Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Eco Today - Mar10:ET Master Page 2007 - ASKnLearn

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key words<br />

Gross domestic product<br />

Deflation<br />

Output gap<br />

Aggregate demand and supply<br />

Commodity prices<br />

The Prospect Ahead:<br />

Deflation or Inflation<br />

Quintin Brewer, a Chief Examiner and teacher at North London Collegiate School,<br />

considers a data response question concerning the prospects for deflation or inflation.<br />

A<br />

s the UK and world economy moves out of recession and into recovery in<br />

2010, there is discussion about whether there is a danger of deflation or a<br />

likelihood of inflation. Obviously, this has important implications for monetary<br />

policy, in terms of decisions made by the Bank of England’s Monetary Policy<br />

Committee with regard to both interest rates and its policy of quantitative easing.<br />

Much of this is highly topical and you should remember that examiners are always<br />

impressed by those candidates whose responses reflect understanding of current<br />

economic issues together with an ability to apply relevant economic theory in<br />

discussing them.<br />

N.B. Although much of the material is relevant to AS, some of the answers would only be covered in your A2 course.<br />

Extract 1: The danger of deflation<br />

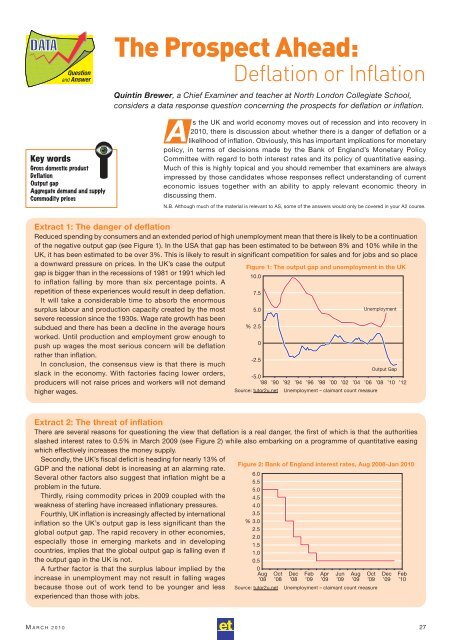

Reduced spending by consumers and an extended period of high unemployment mean that there is likely to be a continuation<br />

of the negative output gap (see Figure 1). In the USA that gap has been estimated to be between 8% and 10% while in the<br />

UK, it has been estimated to be over 3%. This is likely to result in significant competition for sales and for jobs and so place<br />

a downward pressure on prices. In the UK’s case the output<br />

Figure 1: The output gap and unemployment in the UK<br />

gap is bigger than in the recessions of 1981 or 1991 which led<br />

10.0<br />

to inflation falling by more than six percentage points. A<br />

repetition of these experiences would result in deep deflation.<br />

7.5<br />

It will take a considerable time to absorb the enormous<br />

surplus labour and production capacity created by the most<br />

severe recession since the 1930s. Wage rate growth has been<br />

subdued and there has been a decline in the average hours<br />

worked. Until production and employment grow enough to<br />

push up wages the most serious concern will be deflation<br />

5.0<br />

% 2.5<br />

0<br />

Unemployment<br />

rather than inflation.<br />

-2.5<br />

In conclusion, the consensus view is that there is much<br />

Output Gap<br />

slack in the economy. With factories facing lower orders,<br />

-5.0<br />

producers will not raise prices and workers will not demand<br />

’88 ’90 ’92 ’94 ’96 ’98 ’00 ’02 ’04 ’06 ’08 ’10 ’12<br />

higher wages.<br />

Source: tutor2u.net Unemployment – claimant count measure<br />

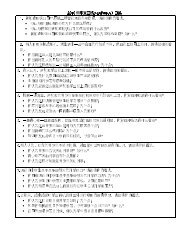

Extract 2: The threat of inflation<br />

There are several reasons for questioning the view that deflation is a real danger, the first of which is that the authorities<br />

slashed interest rates to 0.5% in March 2009 (see Figure 2) while also embarking on a programme of quantitative easing<br />

which effectively increases the money supply.<br />

Secondly, the UK’s fiscal deficit is heading for nearly 13% of<br />

GDP and the national debt is increasing at an alarming rate.<br />

Several other factors also suggest that inflation might be a<br />

problem in the future.<br />

Thirdly, rising commodity prices in 2009 coupled with the<br />

weakness of sterling have increased inflationary pressures.<br />

Fourthly, UK inflation is increasingly affected by international<br />

inflation so the UK’s output gap is less significant than the<br />

global output gap. The rapid recovery in other economies,<br />

especially those in emerging markets and in developing<br />

countries, implies that the global output gap is falling even if<br />

the output gap in the UK is not.<br />

A further factor is that the surplus labour implied by the<br />

increase in unemployment may not result in falling wages<br />

because those out of work tend to be younger and less<br />

experienced than those with jobs.<br />

Figure 2: Bank of England interest rates, Aug 2008-Jan 2010<br />

%<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0<br />

Aug<br />

’08<br />

Oct<br />

’08<br />

Source: tutor2u.net<br />

Dec<br />

’08<br />

Feb<br />

’09<br />

Apr<br />

’09<br />

Jun<br />

’09<br />

Aug<br />

’09<br />

Oct<br />

’09<br />

Unemployment – claimant count measure<br />

Dec<br />

’09<br />

Feb<br />

’10<br />

M ARCH 2010 27