CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

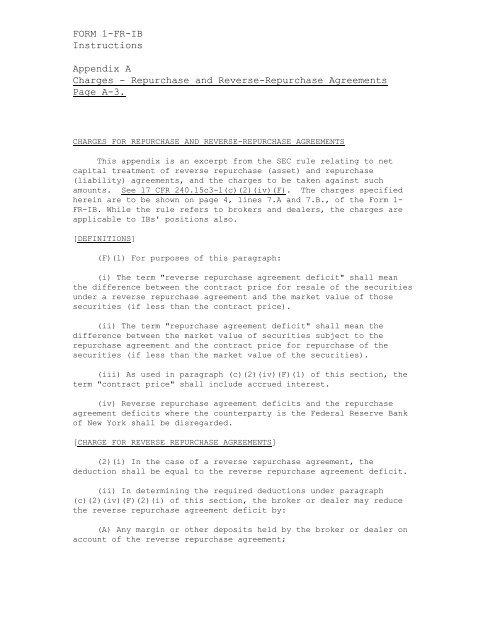

FORM 1-<strong>FR</strong>-<strong>IB</strong><br />

<strong>Instructions</strong><br />

Appendix A<br />

Charges - Repurchase and Reverse-Repurchase Agreements<br />

Page A-3.<br />

CHARGES FOR REPURCHASE AND REVERSE-REPURCHASE AGREEMENTS<br />

This appendix is an excerpt from the SEC rule relating to net<br />

capital treatment of reverse repurchase (asset) and repurchase<br />

(liability) agreements, and the charges to be taken against such<br />

amounts. See 17 C<strong>FR</strong> 240.15c3-1(c)(2)(iv)(F). The charges specified<br />

herein are to be shown on page 4, lines 7.A and 7.B., of the <strong>Form</strong> 1-<br />

<strong>FR</strong>-<strong>IB</strong>. While the rule refers to brokers and dealers, the charges are<br />

applicable to <strong>IB</strong>s' positions also.<br />

[DEFINITIONS]<br />

(F)(1) For purposes of this paragraph:<br />

(i) The term "reverse repurchase agreement deficit" shall mean<br />

the difference between the contract price for resale of the securities<br />

under a reverse repurchase agreement and the market value of those<br />

securities (if less than the contract price).<br />

(ii) The term "repurchase agreement deficit" shall mean the<br />

difference between the market value of securities subject to the<br />

repurchase agreement and the contract price for repurchase of the<br />

securities (if less than the market value of the securities).<br />

(iii) As used in paragraph (c)(2)(iv)(F)(1) of this section, the<br />

term "contract price" shall include accrued interest.<br />

(iv) Reverse repurchase agreement deficits and the repurchase<br />

agreement deficits where the counterparty is the Federal Reserve Bank<br />

of New York shall be disregarded.<br />

[CHARGE FOR REVERSE REPURCHASE AGREEMENTS]<br />

(2)(i) In the case of a reverse repurchase agreement, the<br />

deduction shall be equal to the reverse repurchase agreement deficit.<br />

(ii) In determining the required deductions under paragraph<br />

(c)(2)(iv)(F)(2)(i) of this section, the broker or dealer may reduce<br />

the reverse repurchase agreement deficit by:<br />

(A) Any margin or other deposits held by the broker or dealer on<br />

account of the reverse repurchase agreement;