Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to Consolidated Financial Statements<br />

<strong>Komatsu</strong> Ltd. and Consolidated Subsidiaries<br />

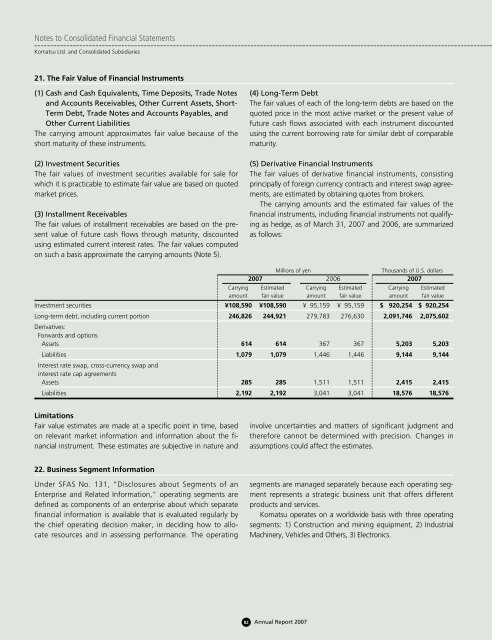

21. The Fair Value of Financial Instruments<br />

(1) Cash and Cash Equivalents, Time Deposits, Trade Notes<br />

and Accounts Receivables, Other Current Assets, Short-<br />

Term Debt, Trade Notes and Accounts Payables, and<br />

Other Current Liabilities<br />

The carrying amount approximates fair value because of the<br />

short maturity of these instruments.<br />

(2) Investment Securities<br />

The fair values of investment securities available for sale for<br />

which it is practicable to estimate fair value are based on quoted<br />

market prices.<br />

(3) Installment Receivables<br />

The fair values of installment receivables are based on the present<br />

value of future cash flows through maturity, discounted<br />

using estimated current interest rates. The fair values computed<br />

on such a basis approximate the carrying amounts (Note 5).<br />

(4) Long-Term Debt<br />

The fair values of each of the long-term debts are based on the<br />

quoted price in the most active market or the present value of<br />

future cash flows associated with each instrument discounted<br />

using the current borrowing rate for similar debt of comparable<br />

maturity.<br />

(5) Derivative Financial Instruments<br />

The fair values of derivative financial instruments, consisting<br />

principally of foreign currency contracts and interest swap agreements,<br />

are estimated by obtaining quotes from brokers.<br />

The carrying amounts and the estimated fair values of the<br />

financial instruments, including financial instruments not qualifying<br />

as hedge, as of March 31, <strong>2007</strong> and 2006, are summarized<br />

as follows:<br />

Millions of yen<br />

Thousands of U.S. dollars<br />

<strong>2007</strong> 2006 <strong>2007</strong><br />

Carrying Estimated Carrying Estimated Carrying Estimated<br />

amount fair value amount fair value amount fair value<br />

Investment securities ¥108,590 ¥108,590 ¥ 95,159 ¥ 95,159 $ 920,254 $ 920,254<br />

Long-term debt, including current portion 246,826 244,921 279,783 276,630 2,091,746 2,075,602<br />

Derivatives:<br />

Forwards and options<br />

Assets 614 614 367 367 5,203 5,203<br />

Liabilities 1,079 1,079 1,446 1,446 9,144 9,144<br />

Interest rate swap, cross-currency swap and<br />

interest rate cap agreements<br />

Assets 285 285 1,511 1,511 2,415 2,415<br />

Liabilities 2,192 2,192 3,041 3,041 18,576 18,576<br />

Limitations<br />

Fair value estimates are made at a specific point in time, based<br />

on relevant market information and information about the financial<br />

instrument. These estimates are subjective in nature and<br />

involve uncertainties and matters of significant judgment and<br />

therefore cannot be determined with precision. Changes in<br />

assumptions could affect the estimates.<br />

22. Business Segment Information<br />

Under SFAS No. 131, “Disclosures about Segments of an<br />

Enterprise and Related Information,” operating segments are<br />

defined as components of an enterprise about which separate<br />

financial information is available that is evaluated regularly by<br />

the chief operating decision maker, in deciding how to allocate<br />

resources and in assessing performance. The operating<br />

segments are managed separately because each operating segment<br />

represents a strategic business unit that offers different<br />

products and services.<br />

<strong>Komatsu</strong> operates on a worldwide basis with three operating<br />

segments: 1) Construction and mining equipment, 2) Industrial<br />

Machinery, Vehicles and Others, 3) Electronics.<br />

82 <strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>