2011/2012 Annual Plan - Waikato District Council

2011/2012 Annual Plan - Waikato District Council

2011/2012 Annual Plan - Waikato District Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

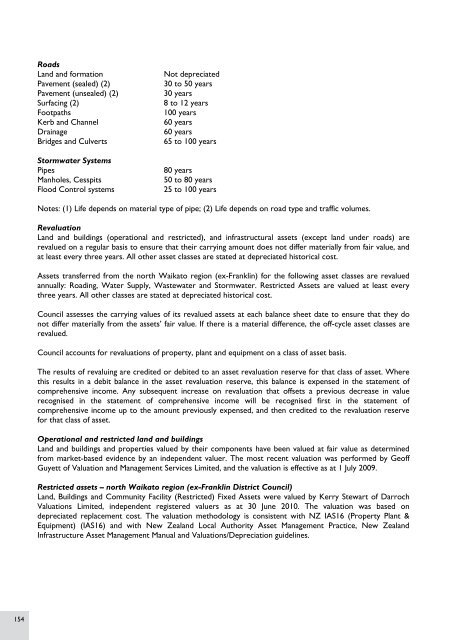

Roads<br />

Land and formation<br />

Pavement (sealed) (2)<br />

Pavement (unsealed) (2)<br />

Surfacing (2)<br />

Footpaths<br />

Kerb and Channel<br />

Drainage<br />

Bridges and Culverts<br />

Stormwater Systems<br />

Pipes<br />

Manholes, Cesspits<br />

Flood Control systems<br />

Not depreciated<br />

30 to 50 years<br />

30 years<br />

8 to 12 years<br />

100 years<br />

60 years<br />

60 years<br />

65 to 100 years<br />

80 years<br />

50 to 80 years<br />

25 to 100 years<br />

Notes: (1) Life depends on material type of pipe; (2) Life depends on road type and traffic volumes.<br />

Revaluation<br />

Land and buildings (operational and restricted), and infrastructural assets (except land under roads) are<br />

revalued on a regular basis to ensure that their carrying amount does not differ materially from fair value, and<br />

at least every three years. All other asset classes are stated at depreciated historical cost.<br />

Assets transferred from the north <strong>Waikato</strong> region (ex-Franklin) for the following asset classes are revalued<br />

annually: Roading, Water Supply, Wastewater and Stormwater. Restricted Assets are valued at least every<br />

three years. All other classes are stated at depreciated historical cost.<br />

<strong>Council</strong> assesses the carrying values of its revalued assets at each balance sheet date to ensure that they do<br />

not differ materially from the assets’ fair value. If there is a material difference, the off-cycle asset classes are<br />

revalued.<br />

<strong>Council</strong> accounts for revaluations of property, plant and equipment on a class of asset basis.<br />

The results of revaluing are credited or debited to an asset revaluation reserve for that class of asset. Where<br />

this results in a debit balance in the asset revaluation reserve, this balance is expensed in the statement of<br />

comprehensive income. Any subsequent increase on revaluation that offsets a previous decrease in value<br />

recognised in the statement of comprehensive income will be recognised first in the statement of<br />

comprehensive income up to the amount previously expensed, and then credited to the revaluation reserve<br />

for that class of asset.<br />

Operational and restricted land and buildings<br />

Land and buildings and properties valued by their components have been valued at fair value as determined<br />

from market-based evidence by an independent valuer. The most recent valuation was performed by Geoff<br />

Guyett of Valuation and Management Services Limited, and the valuation is effective as at 1 July 2009.<br />

Restricted assets – north <strong>Waikato</strong> region (ex-Franklin <strong>District</strong> <strong>Council</strong>)<br />

Land, Buildings and Community Facility (Restricted) Fixed Assets were valued by Kerry Stewart of Darroch<br />

Valuations Limited, independent registered valuers as at 30 June 2010. The valuation was based on<br />

depreciated replacement cost. The valuation methodology is consistent with NZ IAS16 (Property <strong>Plan</strong>t &<br />

Equipment) (IAS16) and with New Zealand Local Authority Asset Management Practice, New Zealand<br />

Infrastructure Asset Management Manual and Valuations/Depreciation guidelines.<br />

154