2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(thousands of dollars unless otherwise indicated)<br />

NOTE 7 – DEBT<br />

Maturities of long-term debt are as follows for the<br />

next five years: $10,493 in 2006; $197,405 in 2007;<br />

$65 in 2008; $65 in 2009, and $65 in 2010. Interest<br />

expense on long-term debt was $37,201, $37,315 and<br />

$37,460 for <strong>2005</strong>, 2004 and 2003, respectively.<br />

Among other restrictions, the Company’s Notes,<br />

Debentures and revolving credit agreement contain<br />

certain covenants relating to liens, ratings changes,<br />

merger and sale of assets, consolidated leverage and<br />

change of control as defined in the agreements. In the<br />

event of default under any one of these arrangements,<br />

acceleration of the maturity of any one or more of these<br />

borrowings may result. The Company was in compliance<br />

with all covenants for all years presented.<br />

During 2003, the Company entered into two separate<br />

interest rate swap contracts. Both interest rate swap<br />

contracts were with a bank to hedge against changes in<br />

the fair value of a portion of the Company’s 6.85%<br />

Notes. Each interest rate swap contract had a notional<br />

amount of $25,000. The Company agreed to receive<br />

interest at a fixed rate of 6.85% and pay interest at sixmonth<br />

London Interbank Offered Rates plus points that<br />

varied by contract. These contracts were designated as<br />

perfect fair value hedges of the 6.85% Notes. Accordingly,<br />

changes in the fair value of these contracts were<br />

recorded as assets or liabilities and offset changes in the<br />

carrying value of the 6.85% Notes. During 2004, the<br />

Company unwound all of the interest rate swap contracts<br />

and paid $1,084 to the bank for discontinuation<br />

of the contracts. The net payment decreased the carrying<br />

amount of the 6.85% Notes and is being amortized to<br />

expense over the remaining maturity of the Notes. At<br />

December 31, 2003, the fair value of the two separate<br />

interest rate swap contracts represented unrealized losses<br />

of $819, which was included in Other long-term liabilities.<br />

The weighted average interest rate on these<br />

contracts was 5.35 percent at December 31, 2003.<br />

Prior to 2003, the Company entered into interest rate<br />

swap contracts with a bank to hedge against changes in<br />

the fair value of a portion of the Company’s 6.85%<br />

Notes. Prior to 2003, the Company unwound the interest<br />

rate swap contracts and received a net premium of<br />

$4,762 for discontinuation of the contracts. The net<br />

premium increased the carrying amount of the 6.85%<br />

Notes and is being amortized to income over the<br />

remaining maturity of the Notes. There were no interest<br />

rate swap agreements outstanding at December 31,<br />

<strong>2005</strong> and 2004.<br />

The Company has a five-year senior unsecured<br />

revolving credit agreement. The agreement, aggregating<br />

$910,000, was amended effective July 19, <strong>2005</strong> and<br />

expires July 20, 2009. Effective December 8, <strong>2005</strong>, a<br />

$500,000 letter of credit subfacility amendment was<br />

added to the agreement. There were no borrowings<br />

outstanding under the revolving credit agreement<br />

during all years presented.<br />

At December 31, <strong>2005</strong> and 2004, borrowings outstanding<br />

under the commercial paper program totaled<br />

$74,678 and $231,203, respectively and were included<br />

in Short-term borrowings on the balance sheet. The<br />

weighted-average interest rate related to these borrowings<br />

was 4.2% and 2.3% at December 31, <strong>2005</strong> and<br />

2004, respectively. There were no borrowings outstanding<br />

under the Company’s commercial paper program at<br />

December 31, 2003. The Company uses the revolving<br />

credit agreement primarily to satisfy its commercial<br />

paper program’s dollar for dollar liquidity requirement.<br />

Effective September 26, <strong>2005</strong>, the Company’s commercial<br />

paper program maximum borrowing capability was<br />

increased to $910,000. Borrowings outstanding under<br />

various foreign programs at December 31, <strong>2005</strong> of<br />

$49,003 with a weighted-average interest rate of 5.4%<br />

and at December 31, 2004 of $7,612 with a weightedaverage<br />

interest rate of 5.0% were included in Shortterm<br />

borrowings on the balance sheet. There were no<br />

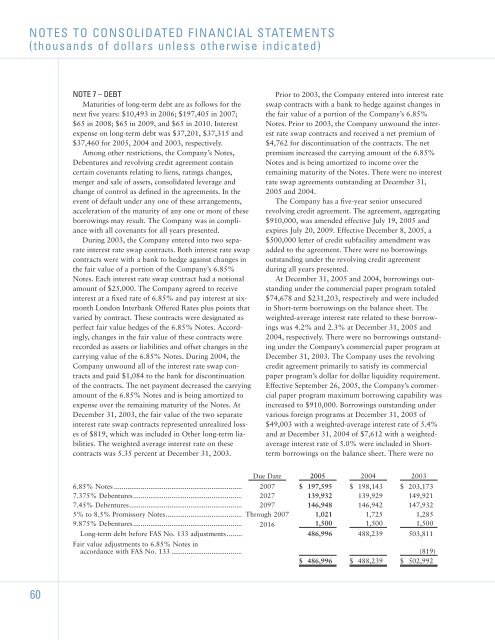

Due Date <strong>2005</strong> 2004 2003<br />

6.85% Notes ................................................................... 2007 $ 197,595 $ 198,143 $ 203,173<br />

7.375% Debentures......................................................... 2027 139,932 139,929 149,921<br />

7.45% Debentures........................................................... 2097 146,948 146,942 147,932<br />

5% to 8.5% Promissory Notes........................................ Through 2007 1,021 1,725 1,285<br />

9.875% Debentures......................................................... 2016 1,500 1,500 1,500<br />

Long-term debt before FAS No. 133 adjustments........ 486,996 488,239 503,811<br />

Fair value adjustments to 6.85% Notes in<br />

accordance with FAS No. 133 ..................................... (819)<br />

$ 486,996 $ 488,239 $ 502,992<br />

60