2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(thousands of dollars unless otherwise indicated)<br />

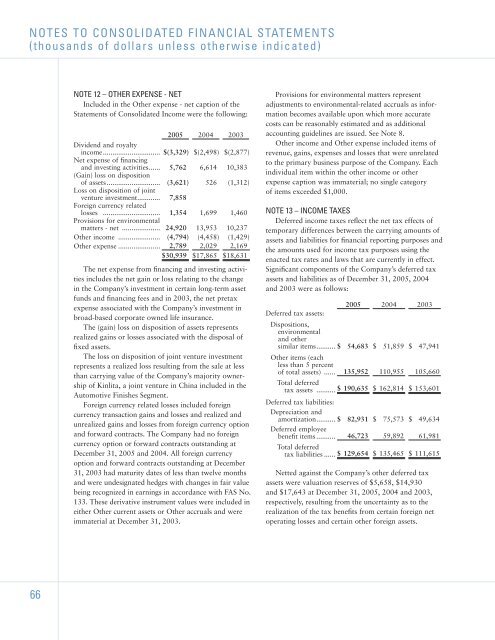

NOTE 12 – OTHER EXPENSE - NET<br />

Included in the Other expense - net caption of the<br />

Statements of Consolidated Income were the following:<br />

<strong>2005</strong> 2004 2003<br />

Dividend and royalty<br />

income.............................. $(3,329) $(2,498) $(2,877)<br />

Net expense of financing<br />

and investing activities...... 5,762 6,614 10,383<br />

(Gain) loss on disposition<br />

of assets............................ (3,621) 526 (1,312)<br />

Loss on disposition of joint<br />

venture investment............ 7,858<br />

Foreign currency related<br />

losses .............................. 1,354 1,699 1,460<br />

Provisions for environmental<br />

matters - net .................... 24,920 13,953 10,237<br />

Other income ...................... (4,794) (4,458) (1,429)<br />

Other expense ...................... 2,789 2,029 2,169<br />

$30,939 $17,865 $18,631<br />

The net expense from financing and investing activities<br />

includes the net gain or loss relating to the change<br />

in the Company’s investment in certain long-term asset<br />

funds and financing fees and in 2003, the net pretax<br />

expense associated with the Company’s investment in<br />

broad-based corporate owned life insurance.<br />

The (gain) loss on disposition of assets represents<br />

realized gains or losses associated with the disposal of<br />

fixed assets.<br />

The loss on disposition of joint venture investment<br />

represents a realized loss resulting from the sale at less<br />

than carrying value of the Company’s majority ownership<br />

of Kinlita, a joint venture in China included in the<br />

Automotive Finishes Segment.<br />

Foreign currency related losses included foreign<br />

currency transaction gains and losses and realized and<br />

unrealized gains and losses from foreign currency option<br />

and forward contracts. The Company had no foreign<br />

currency option or forward contracts outstanding at<br />

December 31, <strong>2005</strong> and 2004. All foreign currency<br />

option and forward contracts outstanding at December<br />

31, 2003 had maturity dates of less than twelve months<br />

and were undesignated hedges with changes in fair value<br />

being recognized in earnings in accordance with FAS No.<br />

133. These derivative instrument values were included in<br />

either Other current assets or Other accruals and were<br />

immaterial at December 31, 2003.<br />

Provisions for environmental matters represent<br />

adjustments to environmental-related accruals as information<br />

becomes available upon which more accurate<br />

costs can be reasonably estimated and as additional<br />

accounting guidelines are issued. See Note 8.<br />

Other income and Other expense included items of<br />

revenue, gains, expenses and losses that were unrelated<br />

to the primary business purpose of the Company. Each<br />

individual item within the other income or other<br />

expense caption was immaterial; no single category<br />

of items exceeded $1,000.<br />

NOTE 13 – INCOME TAXES<br />

Deferred income taxes reflect the net tax effects of<br />

temporary differences between the carrying amounts of<br />

assets and liabilities for financial reporting purposes and<br />

the amounts used for income tax purposes using the<br />

enacted tax rates and laws that are currently in effect.<br />

Significant components of the Company’s deferred tax<br />

assets and liabilities as of December 31, <strong>2005</strong>, 2004<br />

and 2003 were as follows:<br />

<strong>2005</strong> 2004 2003<br />

Deferred tax assets:<br />

Dispositions,<br />

environmental<br />

and other<br />

similar items.......... $ 54,683 $ 51,859 $ 47,941<br />

Other items (each<br />

less than 5 percent<br />

of total assets) ...... 135,952 110,955 105,660<br />

Total deferred<br />

tax assets .......... $ 190,635 $ 162,814 $ 153,601<br />

Deferred tax liabilities:<br />

Depreciation and<br />

amortization.......... $ 82,931 $ 75,573 $ 49,634<br />

Deferred employee<br />

benefit items .......... 46,723 59,892 61,981<br />

Total deferred<br />

tax liabilities ...... $ 129,654 $ 135,465 $ 111,615<br />

Netted against the Company’s other deferred tax<br />

assets were valuation reserves of $5,658, $14,930<br />

and $17,643 at December 31, <strong>2005</strong>, 2004 and 2003,<br />

respectively, resulting from the uncertainty as to the<br />

realization of the tax benefits from certain foreign net<br />

operating losses and certain other foreign assets.<br />

66