CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

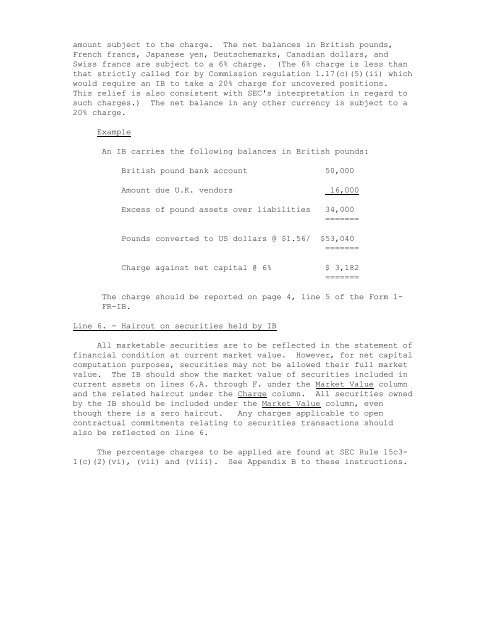

amount subject to the charge. The net balances in British pounds,<br />

French francs, Japanese yen, Deutschemarks, Canadian dollars, and<br />

Swiss francs are subject to a 6% charge. (The 6% charge is less than<br />

that strictly called for by Commission regulation 1.17(c)(5)(ii) which<br />

would require an <strong>IB</strong> to take a 20% charge for uncovered positions.<br />

This relief is also consistent with SEC's interpretation in regard to<br />

such charges.) The net balance in any other currency is subject to a<br />

20% charge.<br />

Example<br />

An <strong>IB</strong> carries the following balances in British pounds:<br />

British pound bank account 50,000<br />

Amount due U.K. vendors 16,000<br />

Excess of pound assets over liabilities 34,000<br />

=======<br />

Pounds converted to US dollars @ $1.56/ $53,040<br />

=======<br />

Charge against net capital @ 6% $ 3,182<br />

=======<br />

The charge should be reported on page 4, line 5 of the <strong>Form</strong> 1-<br />

<strong>FR</strong>-<strong>IB</strong>.<br />

Line 6. - Haircut on securities held by <strong>IB</strong><br />

All marketable securities are to be reflected in the statement of<br />

financial condition at current market value. However, for net capital<br />

computation purposes, securities may not be allowed their full market<br />

value. The <strong>IB</strong> should show the market value of securities included in<br />

current assets on lines 6.A. through F. under the Market Value column<br />

and the related haircut under the Charge column. All securities owned<br />

by the <strong>IB</strong> should be included under the Market Value column, even<br />

though there is a zero haircut. Any charges applicable to open<br />

contractual commitments relating to securities transactions should<br />

also be reflected on line 6.<br />

The percentage charges to be applied are found at SEC Rule 15c3-<br />

1(c)(2)(vi), (vii) and (viii). See Appendix B to these instructions.