CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

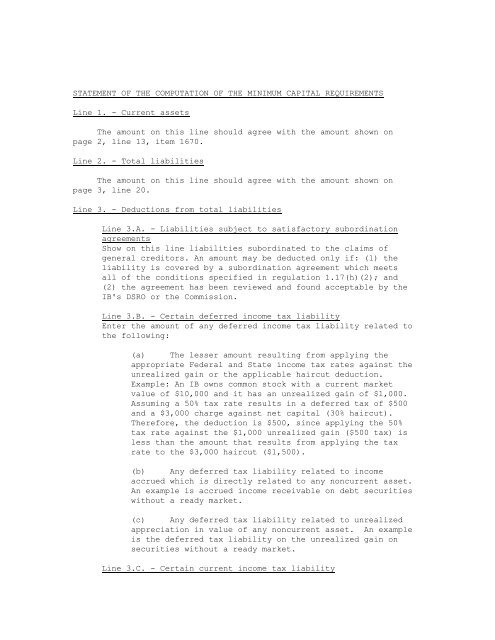

STATEMENT OF THE COMPUTATION OF THE MINIMUM CAPITAL REQUIREMENTS<br />

Line 1. - Current assets<br />

The amount on this line should agree with the amount shown on<br />

page 2, line 13, item 1670.<br />

Line 2. - Total liabilities<br />

The amount on this line should agree with the amount shown on<br />

page 3, line 20.<br />

Line 3. - Deductions from total liabilities<br />

Line 3.A. - Liabilities subject to satisfactory subordination<br />

agreements<br />

Show on this line liabilities subordinated to the claims of<br />

general creditors. An amount may be deducted only if: (1) the<br />

liability is covered by a subordination agreement which meets<br />

all of the conditions specified in regulation 1.17(h)(2); and<br />

(2) the agreement has been reviewed and found acceptable by the<br />

<strong>IB</strong>'s DSRO or the Commission.<br />

Line 3.B. - Certain deferred income tax liability<br />

Enter the amount of any deferred income tax liability related to<br />

the following:<br />

(a) The lesser amount resulting from applying the<br />

appropriate Federal and State income tax rates against the<br />

unrealized gain or the applicable haircut deduction.<br />

Example: An <strong>IB</strong> owns common stock with a current market<br />

value of $10,000 and it has an unrealized gain of $1,000.<br />

Assuming a 50% tax rate results in a deferred tax of $500<br />

and a $3,000 charge against net capital (30% haircut).<br />

Therefore, the deduction is $500, since applying the 50%<br />

tax rate against the $1,000 unrealized gain ($500 tax) is<br />

less than the amount that results from applying the tax<br />

rate to the $3,000 haircut ($1,500).<br />

(b) Any deferred tax liability related to income<br />

accrued which is directly related to any noncurrent asset.<br />

An example is accrued income receivable on debt securities<br />

without a ready market.<br />

(c) Any deferred tax liability related to unrealized<br />

appreciation in value of any noncurrent asset. An example<br />

is the deferred tax liability on the unrealized gain on<br />

securities without a ready market.<br />

Line 3.C. - Certain current income tax liability