Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

There are a number of arguments for trade barriers but can they be justified?<br />

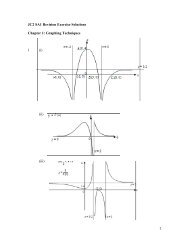

number of foreign goods can be<br />

purchased at a constant world price Pw<br />

in Figure 2. This means that the world<br />

supply curve for the product is perfectly<br />

elastic at price Pw.<br />

With no tariff (world price Pw),<br />

domestic supply is Q1 and domestic<br />

demand is Q4. The difference is met by<br />

imports (Q1-Q4). The introduction of a<br />

tariff effectively raises the world price to<br />

Pw+t. Domestic supply expands to Q2,<br />

while demand contracts to Q3. With the<br />

tariff, the level of the imports is Q2-Q3. If<br />

there is no retaliation by other countries<br />

(and this may be assuming a great deal),<br />

this fall in imports may reduce a current<br />

account deficit.<br />

However, the rise in price reduces the<br />

level of consumer surplus by the area<br />

A + B + C + D. Not good for domestic<br />

consumers, especially if hard pressed by<br />

recession. On the other hand, although<br />

consumer welfare has been reduced,<br />

domestic producers and the government<br />

both benefit from the tariff. Producer<br />

surplus has increased by area A, and the<br />

government receives revenue from the<br />

tariff equal to area C. This is calculated<br />

by multiplying the tariff by the level of<br />

imports Q2-Q3.<br />

Part of the fall in consumer surplus is<br />

not compensated for by gains to any<br />

other group in the economy. It is<br />

common, then, to regard areas B and D<br />

as deadweight welfare losses to the<br />

economy as a whole. However, the<br />

expansion in domestic output means<br />

that producers also receive area B in the<br />

form of higher revenue so the dead -<br />

weight loss could be argued to be area<br />

D alone.<br />

Whichever approach we take, there is<br />

an overall loss of welfare to the economy<br />

Key terms<br />

and questions of equity (fairness) may<br />

have to be considered and weighed to<br />

justify this loss.<br />

What conclusions<br />

might be drawn?<br />

There would appear to be a formidable<br />

economic case for free international<br />

Absolute Advantage – This describes a situation in which, for a given set<br />

of resources one country can produce more of a particular good or service<br />

than another country.<br />

Comparative Advantage – If a country has an absolute advantage in<br />

producing both goods (in a two good example) it should specialise in the<br />

production of the good in which it has the greatest advantage.<br />

Consumption Possibility Curve – This shows all possible levels of<br />

consumption that are available to a country if it specialises on the grounds<br />

laid down by the Law of Comparative Advantage.<br />

Deadweight Loss of Welfare – In the context of the imposition of tariffs,<br />

this is the net loss of welfare to the country concerned. It is the difference<br />

between the welfare loss to domestic consumers from price increases (a<br />

reduction in consumer surplus) and the welfare gain to domestic producers<br />

(an increase in producer surplus) and the government (tax revenue<br />

increases).<br />

Infant Industry Argument – The argument that newly-formed industries,<br />

with the potential to achieve an absolute or comparative advantage in the<br />

future, should be temporarily protected from overseas competition.<br />

Dumping – The selling of goods in an overseas market at a price below the<br />

cost of production.<br />

M ARCH 2010 25