2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

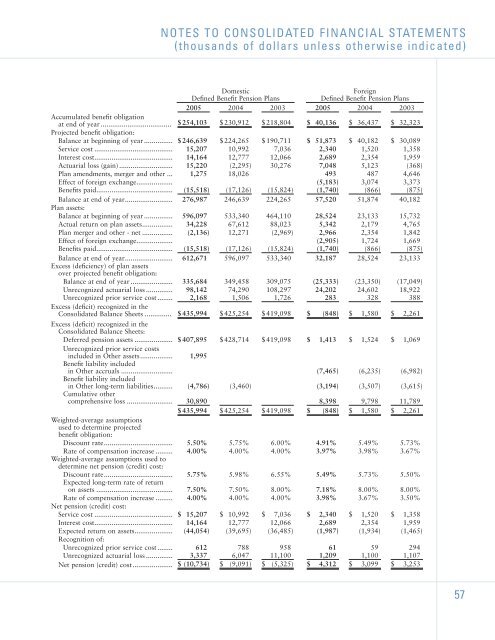

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(thousands of dollars unless otherwise indicated)<br />

Domestic<br />

Defined Benefit Pension Plans<br />

Foreign<br />

Defined Benefit Pension Plans<br />

<strong>2005</strong> 2004 2003 <strong>2005</strong> 2004 2003<br />

Accumulated benefit obligation<br />

at end of year ..................................... $ 254,103 $ 230,912 $ 218,804 $ 40,136 $ 36,437 $ 32,323<br />

Projected benefit obligation:<br />

Balance at beginning of year ............... $ 246,639 $ 224,265 $ 190,711 $ 51,873 $ 40,182 $ 30,089<br />

Service cost ......................................... 15,207 10,992 7,036 2,340 1,520 1,358<br />

Interest cost......................................... 14,164 12,777 12,066 2,689 2,354 1,959<br />

Actuarial loss (gain) ............................ 15,220 (2,295) 30,276 7,048 5,123 (368)<br />

Plan amendments, merger and other ... 1,275 18,026 493 487 4,646<br />

Effect of foreign exchange................... (5,183) 3,074 3,373<br />

Benefits paid........................................ (15,518) (17,126) (15,824) (1,740) (866) (875)<br />

Balance at end of year......................... 276,987 246,639 224,265 57,520 51,874 40,182<br />

Plan assets:<br />

Balance at beginning of year ............... 596,097 533,340 464,110 28,524 23,133 15,732<br />

Actual return on plan assets................ 34,228 67,612 88,023 5,342 2,179 4,765<br />

Plan merger and other - net ................ (2,136) 12,271 (2,969) 2,966 2,354 1,842<br />

Effect of foreign exchange................... (2,905) 1,724 1,669<br />

Benefits paid........................................ (15,518) (17,126) (15,824) (1,740) (866) (875)<br />

Balance at end of year......................... 612,671 596,097 533,340 32,187 28,524 23,133<br />

Excess (deficiency) of plan assets<br />

over projected benefit obligation:<br />

Balance at end of year ...................... 335,684 349,458 309,075 (25,333) (23,350) (17,049)<br />

Unrecognized actuarial loss .............. 98,142 74,290 108,297 24,202 24,602 18,922<br />

Unrecognized prior service cost ........ 2,168 1,506 1,726 283 328 388<br />

Excess (deficit) recognized in the<br />

Consolidated Balance Sheets .............. $ 435,994 $ 425,254 $ 419,098 $ (848) $ 1,580 $ 2,261<br />

Excess (deficit) recognized in the<br />

Consolidated Balance Sheets:<br />

Deferred pension assets .................... $ 407,895 $ 428,714 $ 419,098 $ 1,413 $ 1,524 $ 1,069<br />

Unrecognized prior service costs<br />

included in Other assets................. 1,995<br />

Benefit liability included<br />

in Other accruals ........................... (7,465) (6,235) (6,982)<br />

Benefit liability included<br />

in Other long-term liabilities.......... (4,786) (3,460) (3,194) (3,507) (3,615)<br />

Cumulative other<br />

comprehensive loss ........................ 30,890 8,398 9,798 11,789<br />

$ 435,994 $ 425,254 $ 419,098 $ (848) $ 1,580 $ 2,261<br />

Weighted-average assumptions<br />

used to determine projected<br />

benefit obligation:<br />

Discount rate.................................... 5.50% 5.75% 6.00% 4.91% 5.49% 5.73%<br />

Rate of compensation increase ......... 4.00% 4.00% 4.00% 3.97% 3.98% 3.67%<br />

Weighted-average assumptions used to<br />

determine net pension (credit) cost:<br />

Discount rate.................................... 5.75% 5.98% 6.55% 5.49% 5.73% 5.50%<br />

Expected long-term rate of return<br />

on assets ........................................ 7.50% 7.50% 8.00% 7.18% 8.00% 8.00%<br />

Rate of compensation increase ......... 4.00% 4.00% 4.00% 3.98% 3.67% 3.50%<br />

Net pension (credit) cost:<br />

Service cost ......................................... $ 15,207 $ 10,992 $ 7,036 $ 2,340 $ 1,520 $ 1,358<br />

Interest cost......................................... 14,164 12,777 12,066 2,689 2,354 1,959<br />

Expected return on assets.................... (44,054) (39,695) (36,485) (1,987) (1,934) (1,465)<br />

Recognition of:<br />

Unrecognized prior service cost ........ 612 788 958 61 59 294<br />

Unrecognized actuarial loss .............. 3,337 6,047 11,100 1,209 1,100 1,107<br />

Net pension (credit) cost..................... $ (10,734) $ (9,091) $ (5,325) $ 4,312 $ 3,099 $ 3,253<br />

57