Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Annual Report 2007 - Komatsu

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL REVIEW<br />

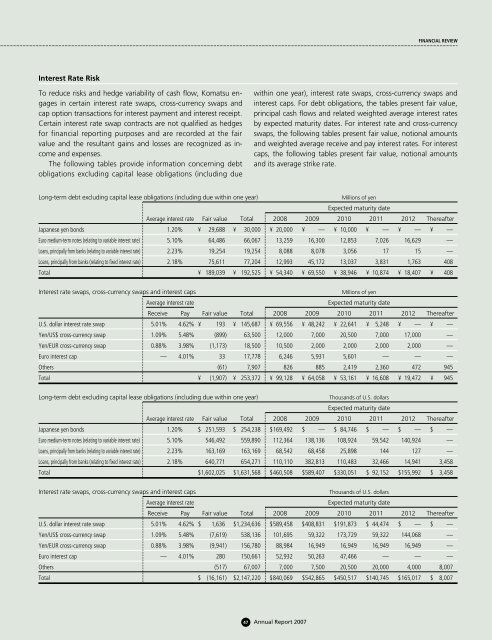

Interest Rate Risk<br />

To reduce risks and hedge variability of cash flow, <strong>Komatsu</strong> engages<br />

in certain interest rate swaps, cross-currency swaps and<br />

cap option transactions for interest payment and interest receipt.<br />

Certain interest rate swap contracts are not qualified as hedges<br />

for financial reporting purposes and are recorded at the fair<br />

value and the resultant gains and losses are recognized as income<br />

and expenses.<br />

The following tables provide information concerning debt<br />

obligations excluding capital lease obligations (including due<br />

within one year), interest rate swaps, cross-currency swaps and<br />

interest caps. For debt obligations, the tables present fair value,<br />

principal cash flows and related weighted average interest rates<br />

by expected maturity dates. For interest rate and cross-currency<br />

swaps, the following tables present fair value, notional amounts<br />

and weighted average receive and pay interest rates. For interest<br />

caps, the following tables present fair value, notional amounts<br />

and its average strike rate.<br />

Long-term debt excluding capital lease obligations (including due within one year)<br />

Millions of yen<br />

Expected maturity date<br />

Average interest rate Fair value Total 2008 2009 2010 2011 2012 Thereafter<br />

Japanese yen bonds 1.20% ¥ 29,688 ¥ 30,000 ¥ 20,000 ¥ — ¥ 10,000 ¥ — ¥ — ¥ —<br />

Euro medium-term notes (relating to variable interest rate) 5.10% 64,486 66,067 13,259 16,300 12,853 7,026 16,629 —<br />

Loans, principally from banks (relating to variable interest rate) 2.23% 19,254 19,254 8,088 8,078 3,056 17 15 —<br />

Loans, principally from banks (relating to fixed interest rate) 2.18% 75,611 77,204 12,993 45,172 13,037 3,831 1,763 408<br />

Total ¥ 189,039 ¥ 192,525 ¥ 54,340 ¥ 69,550 ¥ 38,946 ¥ 10,874 ¥ 18,407 ¥ 408<br />

Interest rate swaps, cross-currency swaps and interest caps<br />

Millions of yen<br />

Average interest rate<br />

Expected maturity date<br />

Receive Pay Fair value Total 2008 2009 2010 2011 2012 Thereafter<br />

U.S. dollar interest rate swap 5.01% 4.62% ¥ 193 ¥ 145,687 ¥ 69,556 ¥ 48,242 ¥ 22,641 ¥ 5,248 ¥ — ¥ —<br />

Yen/US$ cross-currency swap 1.09% 5.48% (899) 63,500 12,000 7,000 20,500 7,000 17,000 —<br />

Yen/EUR cross-currency swap 0.88% 3.98% (1,173) 18,500 10,500 2,000 2,000 2,000 2,000 —<br />

Euro interest cap — 4.01% 33 17,778 6,246 5,931 5,601 — — —<br />

Others (61) 7,907 826 885 2,419 2,360 472 945<br />

Total ¥ (1,907) ¥ 253,372 ¥ 99,128 ¥ 64,058 ¥ 53,161 ¥ 16,608 ¥ 19,472 ¥ 945<br />

Long-term debt excluding capital lease obligations (including due within one year)<br />

Thousands of U.S. dollars<br />

Expected maturity date<br />

Average interest rate Fair value Total 2008 2009 2010 2011 2012 Thereafter<br />

Japanese yen bonds 1.20% $ 251,593 $ 254,238 $169,492 $ — $ 84,746 $ — $ — $ —<br />

Euro medium-term notes (relating to variable interest rate) 5.10% 546,492 559,890 112,364 138,136 108,924 59,542 140,924 —<br />

Loans, principally from banks (relating to variable interest rate) 2.23% 163,169 163,169 68,542 68,458 25,898 144 127 —<br />

Loans, principally from banks (relating to fixed interest rate) 2.18% 640,771 654,271 110,110 382,813 110,483 32,466 14,941 3,458<br />

Total $1,602,025 $1,631,568 $460,508 $589,407 $330,051 $ 92,152 $155,992 $ 3,458<br />

Interest rate swaps, cross-currency swaps and interest caps<br />

Thousands of U.S. dollars<br />

Average interest rate<br />

Expected maturity date<br />

Receive Pay Fair value Total 2008 2009 2010 2011 2012 Thereafter<br />

U.S. dollar interest rate swap 5.01% 4.62% $ 1,636 $1,234,636 $589,458 $408,831 $191,873 $ 44,474 $ — $ —<br />

Yen/US$ cross-currency swap 1.09% 5.48% (7,619) 538,136 101,695 59,322 173,729 59,322 144,068 —<br />

Yen/EUR cross-currency swap 0.88% 3.98% (9,941) 156,780 88,984 16,949 16,949 16,949 16,949 —<br />

Euro interest cap — 4.01% 280 150,661 52,932 50,263 47,466 — — —<br />

Others (517) 67,007 7,000 7,500 20,500 20,000 4,000 8,007<br />

Total $ (16,161) $2,147,220 $840,069 $542,865 $450,517 $140,745 $165,017 $ 8,007<br />

47 <strong>Annual</strong> <strong>Report</strong> <strong>2007</strong>