Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to Consolidated Financial Statements<br />

<strong>Komatsu</strong> Ltd. and Consolidated Subsidiaries<br />

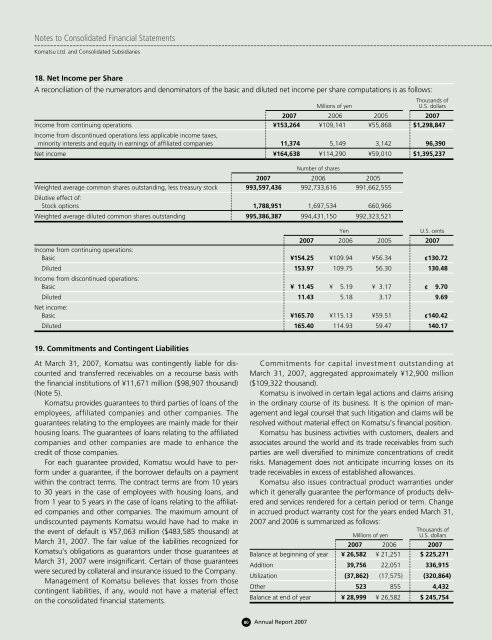

18. Net Income per Share<br />

A reconciliation of the numerators and denominators of the basic and diluted net income per share computations is as follows:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

<strong>2007</strong> 2006 2005 <strong>2007</strong><br />

Income from continuing operations ¥153,264 ¥109,141 ¥55,868 $1,298,847<br />

Income from discontinued operations less applicable income taxes,<br />

minority interests and equity in earnings of affiliated companies 11,374 5,149 3,142 96,390<br />

Net income ¥164,638 ¥114,290 ¥59,010 $1,395,237<br />

Number of shares<br />

<strong>2007</strong> 2006 2005<br />

Weighted average common shares outstanding, less treasury stock 993,597,436 992,733,616 991,662,555<br />

Dilutive effect of:<br />

Stock options 1,788,951 1,697,534 660,966<br />

Weighted average diluted common shares outstanding 995,386,387 994,431,150 992,323,521<br />

Yen<br />

U.S. cents<br />

<strong>2007</strong> 2006 2005 <strong>2007</strong><br />

Income from continuing operations:<br />

Basic ¥154.25 ¥109.94 ¥56.34 ¢130.72<br />

Diluted 153.97 109.75 56.30 130.48<br />

Income from discontinued operations:<br />

Basic ¥ 11.45 ¥ 5.19 ¥ 3.17 ¢ 9.70<br />

Diluted 11.43 5.18 3.17 9.69<br />

Net income:<br />

Basic ¥165.70 ¥115.13 ¥59.51 ¢140.42<br />

Diluted 165.40 114.93 59.47 140.17<br />

19. Commitments and Contingent Liabilities<br />

At March 31, <strong>2007</strong>, <strong>Komatsu</strong> was contingently liable for discounted<br />

and transferred receivables on a recourse basis with<br />

the financial institutions of ¥11,671 million ($98,907 thousand)<br />

(Note 5).<br />

<strong>Komatsu</strong> provides guarantees to third parties of loans of the<br />

employees, affiliated companies and other companies. The<br />

guarantees relating to the employees are mainly made for their<br />

housing loans. The guarantees of loans relating to the affiliated<br />

companies and other companies are made to enhance the<br />

credit of those companies.<br />

For each guarantee provided, <strong>Komatsu</strong> would have to perform<br />

under a guarantee, if the borrower defaults on a payment<br />

within the contract terms. The contract terms are from 10 years<br />

to 30 years in the case of employees with housing loans, and<br />

from 1 year to 5 years in the case of loans relating to the affiliated<br />

companies and other companies. The maximum amount of<br />

undiscounted payments <strong>Komatsu</strong> would have had to make in<br />

the event of default is ¥57,063 million ($483,585 thousand) at<br />

March 31, <strong>2007</strong>. The fair value of the liabilities recognized for<br />

<strong>Komatsu</strong>’s obligations as guarantors under those guarantees at<br />

March 31, <strong>2007</strong> were insignificant. Certain of those guarantees<br />

were secured by collateral and insurance issued to the Company.<br />

Management of <strong>Komatsu</strong> believes that losses from those<br />

contingent liabilities, if any, would not have a material effect<br />

on the consolidated financial statements.<br />

Commitments for capital investment outstanding at<br />

March 31, <strong>2007</strong>, aggregated approximately ¥12,900 million<br />

($109,322 thousand).<br />

<strong>Komatsu</strong> is involved in certain legal actions and claims arising<br />

in the ordinary course of its business. It is the opinion of management<br />

and legal counsel that such litigation and claims will be<br />

resolved without material effect on <strong>Komatsu</strong>’s financial position.<br />

<strong>Komatsu</strong> has business activities with customers, dealers and<br />

associates around the world and its trade receivables from such<br />

parties are well diversified to minimize concentrations of credit<br />

risks. Management does not anticipate incurring losses on its<br />

trade receivables in excess of established allowances.<br />

<strong>Komatsu</strong> also issues contractual product warranties under<br />

which it generally guarantee the performance of products delivered<br />

and services rendered for a certain period or term. Change<br />

in accrued product warranty cost for the years ended March 31,<br />

<strong>2007</strong> and 2006 is summarized as follows:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

<strong>2007</strong> 2006 <strong>2007</strong><br />

Balance at beginning of year ¥ 26,582 ¥ 21,251 $ 225,271<br />

Addition 39,756 22,051 336,915<br />

Utilization (37,862) (17,575) (320,864)<br />

Other 523 855 4,432<br />

Balance at end of year ¥ 28,999 ¥ 26,582 $ 245,754<br />

80 <strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>