CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

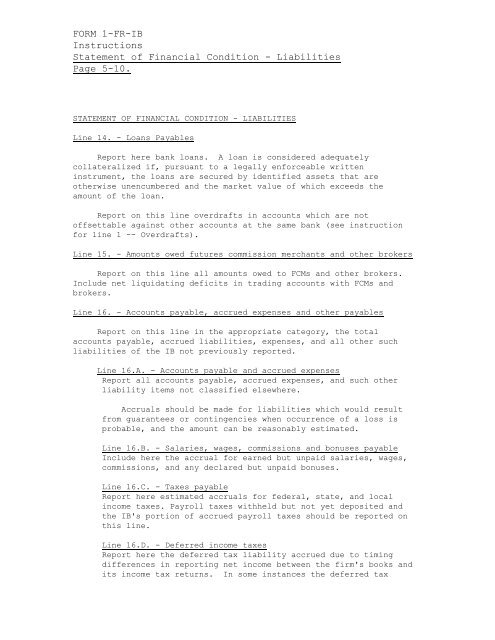

FORM 1-<strong>FR</strong>-<strong>IB</strong><br />

<strong>Instructions</strong><br />

Statement of Financial Condition - Liabilities<br />

Page 5-10.<br />

STATEMENT OF FINANCIAL CONDITION - LIABILITIES<br />

Line 14. - Loans Payables<br />

Report here bank loans. A loan is considered adequately<br />

collateralized if, pursuant to a legally enforceable written<br />

instrument, the loans are secured by identified assets that are<br />

otherwise unencumbered and the market value of which exceeds the<br />

amount of the loan.<br />

Report on this line overdrafts in accounts which are not<br />

offsettable against other accounts at the same bank (see instruction<br />

for line 1 -- Overdrafts).<br />

Line 15. - Amounts owed futures commission merchants and other brokers<br />

Report on this line all amounts owed to FCMs and other brokers.<br />

Include net liquidating deficits in trading accounts with FCMs and<br />

brokers.<br />

Line 16. - Accounts payable, accrued expenses and other payables<br />

Report on this line in the appropriate category, the total<br />

accounts payable, accrued liabilities, expenses, and all other such<br />

liabilities of the <strong>IB</strong> not previously reported.<br />

Line 16.A. - Accounts payable and accrued expenses<br />

Report all accounts payable, accrued expenses, and such other<br />

liability items not classified elsewhere.<br />

Accruals should be made for liabilities which would result<br />

from guarantees or contingencies when occurrence of a loss is<br />

probable, and the amount can be reasonably estimated.<br />

Line 16.B. - Salaries, wages, commissions and bonuses payable<br />

Include here the accrual for earned but unpaid salaries, wages,<br />

commissions, and any declared but unpaid bonuses.<br />

Line 16.C. - Taxes payable<br />

Report here estimated accruals for federal, state, and local<br />

income taxes. Payroll taxes withheld but not yet deposited and<br />

the <strong>IB</strong>'s portion of accrued payroll taxes should be reported on<br />

this line.<br />

Line 16.D. - Deferred income taxes<br />

Report here the deferred tax liability accrued due to timing<br />

differences in reporting net income between the firm's books and<br />

its income tax returns. In some instances the deferred tax