Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A reduction in interest rates also makes it cheaper<br />

for businesses to borrow which should help to<br />

promote investment. However, a lack of business<br />

confidence might make firms unwilling to invest<br />

especially if they consider that the recovery will be<br />

very weak. Another important issue affecting both<br />

consumption and investment is the unwillingness of<br />

banks to lend as they try to rebuild their capital.<br />

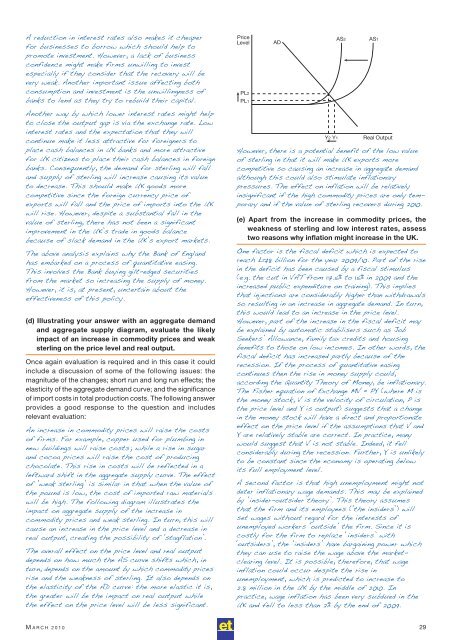

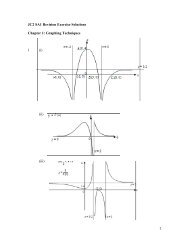

Price<br />

Level<br />

PL2<br />

PL1<br />

AD<br />

AS2<br />

AS1<br />

Another way by which lower interest rates might help<br />

to close the output gap is via the exchange rate. Low<br />

interest rates and the expectation that they will<br />

continue make it less attractive for foreigners to<br />

place cash balances in UK banks and more attractive<br />

for UK citizens to place their cash balances in foreign<br />

banks. Consequently, the demand for sterling will fall<br />

and supply of sterling will increase causing its value<br />

to decrease. This should make UK goods more<br />

competitive since the foreign currency price of<br />

exports will fall and the price of imports into the UK<br />

will rise. However, despite a substantial fall in the<br />

value of sterling, there has not been a significant<br />

improvement in the UK’s trade in goods balance<br />

because of slack demand in the UK’s export markets.<br />

The above analysis explains why the Bank of England<br />

has embarked on a process of quantitative easing.<br />

This involves the Bank buying gilt-edged securities<br />

from the market so increasing the supply of money.<br />

However, it is, at present, uncertain about the<br />

effectiveness of this policy.<br />

(d) Illustrating your answer with an aggregate demand<br />

and aggregate supply diagram, evaluate the likely<br />

impact of an increase in commodity prices and weak<br />

sterling on the price level and real output.<br />

Once again evaluation is required and in this case it could<br />

include a discussion of some of the following issues: the<br />

magnitude of the changes; short run and long run effects; the<br />

elasticity of the aggregate demand curve; and the significance<br />

of import costs in total production costs. The following answer<br />

provides a good response to the question and includes<br />

relevant evaluation:<br />

An increase in commodity prices will raise the costs<br />

of firms. For example, copper used for plumbing in<br />

new buildings will raise costs; while a rise in sugar<br />

and cocoa prices will raise the cost of producing<br />

chocolate. This rise in costs will be reflected in a<br />

leftward shift in the aggregate supply curve. The effect<br />

of ‘weak sterling’ is similar in that when the value of<br />

the pound is low, the cost of imported raw materials<br />

will be high. The following diagram illustrates the<br />

impact on aggregate supply of the increase in<br />

commodity prices and weak sterling. In turn, this will<br />

cause an increase in the price level and a decrease in<br />

real output, creating the possibility of ‘stagflation’.<br />

The overall effect on the price level and real output<br />

depends on how much the AS curve shifts which, in<br />

turn, depends on the amount by which commodity prices<br />

rise and the weakness of sterling. It also depends on<br />

the elasticity of the AD curve: the more elastic it is,<br />

the greater will be the impact on real output while<br />

the effect on the price level will be less significant.<br />

Y2 Y1<br />

Real Output<br />

However, there is a potential benefit of the low value<br />

of sterling in that it will make UK exports more<br />

competitive so causing an increase in aggregate demand<br />

although this could also stimulate inflationary<br />

pressures. The effect on inflation will be relatively<br />

insignificant if the high commodity prices are only tem -<br />

porary and if the value of sterling recovers during 2010.<br />

(e) Apart from the increase in commodity prices, the<br />

weakness of sterling and low interest rates, assess<br />

two reasons why inflation might increase in the UK.<br />

One factor is the fiscal deficit which is expected to<br />

reach £178 billion for the year 2009/10. Part of the rise<br />

in the deficit has been caused by a fiscal stimulus<br />

(e.g. the cut in VAT from 17.5% to 15% in 2009 and the<br />

increased public expenditure on training). This implies<br />

that injections are considerably higher than withdrawals<br />

so resulting in an increase in aggregate demand. In turn,<br />

this would lead to an increase in the price level.<br />

However, part of the increase in the fiscal deficit may<br />

be explained by automatic stabilisers such as Job<br />

Seekers’ Allowance, family tax credits and housing<br />

benefits to those on low incomes. In other words, the<br />

fiscal deficit has increased partly because of the<br />

recession. If the process of quantitative easing<br />

continues then the rise in money supply could,<br />

according the Quantity Theory of Money, be inflationary.<br />

The Fisher equation of Exchange MV = PY (where M is<br />

the money stock, V is the velocity of circulation, P is<br />

the price level and Y is output) suggests that a change<br />

in the money stock will have a direct and proportionate<br />

effect on the price level if the assumptions that V and<br />

Y are relatively stable are correct. In practice, many<br />

would suggest that V is not stable. Indeed, it fell<br />

considerably during the recession. Further, Y is unlikely<br />

to be constant since the economy is operating below<br />

its full employment level.<br />

A second factor is that high unemployment might not<br />

deter inflationary wage demands. This may be explained<br />

by ‘insider-outsider theory’. This theory assumes<br />

that the firm and its employees ( ‘the insiders’ ) will<br />

set wages without regard for the interests of<br />

unemployed workers ‘outside’ the firm. Since it is<br />

costly for the firm to replace ‘insiders’ with<br />

‘outsiders’, the ‘insiders’ have bargaining power which<br />

they can use to raise the wage above the marketclearing<br />

level. It is possible, therefore, that wage<br />

inflation could occur despite the rise in<br />

unemployment, which is predicted to increase to<br />

2.8 million in the UK by the middle of 2010. In<br />

practice, wage inflation has been very subdued in the<br />

UK and fell to less than 2% by the end of 2009.<br />

M ARCH 2010 29