macquarie global infrastructure total return fund annual report 2012

macquarie global infrastructure total return fund annual report 2012

macquarie global infrastructure total return fund annual report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

dividend rule and repeals the<br />

60‐day designation requirement<br />

for certain types of pay through<br />

income and gains.<br />

• Finally, the Modernization Act<br />

contains several provisions aimed<br />

at preserving the character of<br />

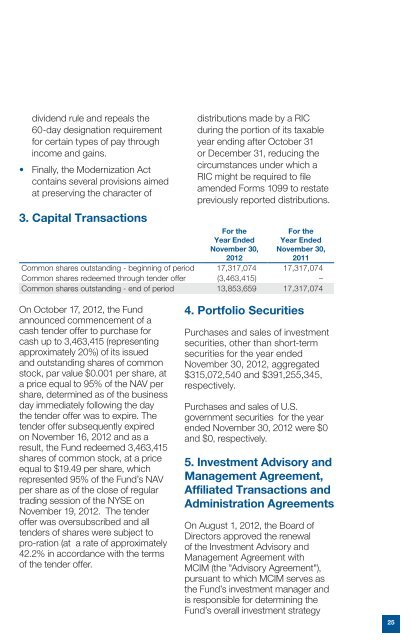

3. Capital Transactions<br />

distributions made by a RIC<br />

during the portion of its taxable<br />

year ending after October 31<br />

or December 31, reducing the<br />

circumstances under which a<br />

RIC might be required to file<br />

amended Forms 1099 to restate<br />

previously <strong>report</strong>ed distributions.<br />

For the<br />

Year Ended<br />

November 30,<br />

<strong>2012</strong><br />

For the<br />

Year Ended<br />

November 30,<br />

2011<br />

Common shares outstanding - beginning of period 17,317,074 17,317,074<br />

Common shares redeemed through tender offer (3,463,415) –<br />

Common shares outstanding - end of period 13,853,659 17,317,074<br />

On October 17, <strong>2012</strong>, the Fund<br />

announced commencement of a<br />

cash tender offer to purchase for<br />

cash up to 3,463,415 (representing<br />

approximately 20%) of its issued<br />

and outstanding shares of common<br />

stock, par value $0.001 per share, at<br />

a price equal to 95% of the NAV per<br />

share, determined as of the business<br />

day immediately following the day<br />

the tender offer was to expire. The<br />

tender offer subsequently expired<br />

on November 16, <strong>2012</strong> and as a<br />

result, the Fund redeemed 3,463,415<br />

shares of common stock, at a price<br />

equal to $19.49 per share, which<br />

represented 95% of the Fund’s NAV<br />

per share as of the close of regular<br />

trading session of the NYSE on<br />

November 19, <strong>2012</strong>. The tender<br />

offer was oversubscribed and all<br />

tenders of shares were subject to<br />

pro-ration (at a rate of approximately<br />

42.2% in accordance with the terms<br />

of the tender offer.<br />

4. Portfolio Securities<br />

Purchases and sales of investment<br />

securities, other than short-term<br />

securities for the year ended<br />

November 30, <strong>2012</strong>, aggregated<br />

$315,072,540 and $391,255,345,<br />

respectively.<br />

Purchases and sales of U.S.<br />

government securities for the year<br />

ended November 30, <strong>2012</strong> were $0<br />

and $0, respectively.<br />

5. Investment Advisory and<br />

Management Agreement,<br />

Affiliated Transactions and<br />

Administration Agreements<br />

On August 1, <strong>2012</strong>, the Board of<br />

Directors approved the renewal<br />

of the Investment Advisory and<br />

Management Agreement with<br />

MCIM (the "Advisory Agreement"),<br />

pursuant to which MCIM serves as<br />

the Fund’s investment manager and<br />

is responsible for determining the<br />

Fund’s overall investment strategy<br />

25