Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

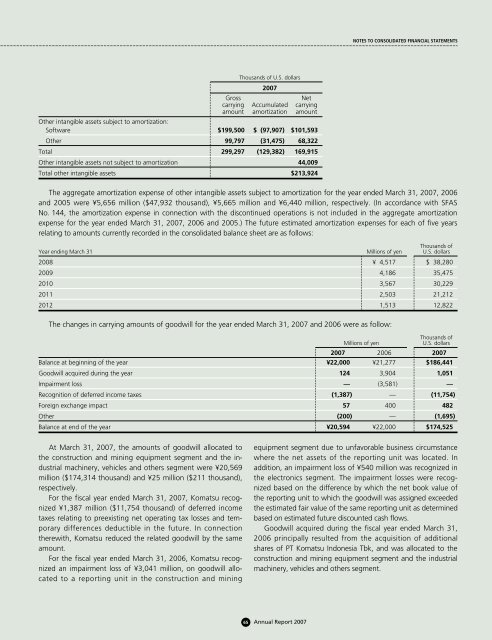

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

Thousands of U.S. dollars<br />

<strong>2007</strong><br />

Gross<br />

Net<br />

carrying Accumulated carrying<br />

amount amortization amount<br />

Other intangible assets subject to amortization:<br />

Software $199,500 $ (97,907) $101,593<br />

Other 99,797 (31,475) 68,322<br />

Total 299,297 (129,382) 169,915<br />

Other intangible assets not subject to amortization 44,009<br />

Total other intangible assets $213,924<br />

The aggregate amortization expense of other intangible assets subject to amortization for the year ended March 31, <strong>2007</strong>, 2006<br />

and 2005 were ¥5,656 million ($47,932 thousand), ¥5,665 million and ¥6,440 million, respectively. (In accordance with SFAS<br />

No. 144, the amortization expense in connection with the discontinued operations is not included in the aggregate amortization<br />

expense for the year ended March 31, <strong>2007</strong>, 2006 and 2005.) The future estimated amortization expenses for each of five years<br />

relating to amounts currently recorded in the consolidated balance sheet are as follows:<br />

Thousands of<br />

Year ending March 31 Millions of yen U.S. dollars<br />

2008 ¥ 4,517 $ 38,280<br />

2009 4,186 35,475<br />

2010 3,567 30,229<br />

2011 2,503 21,212<br />

2012 1,513 12,822<br />

The changes in carrying amounts of goodwill for the year ended March 31, <strong>2007</strong> and 2006 were as follow:<br />

Thousands of<br />

Millions of yen<br />

U.S. dollars<br />

<strong>2007</strong> 2006 <strong>2007</strong><br />

Balance at beginning of the year ¥22,000 ¥21,277 $186,441<br />

Goodwill acquired during the year 124 3,904 1,051<br />

Impairment loss — (3,581) —<br />

Recognition of deferred income taxes (1,387) — (11,754)<br />

Foreign exchange impact 57 400 482<br />

Other (200) — (1,695)<br />

Balance at end of the year ¥20,594 ¥22,000 $174,525<br />

At March 31, <strong>2007</strong>, the amounts of goodwill allocated to<br />

the construction and mining equipment segment and the industrial<br />

machinery, vehicles and others segment were ¥20,569<br />

million ($174,314 thousand) and ¥25 million ($211 thousand),<br />

respectively.<br />

For the fiscal year ended March 31, <strong>2007</strong>, <strong>Komatsu</strong> recognized<br />

¥1,387 million ($11,754 thousand) of deferred income<br />

taxes relating to preexisting net operating tax losses and temporary<br />

differences deductible in the future. In connection<br />

therewith, <strong>Komatsu</strong> reduced the related goodwill by the same<br />

amount.<br />

For the fiscal year ended March 31, 2006, <strong>Komatsu</strong> recognized<br />

an impairment loss of ¥3,041 million, on goodwill allocated<br />

to a reporting unit in the construction and mining<br />

equipment segment due to unfavorable business circumstance<br />

where the net assets of the reporting unit was located. In<br />

addition, an impairment loss of ¥540 million was recognized in<br />

the electronics segment. The impairment losses were recognized<br />

based on the difference by which the net book value of<br />

the reporting unit to which the goodwill was assigned exceeded<br />

the estimated fair value of the same reporting unit as determined<br />

based on estimated future discounted cash flows.<br />

Goodwill acquired during the fiscal year ended March 31,<br />

2006 principally resulted from the acquisition of additional<br />

shares of PT <strong>Komatsu</strong> Indonesia Tbk, and was allocated to the<br />

construction and mining equipment segment and the industrial<br />

machinery, vehicles and others segment.<br />

65 <strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>