US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Why I Own: EIDO<br />

iShares MSCI Indonesia<br />

Investable Market<br />

Name: Blair Shein<br />

Title: Vice President<br />

firm: Compass Financial<br />

Group Inc.<br />

founded: 1961<br />

Location: Deerfield Beach, Fla<br />

Aum: $200 million<br />

All eTfs? No<br />

ETFR: Today you wanted <strong>to</strong> talk about<br />

single-country Indonesian funds?<br />

Shein: Right. When we began purchasing<br />

Indonesia <strong>ETFs</strong>, we did so through the<br />

Market Vec<strong>to</strong>rs Indonesia Index ETF (NYSE<br />

Arca: IDX), because that was the only one<br />

available at the time. We’ve added the<br />

iShares MSCI Indonesia Investable Market<br />

Index Fund (NYSE Arca: EIDO), because<br />

we like the fact that it has a little higher<br />

allocation <strong>to</strong> the consumer discretionary<br />

sec<strong>to</strong>r. We saw it as a way <strong>to</strong> add <strong>to</strong> our Indonesia<br />

exposure with an investment that<br />

didn’t have the same tax basis.<br />

ETFR: When did you first buy IDX?<br />

Shein: We started buying Indonesia in 2009.<br />

Since that time, it’s appreciated <strong>by</strong> about 50<br />

percent. When we wanted <strong>to</strong> add exposure<br />

during 2011, we asked, “What difference is<br />

there between IDX <strong>and</strong> EIDO?”<br />

One of the reasons we like Indonesia is<br />

because of the consumers <strong>and</strong> the growth<br />

that we see there. And EIDO has a slightly<br />

higher allocation <strong>to</strong> the consumer discretionary<br />

sec<strong>to</strong>r. It also has about twice the<br />

number of holdings as IDX.<br />

ETFR: What made you decide <strong>to</strong> look at<br />

Indonesia?<br />

Shein: One of the main reasons is that<br />

its economy is heavily consumer-driven.<br />

About 60 percent of its GDP is related <strong>to</strong><br />

domestic consumption. And, with the<br />

country’s current demographics, the<br />

potential for additional growth there is<br />

significant. It’s not heavily driven <strong>by</strong> exports,<br />

<strong>and</strong> it appears <strong>to</strong> have a growing<br />

local dem<strong>and</strong>. From the financial stability<br />

st<strong>and</strong>point, it has exercised some fiscal<br />

constraint, unlike many of the other<br />

countries out there. Its debt-<strong>to</strong>-GDP ratio<br />

is roughly 25 percent, which is well<br />

below that of the U.S. <strong>and</strong> many other<br />

developed countries.<br />

ETFR: How does this compare with<br />

other countries?<br />

Shein: Japan is probably the most startling<br />

comparison. Japan’s debt-<strong>to</strong>-GDP ratio is<br />

close <strong>to</strong> 200 percent, while China’s is about<br />

20 percent. Japan is near the <strong>to</strong>p of the<br />

country debt ratio list. Some of the others—<br />

Italy, Greece—are high up there, <strong>to</strong>o.<br />

ETFR: Is EIDO’s sec<strong>to</strong>r breakdown appealing<br />

<strong>to</strong> you because it has a 15 percent allocation<br />

<strong>to</strong> consumer discretionary?<br />

Shein: Yes, compared <strong>to</strong> 11 percent for<br />

IDX. And when we purchased EIDO earlier<br />

this year, it was actually at 18 percent.<br />

ETFR: When you’re evaluating products,<br />

do you evaluate each specific holding?<br />

Shein: No, not every single security. We<br />

will look at some of the individual positions<br />

<strong>to</strong> see if there is a specific company<br />

that we want <strong>to</strong> have exposure <strong>to</strong>. But<br />

really, when we make our decision, we’re<br />

looking more at the demographics of the<br />

country as a whole.<br />

ETFR: Are you looking at these positions<br />

from a long-term perspective?<br />

Shein: For the most part, yes. That being<br />

said, inves<strong>to</strong>rs should be aware that<br />

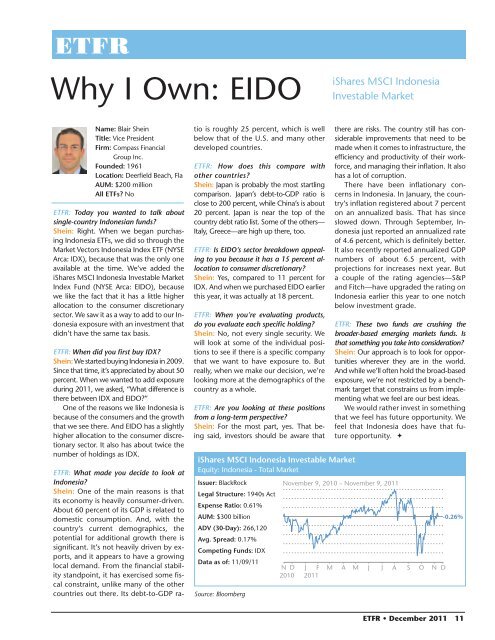

iShares mSci indonesia investable market<br />

Equity: Indonesia - Total Market<br />

issuer: BlackRock<br />

Legal Structure: 1940s Act<br />

expense Ratio: 0.61%<br />

Aum: $300 billion<br />

ADV (30-Day): 266,120<br />

Avg. Spread: 0.17%<br />

competing funds: IDX<br />

Data as of: 11/09/11<br />

Source: Bloomberg<br />

there are risks. The country still has considerable<br />

improvements that need <strong>to</strong> be<br />

made when it comes <strong>to</strong> infrastructure, the<br />

efficiency <strong>and</strong> productivity of their workforce,<br />

<strong>and</strong> managing their inflation. It also<br />

has a lot of corruption.<br />

There have been inflationary concerns<br />

in Indonesia. In January, the country’s<br />

inflation registered about 7 percent<br />

on an annualized basis. That has since<br />

slowed down. Through September, Indonesia<br />

just reported an annualized rate<br />

of 4.6 percent, which is definitely better.<br />

It also recently reported annualized GDP<br />

numbers of about 6.5 percent, with<br />

projections for increases next year. But<br />

a couple of the rating agencies—S&P<br />

<strong>and</strong> Fitch—have upgraded the rating on<br />

Indonesia earlier this year <strong>to</strong> one notch<br />

below investment grade.<br />

ETFR: These two funds are crushing the<br />

broader-based emerging markets funds. Is<br />

that something you take in<strong>to</strong> consideration?<br />

Shein: Our approach is <strong>to</strong> look for opportunities<br />

wherever they are in the world.<br />

And while we’ll often hold the broad-based<br />

exposure, we’re not restricted <strong>by</strong> a benchmark<br />

target that constrains us from implementing<br />

what we feel are our best ideas.<br />

We would rather invest in something<br />

that we feel has future opportunity. We<br />

feel that Indonesia does have that future<br />

opportunity. <br />

November 9, 2010 – November 9, 2011<br />

N D J F M A M J J A<br />

2010 2011<br />

S O N D<br />

-0.26%<br />

ETFR • December 2011 11