<br />

Data as of 10/31/2011. Source: Morningstar. Exp Ratio is annual expense ratio. <strong>Asset</strong>s are net assets in $<strong>US</strong> millions. 3-Mo is 3-month <strong>to</strong>tal return. YTD is year-<strong>to</strong>-date. 3- <strong>and</strong> 5-year<br />

returns are annualized. Mkt Cap is geometric average market capitalization. P/E is price-<strong>to</strong>-earnings ratio. Std Dev is 3-year st<strong>and</strong>ard deviation. Yield is 12-month. Includes all<br />

U.S.-listed <strong>ETFs</strong> <strong>and</strong> ETNs with assets over $100 million.<br />

14 ETFR • December 2011<br />

Yield