CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

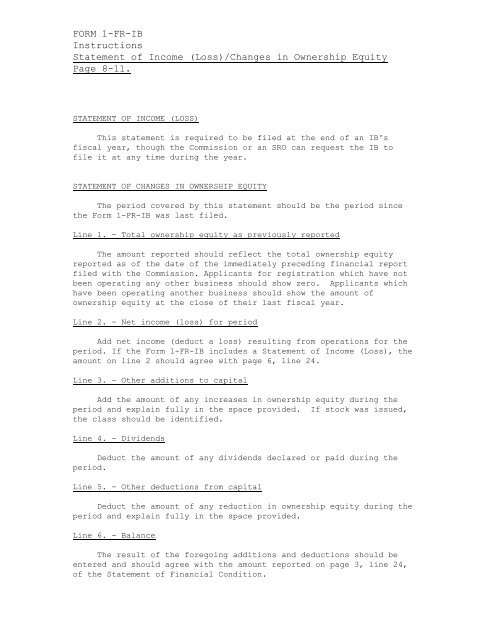

FORM 1-<strong>FR</strong>-<strong>IB</strong><br />

<strong>Instructions</strong><br />

Statement of Income (Loss)/Changes in Ownership Equity<br />

Page 8-11.<br />

STATEMENT OF INCOME (LOSS)<br />

This statement is required to be filed at the end of an <strong>IB</strong>'s<br />

fiscal year, though the Commission or an SRO can request the <strong>IB</strong> to<br />

file it at any time during the year.<br />

STATEMENT OF CHANGES IN OWNERSHIP EQUITY<br />

The period covered by this statement should be the period since<br />

the <strong>Form</strong> 1-<strong>FR</strong>-<strong>IB</strong> was last filed.<br />

Line 1. - Total ownership equity as previously reported<br />

The amount reported should reflect the total ownership equity<br />

reported as of the date of the immediately preceding financial report<br />

filed with the Commission. Applicants for registration which have not<br />

been operating any other business should show zero. Applicants which<br />

have been operating another business should show the amount of<br />

ownership equity at the close of their last fiscal year.<br />

Line 2. - Net income (loss) for period<br />

Add net income (deduct a loss) resulting from operations for the<br />

period. If the <strong>Form</strong> 1-<strong>FR</strong>-<strong>IB</strong> includes a Statement of Income (Loss), the<br />

amount on line 2 should agree with page 6, line 24.<br />

Line 3. - Other additions to capital<br />

Add the amount of any increases in ownership equity during the<br />

period and explain fully in the space provided. If stock was issued,<br />

the class should be identified.<br />

Line 4. - Dividends<br />

Deduct the amount of any dividends declared or paid during the<br />

period.<br />

Line 5. - Other deductions from capital<br />

Deduct the amount of any reduction in ownership equity during the<br />

period and explain fully in the space provided.<br />

Line 6. - Balance<br />

The result of the foregoing additions and deductions should be<br />

entered and should agree with the amount reported on page 3, line 24,<br />

of the Statement of Financial Condition.