2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(thousands of dollars unless otherwise indicated)<br />

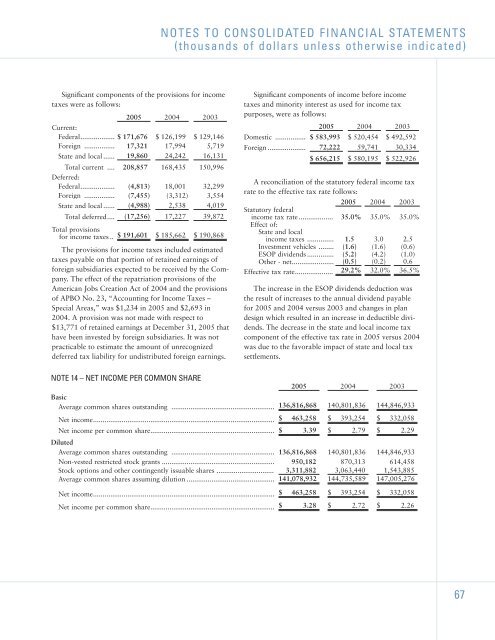

Significant components of the provisions for income<br />

taxes were as follows:<br />

<strong>2005</strong> 2004 2003<br />

Current:<br />

Federal.................. $ 171,676 $ 126,199 $ 129,146<br />

Foreign ................ 17,321 17,994 5,719<br />

State and local ...... 19,860 24,242 16,131<br />

Total current .... 208,857 168,435 150,996<br />

Deferred:<br />

Federal.................. (4,813) 18,001 32,299<br />

Foreign ................ (7,455) (3,312) 3,554<br />

State and local ...... (4,988) 2,538 4,019<br />

Total deferred.... (17,256) 17,227 39,872<br />

Total provisions<br />

for income taxes .. $ 191,601 $ 185,662 $ 190,868<br />

The provisions for income taxes included estimated<br />

taxes payable on that portion of retained earnings of<br />

foreign subsidiaries expected to be received by the Company.<br />

The effect of the repatriation provisions of the<br />

American Jobs Creation Act of 2004 and the provisions<br />

of APBO No. 23, “Accounting for Income Taxes –<br />

Special Areas,” was $1,234 in <strong>2005</strong> and $2,693 in<br />

2004. A provision was not made with respect to<br />

$13,771 of retained earnings at December 31, <strong>2005</strong> that<br />

have been invested by foreign subsidiaries. It was not<br />

practicable to estimate the amount of unrecognized<br />

deferred tax liability for undistributed foreign earnings.<br />

Significant components of income before income<br />

taxes and minority interest as used for income tax<br />

purposes, were as follows:<br />

<strong>2005</strong> 2004 2003<br />

Domestic ................ $ 583,993 $ 520,454 $ 492,592<br />

Foreign .................... 72,222 59,741 30,334<br />

$ 656,215 $ 580,195 $ 522,926<br />

A reconciliation of the statutory federal income tax<br />

rate to the effective tax rate follows:<br />

<strong>2005</strong> 2004 2003<br />

Statutory federal<br />

income tax rate .................. 35.0% 35.0% 35.0%<br />

Effect of:<br />

State and local<br />

income taxes .............. 1.5 3.0 2.5<br />

Investment vehicles ........ (1.6) (1.6) (0.6)<br />

ESOP dividends .............. (5.2) (4.2) (1.0)<br />

Other - net...................... (0.5) (0.2) 0.6<br />

Effective tax rate.................... 29.2% 32.0% 36.5%<br />

The increase in the ESOP dividends deduction was<br />

the result of increases to the annual dividend payable<br />

for <strong>2005</strong> and 2004 versus 2003 and changes in plan<br />

design which resulted in an increase in deductible dividends.<br />

The decrease in the state and local income tax<br />

component of the effective tax rate in <strong>2005</strong> versus 2004<br />

was due to the favorable impact of state and local tax<br />

settlements.<br />

NOTE 14 – NET INCOME PER COMMON SHARE<br />

<strong>2005</strong> 2004 2003<br />

Basic<br />

Average common shares outstanding ...................................................... 136,816,868 140,801,836 144,846,933<br />

Net income............................................................................................... $ 463,258 $ 393,254 $ 332,058<br />

Net income per common share................................................................. $ 3.39 $ 2.79 $ 2.29<br />

Diluted<br />

Average common shares outstanding ...................................................... 136,816,868 140,801,836 144,846,933<br />

Non-vested restricted stock grants ........................................................... 950,182 870,313 614,458<br />

Stock options and other contingently issuable shares .............................. 3,311,882 3,063,440 1,543,885<br />

Average common shares assuming dilution .............................................. 141,078,932 144,735,589 147,005,276<br />

Net income............................................................................................... $ 463,258 $ 393,254 $ 332,058<br />

Net income per common share................................................................. $ 3.28 $ 2.72 $ 2.26<br />

67