CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

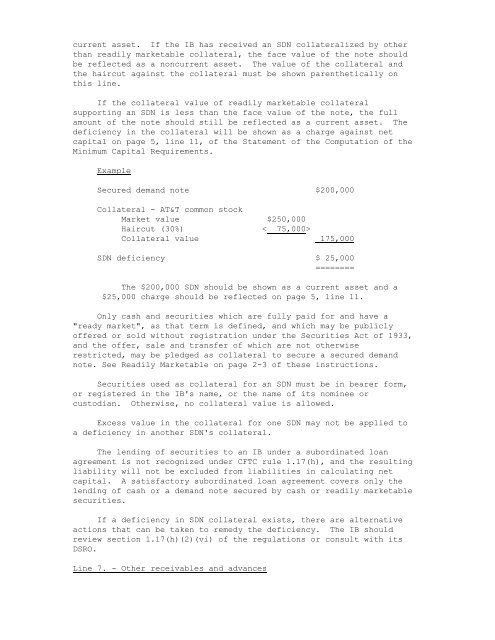

current asset. If the <strong>IB</strong> has received an SDN collateralized by other<br />

than readily marketable collateral, the face value of the note should<br />

be reflected as a noncurrent asset. The value of the collateral and<br />

the haircut against the collateral must be shown parenthetically on<br />

this line.<br />

If the collateral value of readily marketable collateral<br />

supporting an SDN is less than the face value of the note, the full<br />

amount of the note should still be reflected as a current asset. The<br />

deficiency in the collateral will be shown as a charge against net<br />

capital on page 5, line 11, of the Statement of the Computation of the<br />

Minimum Capital Requirements.<br />

Example<br />

Secured demand note $200,000<br />

Collateral - AT&T common stock<br />

Market value $250,000<br />

Haircut (30%) < 75,000><br />

Collateral value 175,000<br />

SDN deficiency $ 25,000<br />

========<br />

The $200,000 SDN should be shown as a current asset and a<br />

$25,000 charge should be reflected on page 5, line 11.<br />

Only cash and securities which are fully paid for and have a<br />

"ready market", as that term is defined, and which may be publicly<br />

offered or sold without registration under the Securities Act of 1933,<br />

and the offer, sale and transfer of which are not otherwise<br />

restricted, may be pledged as collateral to secure a secured demand<br />

note. See Readily Marketable on page 2-3 of these instructions.<br />

Securities used as collateral for an SDN must be in bearer form,<br />

or registered in the <strong>IB</strong>'s name, or the name of its nominee or<br />

custodian. Otherwise, no collateral value is allowed.<br />

Excess value in the collateral for one SDN may not be applied to<br />

a deficiency in another SDN's collateral.<br />

The lending of securities to an <strong>IB</strong> under a subordinated loan<br />

agreement is not recognized under <strong>CFTC</strong> rule 1.17(h), and the resulting<br />

liability will not be excluded from liabilities in calculating net<br />

capital. A satisfactory subordinated loan agreement covers only the<br />

lending of cash or a demand note secured by cash or readily marketable<br />

securities.<br />

If a deficiency in SDN collateral exists, there are alternative<br />

actions that can be taken to remedy the deficiency. The <strong>IB</strong> should<br />

review section 1.17(h)(2)(vi) of the regulations or consult with its<br />

DSRO.<br />

Line 7. - Other receivables and advances