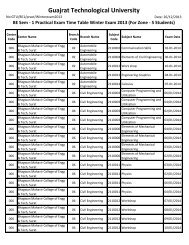

751-Sabar Institute Of Management, Tajpur - Gujarat Technological ...

751-Sabar Institute Of Management, Tajpur - Gujarat Technological ...

751-Sabar Institute Of Management, Tajpur - Gujarat Technological ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview:<br />

Germany is the largest electronic equipment market in Europe. Demand in 2009 declined as a<br />

result of the economic crisis, to a value of €957 billion (ZVEI, 2010). The year 2010 was marked<br />

by moderate market growth, which is also expected for 2011.<br />

The production of electronic equipment in Germany decreased by 17% in 2009 due to the impact<br />

of the global recession and the closure or scaling back of production in the computing,<br />

communications and consumer audio segments. However, production rebounded in 2010,<br />

according to the German Electrical and Electronic Manufacturers’ Association (ZVEI). The<br />

industry was also boosted by renewed growth in automobile production and increased demand<br />

for electronic components.<br />

The German electronics industry is highly innovative and characterized by frequent product and<br />

process introductions. The industry yearly spends around €10 billion on Research and<br />

Development and the German Electrical and Electronic Manufacturers’ Association reports that<br />

over 40% of the industry turnover is the result of new products younger than three years. Solving<br />

complexity and providing value added services are the core competences for success in the<br />

German market. The productions of complex electronic components and systems as well as<br />

projects that require special engineering know-how are indicated as growth markets.<br />

Electronic Manufacturing Service opportunities in Germany<br />

The European Electronic Manufacturing Services (EMS) provider market is expected to witness<br />

a CAGR of 10.1% between 2011 and 2017. Further demand for cost reduction will increase the<br />

role of EMS providers in the electronics market.<br />

Germany hosts the entire value chain with Europe’s largest elec-tronics industry accounting for<br />

EUR 178 billion in 2011. German EMS accounts for 20% of the European EMS market. Growth<br />

drivers include automotive, industrial, medical electronics and renewable energy.<br />

Automotive electronics<br />

Automotive electronics is the biggest segment of the German electronics industry with 39.6%<br />

market share. Microelectronics value per vehicle is expected to grow from USD 155 in 2000 to<br />

USD 400 in 2020. A low EMS provider penetration rate (less than 12%), and the increasing<br />

number of electronic products are at-tractive factors for EMS providers in the automotive<br />

electronics segment.<br />

51