US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

US-Listed ETFs Sorted by Asset Class and Year-to-Date Return

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

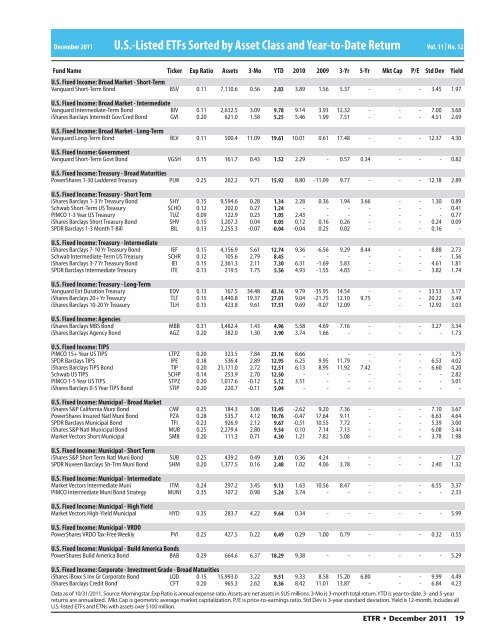

December 2011 U.S.-<strong>Listed</strong> <strong>ETFs</strong> <strong>Sorted</strong> <strong>by</strong> <strong>Asset</strong> <strong>Class</strong> <strong>and</strong> <strong>Year</strong>-<strong>to</strong>-<strong>Date</strong> <strong>Return</strong><br />

Vol. 11 | No. 12<br />

Fund Name Ticker Exp Ratio <strong>Asset</strong>s 3-Mo YTD 2010 2009 3-Yr 5-Yr Mkt Cap P/E Std Dev<br />

U.S. Fixed Income: Broad Market - Short-Term<br />

Vanguard Short-Term Bond BSV 0.11 7,110.6 0.56 2.83 3.89 1.56 5.37 - - - 3.45 1.97<br />

U.S. Fixed Income: Broad Market - Intermediate<br />

Vanguard Intermediate-Term Bond BIV 0.11 2,632.5 3.09 9.78 9.14 3.93 12.32 - - - 7.00 3.68<br />

iShares Barclays Intermdt Gov/Cred Bond GVI 0.20 621.0 1.58 5.25 5.46 1.99 7.51 - - - 4.51 2.69<br />

U.S. Fixed Income: Broad Market - Long-Term<br />

Vanguard Long-Term Bond BLV 0.11 500.4 11.09 19.61 10.01 0.61 17.48 - - - 12.37 4.30<br />

U.S. Fixed Income: Government<br />

Vanguard Short-Term Govt Bond VGSH 0.15 161.7 0.43 1.52 2.29 - 0.57 0.34 - - - 0.82<br />

U.S. Fixed Income: Treasury - Broad Maturities<br />

PowerShares 1-30 Laddered Treasury PLW 0.25 262.2 9.71 15.92 8.80 -11.09 9.77 - - - 12.18 2.89<br />

U.S. Fixed Income: Treasury - Short Term<br />

iShares Barclays 1-3 Yr Treasury Bond SHY 0.15 9,594.6 0.28 1.34 2.28 0.36 1.94 3.66 - - 1.30 0.89<br />

Schwab Short-Term <strong>US</strong> Treasury SCHO 0.12 202.0 0.27 1.24 - - - - - - - 0.41<br />

PIMCO 1-3 <strong>Year</strong> <strong>US</strong> Treasury TUZ 0.09 122.9 0.23 1.05 2.43 - - - - - - 0.77<br />

iShares Barclays Short Treasury Bond SHV 0.15 3,207.3 0.04 0.05 0.12 0.16 0.26 - - - 0.24 0.09<br />

SPDR Barclays 1-3 Month T-Bill BIL 0.13 2,255.3 -0.07 -0.04 -0.04 0.25 0.02 - - - 0.16 -<br />

U.S. Fixed Income: Treasury - Intermediate<br />

iShares Barclays 7-10 Yr Treasury Bond IEF 0.15 4,156.9 5.61 12.74 9.36 -6.56 9.29 8.44 - - 8.88 2.73<br />

Schwab Intermediate-Term <strong>US</strong> Treasury SCHR 0.12 105.6 2.79 8.45 - - - - - - - 1.56<br />

iShares Barclays 3-7 Yr Treasury Bond IEI 0.15 2,361.3 2.11 7.30 6.31 -1.69 5.83 - - - 4.61 1.81<br />

SPDR Barclays Intermediate Treasury ITE 0.13 219.5 1.75 5.56 4.93 -1.55 4.83 - - - 3.82 1.74<br />

U.S. Fixed Income: Treasury - Long-Term<br />

Vanguard Ext Duration Treasury EDV 0.13 167.5 34.48 43.16 9.79 -35.95 14.54 - - - 33.53 3.17<br />

iShares Barclays 20+ Yr Treasury TLT 0.15 3,440.8 19.37 27.01 9.04 -21.75 12.10 9.75 - - 20.22 3.49<br />

iShares Barclays 10-20 Yr Treasury TLH 0.15 423.8 9.61 17.51 9.69 -9.07 12.09 - - - 12.92 3.03<br />

U.S. Fixed Income: Agencies<br />

iShares Barclays MBS Bond MBB 0.31 3,482.4 1.43 4.96 5.58 4.69 7.16 - - - 3.27 3.34<br />

iShares Barclays Agency Bond AGZ 0.20 382.0 1.30 3.90 3.74 1.66 - - - - - 1.73<br />

U.S. Fixed Income: TIPS<br />

PIMCO 15+ <strong>Year</strong> <strong>US</strong> TIPS LTPZ 0.20 323.5 7.84 23.16 8.66 - - - - - - 3.75<br />

SPDR Barclays TIPS IPE 0.18 536.4 2.89 12.95 6.25 9.95 11.79 - - - 6.53 4.02<br />

iShares Barclays TIPS Bond TIP 0.20 21,171.0 2.72 12.51 6.13 8.95 11.92 7.42 - - 6.60 4.20<br />

Schwab <strong>US</strong> TIPS SCHP 0.14 253.9 2.70 12.50 - - - - - - - 2.82<br />

PIMCO 1-5 <strong>Year</strong> <strong>US</strong> TIPS STPZ 0.20 1,017.6 -0.12 5.12 3.51 - - - - - - 3.01<br />

iShares Barclays 0-5 <strong>Year</strong> TIPS Bond STIP 0.20 220.7 -0.11 5.04 - - - - - - - -<br />

U.S. Fixed Income: Municipal - Broad Market<br />

iShares S&P California Muni Bond CMF 0.25 184.3 3.06 13.45 -2.62 9.20 7.36 - - - 7.10 3.67<br />

PowerShares Insured Natl Muni Bond PZA 0.28 535.7 4.12 10.76 -0.47 17.64 9.11 - - - 6.63 4.64<br />

SPDR Barclays Municipal Bond TFI 0.23 926.9 2.12 9.67 -0.51 10.55 7.72 - - - 5.39 3.00<br />

iShares S&P Natl Municipal Bond MUB 0.25 2,279.4 2.80 9.54 0.10 7.14 7.13 - - - 6.08 3.44<br />

Market Vec<strong>to</strong>rs Short Municipal SMB 0.20 111.3 0.71 4.30 1.21 7.82 5.08 - - - 3.78 1.98<br />

U.S. Fixed Income: Municipal - Short Term<br />

iShares S&P Short Term Natl Muni Bond SUB 0.25 439.2 0.49 3.01 0.36 4.24 - - - - - 1.27<br />

SPDR Nuveen Barclays Sh-Trm Muni Bond SHM 0.20 1,377.5 0.16 2.48 1.02 4.06 3.78 - - - 2.40 1.32<br />

U.S. Fixed Income: Municipal - Intermediate<br />

Market Vec<strong>to</strong>rs Intermediate Muni ITM 0.24 297.2 3.45 9.13 1.63 10.56 8.47 - - - 6.55 3.37<br />

PIMCO Intermediate Muni Bond Strategy MUNI 0.35 107.2 0.98 5.24 3.74 - - - - - - 2.33<br />

U.S. Fixed Income: Municipal - High Yield<br />

Market Vec<strong>to</strong>rs High-Yield Municipal HYD 0.35 283.7 4.22 9.64 0.34 - - - - - - 5.99<br />

U.S. Fixed Income: Municipal - VRDO<br />

PowerShares VRDO Tax-Free Weekly PVI 0.25 427.5 0.22 0.49 0.29 1.00 0.79 - - - 0.32 0.55<br />

U.S. Fixed Income: Municipal - Build America Bonds<br />

PowerShares Build America Bond BAB 0.29 664.6 6.37 18.29 9.38 - - - - - - 5.29<br />

U.S. Fixed Income: Corporate - Investment Grade - Broad Maturities<br />

iShares iBoxx $ Inv Gr Corporate Bond LQD 0.15 15,993.0 3.22 9.51 9.33 8.58 15.20 6.80 - - 9.99 4.49<br />

iShares Barclays Credit Bond CFT 0.20 965.3 2.62 8.36 8.42 11.01 13.87 - - - 6.84 4.23<br />

Data as of 10/31/2011. Source: Morningstar. Exp Ratio is annual expense ratio. <strong>Asset</strong>s are net assets in $<strong>US</strong> millions. 3-Mo is 3-month <strong>to</strong>tal return. YTD is year-<strong>to</strong>-date. 3- <strong>and</strong> 5-year<br />

returns are annualized. Mkt Cap is geometric average market capitalization. P/E is price-<strong>to</strong>-earnings ratio. Std Dev is 3-year st<strong>and</strong>ard deviation. Yield is 12-month. Includes all<br />

U.S.-listed <strong>ETFs</strong> <strong>and</strong> ETNs with assets over $100 million.<br />

Yield<br />

ETFR • December 2011 19