2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

2005 Annual Report - Investor Relations - Sherwin-Williams

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

(thousands of dollars unless otherwise indicated)<br />

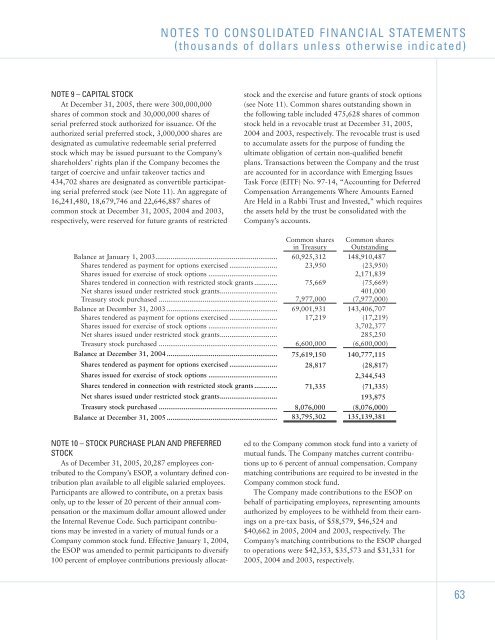

NOTE 9 – CAPITAL STOCK<br />

At December 31, <strong>2005</strong>, there were 300,000,000<br />

shares of common stock and 30,000,000 shares of<br />

serial preferred stock authorized for issuance. Of the<br />

authorized serial preferred stock, 3,000,000 shares are<br />

designated as cumulative redeemable serial preferred<br />

stock which may be issued pursuant to the Company’s<br />

shareholders’ rights plan if the Company becomes the<br />

target of coercive and unfair takeover tactics and<br />

434,702 shares are designated as convertible participating<br />

serial preferred stock (see Note 11). An aggregate of<br />

16,241,480, 18,679,746 and 22,646,887 shares of<br />

common stock at December 31, <strong>2005</strong>, 2004 and 2003,<br />

respectively, were reserved for future grants of restricted<br />

stock and the exercise and future grants of stock options<br />

(see Note 11). Common shares outstanding shown in<br />

the following table included 475,628 shares of common<br />

stock held in a revocable trust at December 31, <strong>2005</strong>,<br />

2004 and 2003, respectively. The revocable trust is used<br />

to accumulate assets for the purpose of funding the<br />

ultimate obligation of certain non-qualified benefit<br />

plans. Transactions between the Company and the trust<br />

are accounted for in accordance with Emerging Issues<br />

Task Force (EITF) No. 97-14, “Accounting for Deferred<br />

Compensation Arrangements Where Amounts Earned<br />

Are Held in a Rabbi Trust and Invested,” which requires<br />

the assets held by the trust be consolidated with the<br />

Company’s accounts.<br />

Common shares<br />

in Treasury<br />

Common shares<br />

Outstanding<br />

Balance at January 1, 2003................................................................ 60,925,312 148,910,487<br />

Shares tendered as payment for options exercised ......................... 23,950 (23,950)<br />

Shares issued for exercise of stock options .................................... 2,171,839<br />

Shares tendered in connection with restricted stock grants ............ 75,669 (75,669)<br />

Net shares issued under restricted stock grants.............................. 401,000<br />

Treasury stock purchased .............................................................. 7,977,000 (7,977,000)<br />

Balance at December 31, 2003 .......................................................... 69,001,931 143,406,707<br />

Shares tendered as payment for options exercised ......................... 17,219 (17,219)<br />

Shares issued for exercise of stock options .................................... 3,702,377<br />

Net shares issued under restricted stock grants.............................. 285,250<br />

Treasury stock purchased .............................................................. 6,600,000 (6,600,000)<br />

Balance at December 31, 2004 .......................................................... 75,619,150 140,777,115<br />

Shares tendered as payment for options exercised ......................... 28,817 (28,817)<br />

Shares issued for exercise of stock options .................................... 2,344,543<br />

Shares tendered in connection with restricted stock grants ............ 71,335 (71,335)<br />

Net shares issued under restricted stock grants.............................. 193,875<br />

Treasury stock purchased .............................................................. 8,076,000 (8,076,000)<br />

Balance at December 31, <strong>2005</strong> .......................................................... 83,795,302 135,139,381<br />

NOTE 10 – STOCK PURCHASE PLAN AND PREFERRED<br />

STOCK<br />

As of December 31, <strong>2005</strong>, 20,287 employees contributed<br />

to the Company’s ESOP, a voluntary defined contribution<br />

plan available to all eligible salaried employees.<br />

Participants are allowed to contribute, on a pretax basis<br />

only, up to the lesser of 20 percent of their annual compensation<br />

or the maximum dollar amount allowed under<br />

the Internal Revenue Code. Such participant contributions<br />

may be invested in a variety of mutual funds or a<br />

Company common stock fund. Effective January 1, 2004,<br />

the ESOP was amended to permit participants to diversify<br />

100 percent of employee contributions previously allocated<br />

to the Company common stock fund into a variety of<br />

mutual funds. The Company matches current contributions<br />

up to 6 percent of annual compensation. Company<br />

matching contributions are required to be invested in the<br />

Company common stock fund.<br />

The Company made contributions to the ESOP on<br />

behalf of participating employees, representing amounts<br />

authorized by employees to be withheld from their earnings<br />

on a pre-tax basis, of $58,579, $46,524 and<br />

$40,662 in <strong>2005</strong>, 2004 and 2003, respectively. The<br />

Company’s matching contributions to the ESOP charged<br />

to operations were $42,353, $35,573 and $31,331 for<br />

<strong>2005</strong>, 2004 and 2003, respectively.<br />

63