Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

Under certain loan agreements, the lender may require the<br />

borrower to submit proposals for the payment of dividends and<br />

other appropriations of earnings for the lender’s review and approval<br />

before presentation to the shareholders. The companies<br />

have never received such a request.<br />

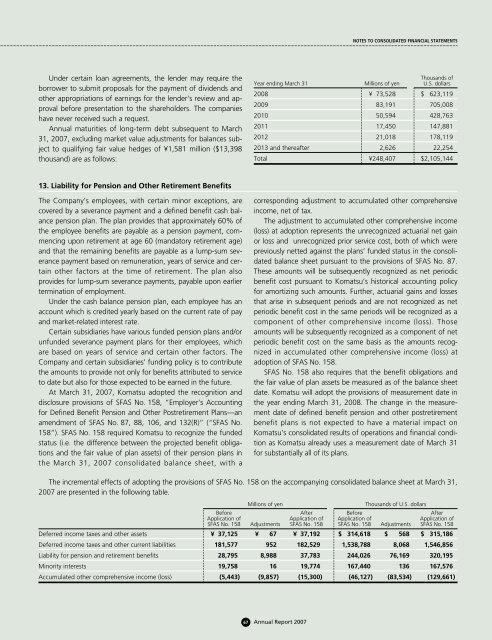

<strong>Annual</strong> maturities of long-term debt subsequent to March<br />

31, <strong>2007</strong>, excluding market value adjustments for balances subject<br />

to qualifying fair value hedges of ¥1,581 million ($13,398<br />

thousand) are as follows:<br />

Thousands of<br />

Year ending March 31 Millions of yen U.S. dollars<br />

2008 ¥ 73,528 $ 623,119<br />

2009 83,191 705,008<br />

2010 50,594 428,763<br />

2011 17,450 147,881<br />

2012 21,018 178,119<br />

2013 and thereafter 2,626 22,254<br />

Total ¥248,407 $2,105,144<br />

13. Liability for Pension and Other Retirement Benefits<br />

The Company’s employees, with certain minor exceptions, are<br />

covered by a severance payment and a defined benefit cash balance<br />

pension plan. The plan provides that approximately 60% of<br />

the employee benefits are payable as a pension payment, commencing<br />

upon retirement at age 60 (mandatory retirement age)<br />

and that the remaining benefits are payable as a lump-sum severance<br />

payment based on remuneration, years of service and certain<br />

other factors at the time of retirement. The plan also<br />

provides for lump-sum severance payments, payable upon earlier<br />

termination of employment.<br />

Under the cash balance pension plan, each employee has an<br />

account which is credited yearly based on the current rate of pay<br />

and market-related interest rate.<br />

Certain subsidiaries have various funded pension plans and/or<br />

unfunded severance payment plans for their employees, which<br />

are based on years of service and certain other factors. The<br />

Company and certain subsidiaries’ funding policy is to contribute<br />

the amounts to provide not only for benefits attributed to service<br />

to date but also for those expected to be earned in the future.<br />

At March 31, <strong>2007</strong>, <strong>Komatsu</strong> adopted the recognition and<br />

disclosure provisions of SFAS No. 158, “Employer’s Accounting<br />

for Defined Benefit Pension and Other Postretirement Plans—an<br />

amendment of SFAS No. 87, 88, 106, and 132(R)” (“SFAS No.<br />

158”). SFAS No. 158 required <strong>Komatsu</strong> to recognize the funded<br />

status (i.e. the difference between the projected benefit obligations<br />

and the fair value of plan assets) of their pension plans in<br />

the March 31, <strong>2007</strong> consolidated balance sheet, with a<br />

corresponding adjustment to accumulated other comprehensive<br />

income, net of tax.<br />

The adjustment to accumulated other comprehensive income<br />

(loss) at adoption represents the unrecognized actuarial net gain<br />

or loss and unrecognized prior service cost, both of which were<br />

previously netted against the plans’ funded status in the consolidated<br />

balance sheet pursuant to the provisions of SFAS No. 87.<br />

These amounts will be subsequently recognized as net periodic<br />

benefit cost pursuant to <strong>Komatsu</strong>’s historical accounting policy<br />

for amortizing such amounts. Further, actuarial gains and losses<br />

that arise in subsequent periods and are not recognized as net<br />

periodic benefit cost in the same periods will be recognized as a<br />

component of other comprehensive income (loss). Those<br />

amounts will be subsequently recognized as a component of net<br />

periodic benefit cost on the same basis as the amounts recognized<br />

in accumulated other comprehensive income (loss) at<br />

adoption of SFAS No. 158.<br />

SFAS No. 158 also requires that the benefit obligations and<br />

the fair value of plan assets be measured as of the balance sheet<br />

date. <strong>Komatsu</strong> will adopt the provisions of measurement date in<br />

the year ending March 31, 2008. The change in the measurement<br />

date of defined benefit pension and other postretirement<br />

benefit plans is not expected to have a material impact on<br />

<strong>Komatsu</strong>’s consolidated results of operations and financial condition<br />

as <strong>Komatsu</strong> already uses a measurement date of March 31<br />

for substantially all of its plans.<br />

The incremental effects of adopting the provisions of SFAS No. 158 on the accompanying consolidated balance sheet at March 31,<br />

<strong>2007</strong> are presented in the following table.<br />

Millions of yen<br />

Thousands of U.S. dollars<br />

Before After Before After<br />

Application of Application of Application of Application of<br />

SFAS No. 158 Adjustments SFAS No. 158 SFAS No. 158 Adjustments SFAS No. 158<br />

Deferred income taxes and other assets ¥ 37,125 ¥ 67 ¥ 37,192 $ 314,618 $ 568 $ 315,186<br />

Deferred income taxes and other current liabilities 181,577 952 182,529 1,538,788 8,068 1,546,856<br />

Liability for pension and retirement benefits 28,795 8,988 37,783 244,026 76,169 320,195<br />

Minority interests 19,758 16 19,774 167,440 136 167,576<br />

Accumulated other comprehensive income (loss) (5,443) (9,857) (15,300) (46,127) (83,534) (129,661)<br />

67 <strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>