macquarie global infrastructure total return fund annual report 2012

macquarie global infrastructure total return fund annual report 2012

macquarie global infrastructure total return fund annual report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2. Income Taxes and Tax<br />

Basis Information<br />

The Fund complies with the<br />

requirements under Subchapter M of<br />

the Internal Revenue Code of 1986,<br />

as amended, applicable to regulated<br />

investment companies ("RICs") and<br />

intends to distribute substantially all of<br />

its net taxable income and net capital<br />

gains, if any, each year. The Fund is<br />

not subject to income taxes to the<br />

extent such distributions are made.<br />

As of and during the fiscal year<br />

ended November 30, <strong>2012</strong>, the<br />

Fund did not have a liability for any<br />

unrecognized tax benefits in the<br />

accompanying financial statements.<br />

The Income Tax Statement requires<br />

management of the Fund to analyze<br />

all open tax years, fiscal years<br />

2006-<strong>2012</strong> as defined by IRS<br />

statute of limitations for all major<br />

jurisdictions, including federal<br />

tax authorities and certain state<br />

tax authorities. The Fund has no<br />

examination in progress and is not<br />

aware of any tax positions for which<br />

it is reasonably possible that the<br />

<strong>total</strong> amounts of unrecognized tax<br />

benefits will significantly change in<br />

the next twelve months.<br />

Classification of Distributions:<br />

Net investment income/loss and<br />

net realized gain/loss may differ<br />

for financial statements and<br />

tax purposes. The character of<br />

distributions made during the year<br />

from net investment income or net<br />

realized gains may differ from its<br />

ultimate characterization for federal<br />

income tax purposes.<br />

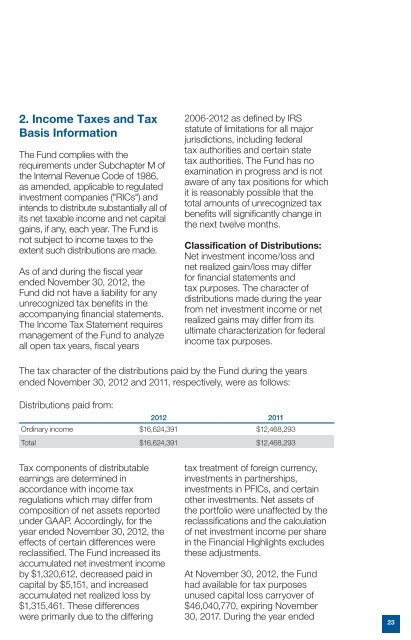

The tax character of the distributions paid by the Fund during the years<br />

ended November 30, <strong>2012</strong> and 2011, respectively, were as follows:<br />

Distributions paid from:<br />

<strong>2012</strong> 2011<br />

Ordinary income $16,624,391 $12,468,293<br />

Total $16,624,391 $12,468,293<br />

Tax components of distributable<br />

earnings are determined in<br />

accordance with income tax<br />

regulations which may differ from<br />

composition of net assets <strong>report</strong>ed<br />

under GAAP. Accordingly, for the<br />

year ended November 30, <strong>2012</strong>, the<br />

effects of certain differences were<br />

reclassified. The Fund increased its<br />

accumulated net investment income<br />

by $1,320,612, decreased paid in<br />

capital by $5,151, and increased<br />

accumulated net realized loss by<br />

$1,315,461. These differences<br />

were primarily due to the differing<br />

tax treatment of foreign currency,<br />

investments in partnerships,<br />

investments in PFICs, and certain<br />

other investments. Net assets of<br />

the portfolio were unaffected by the<br />

reclassifications and the calculation<br />

of net investment income per share<br />

in the Financial Highlights excludes<br />

these adjustments.<br />

At November 30, <strong>2012</strong>, the Fund<br />

had available for tax purposes<br />

unused capital loss carryover of<br />

$46,040,770, expiring November<br />

30, 2017. During the year ended<br />

23