CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

CFTC Form 1-FR-IB Instructions - National Futures Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

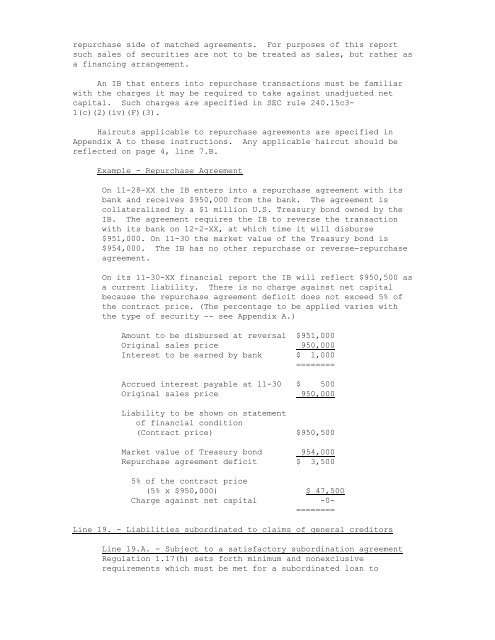

epurchase side of matched agreements. For purposes of this report<br />

such sales of securities are not to be treated as sales, but rather as<br />

a financing arrangement.<br />

An <strong>IB</strong> that enters into repurchase transactions must be familiar<br />

with the charges it may be required to take against unadjusted net<br />

capital. Such charges are specified in SEC rule 240.15c3-<br />

1(c)(2)(iv)(F)(3).<br />

Haircuts applicable to repurchase agreements are specified in<br />

Appendix A to these instructions. Any applicable haircut should be<br />

reflected on page 4, line 7.B.<br />

Example - Repurchase Agreement<br />

On 11-28-XX the <strong>IB</strong> enters into a repurchase agreement with its<br />

bank and receives $950,000 from the bank. The agreement is<br />

collateralized by a $1 million U.S. Treasury bond owned by the<br />

<strong>IB</strong>. The agreement requires the <strong>IB</strong> to reverse the transaction<br />

with its bank on 12-2-XX, at which time it will disburse<br />

$951,000. On 11-30 the market value of the Treasury bond is<br />

$954,000. The <strong>IB</strong> has no other repurchase or reverse-repurchase<br />

agreement.<br />

On its 11-30-XX financial report the <strong>IB</strong> will reflect $950,500 as<br />

a current liability. There is no charge against net capital<br />

because the repurchase agreement deficit does not exceed 5% of<br />

the contract price. (The percentage to be applied varies with<br />

the type of security -- see Appendix A.)<br />

Amount to be disbursed at reversal $951,000<br />

Original sales price 950,000<br />

Interest to be earned by bank $ 1,000<br />

========<br />

Accrued interest payable at 11-30 $ 500<br />

Original sales price 950,000<br />

Liability to be shown on statement<br />

of financial condition<br />

(Contract price) $950,500<br />

Market value of Treasury bond 954,000<br />

Repurchase agreement deficit $ 3,500<br />

5% of the contract price<br />

(5% x $950,000) $ 47,500<br />

Charge against net capital -0-<br />

========<br />

Line 19. - Liabilities subordinated to claims of general creditors<br />

Line 19.A. - Subject to a satisfactory subordination agreement<br />

Regulation 1.17(h) sets forth minimum and nonexclusive<br />

requirements which must be met for a subordinated loan to