Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL REVIEW<br />

cash used in investing activities of the discontinued operations<br />

were ¥18,295 million (US$155 million), ¥21,665 million and<br />

¥10,683 million for the fiscal years ended March 31, <strong>2007</strong>,<br />

2006 and 2005, respectively. Net cash provided by financing<br />

activities of the discontinued operations was ¥1,870 million<br />

(US$16 million) for the fiscal year ended March 31, <strong>2007</strong> and<br />

net cash used in financing activities of the discontinued<br />

operations were ¥4,090 million and ¥5,519 million for the fiscal<br />

years ended March 31, 2006 and 2005, respectively.<br />

Cash flows used in investing activities of its discontinued operations<br />

have been provided mainly by cash flows from their operating<br />

activities. In addition, <strong>Komatsu</strong>’s discontinued operations<br />

did not have any material effect on cash flows from its financing<br />

activities. Accordingly, <strong>Komatsu</strong> does not expect that the absence<br />

of cash flows from its discontinued operations has any<br />

material impact on <strong>Komatsu</strong>’s future liquidity and capital resources.<br />

(3) Capital Investment<br />

With a prime focus on the Construction and Mining Equipment<br />

Business, <strong>Komatsu</strong> responded to a rising level of demand by bolstering<br />

<strong>Komatsu</strong>’s production capacity for large mining equipment<br />

etc., and by bolstering <strong>Komatsu</strong>’s production capacity for<br />

main components of <strong>Komatsu</strong>’s equipment, such as transmissions,<br />

axles, final drives, hydraulics and engines. In addition,<br />

<strong>Komatsu</strong> invested for the DANTOTSU (Unique and Unrivaled)<br />

products and the latest emission regulations. In the Industrial<br />

Machinery, Vehicles and Other Business, <strong>Komatsu</strong> invested for<br />

the purpose of improving productivity. In the Electronic Business,<br />

<strong>Komatsu</strong> invested in improving productivity and in shifting to<br />

higher-quality products.<br />

As a result, <strong>Komatsu</strong>’s capital investment, on a consolidated<br />

basis, for the fiscal year ended March 31, <strong>2007</strong> were ¥129,680<br />

million (US$1,099 million), an increase of ¥15,746 million from<br />

the previous fiscal year.<br />

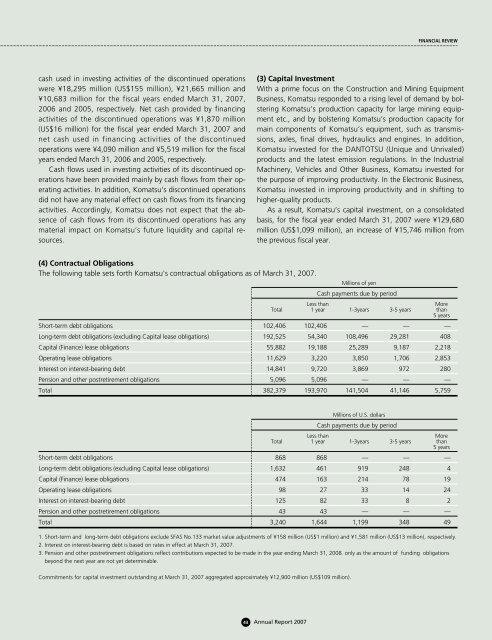

(4) Contractual Obligations<br />

The following table sets forth <strong>Komatsu</strong>'s contractual obligations as of March 31, <strong>2007</strong>.<br />

Millions of yen<br />

Cash payments due by period<br />

Less than<br />

More<br />

Total 1 year 1-3years 3-5 years than<br />

5 years<br />

Short-term debt obligations 102,406 102,406 — — —<br />

Long-term debt obligations (excluding Capital lease obligations) 192,525 54,340 108,496 29,281 408<br />

Capital (Finance) lease obligations 55,882 19,188 25,289 9,187 2,218<br />

Operating lease obligations 11,629 3,220 3,850 1,706 2,853<br />

Interest on interest-bearing debt 14,841 9,720 3,869 972 280<br />

Pension and other postretirement obligations 5,096 5,096 — — —<br />

Total 382,379 193,970 141,504 41,146 5,759<br />

Millions of U.S. dollars<br />

Cash payments due by period<br />

Less than<br />

More<br />

Total 1 year 1-3years 3-5 years than<br />

5 years<br />

Short-term debt obligations 868 868 — — —<br />

Long-term debt obligations (excluding Capital lease obligations) 1,632 461 919 248 4<br />

Capital (Finance) lease obligations 474 163 214 78 19<br />

Operating lease obligations 98 27 33 14 24<br />

Interest on interest-bearing debt 125 82 33 8 2<br />

Pension and other postretirement obligations 43 43 — — —<br />

Total 3,240 1,644 1,199 348 49<br />

1. Short-term and long-term debt obligations exclude SFAS No.133 market value adjustments of ¥158 million (US$1 million) and ¥1,581 million (US$13 million), respectively.<br />

2. Interest on interest-bearing debt is based on rates in effect at March 31, <strong>2007</strong>.<br />

3. Pension and other postretirement obligations reflect contributions expected to be made in the year ending March 31, 2008. only as the amount of funding obligations<br />

beyond the next year are not yet determinable.<br />

Commitments for capital investment outstanding at March 31, <strong>2007</strong> aggregated approximately ¥12,900 million (US$109 million).<br />

43 <strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>