enl commercial limited annual report 2011 - Investing In Africa

enl commercial limited annual report 2011 - Investing In Africa

enl commercial limited annual report 2011 - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

Year ended June 30, <strong>2011</strong><br />

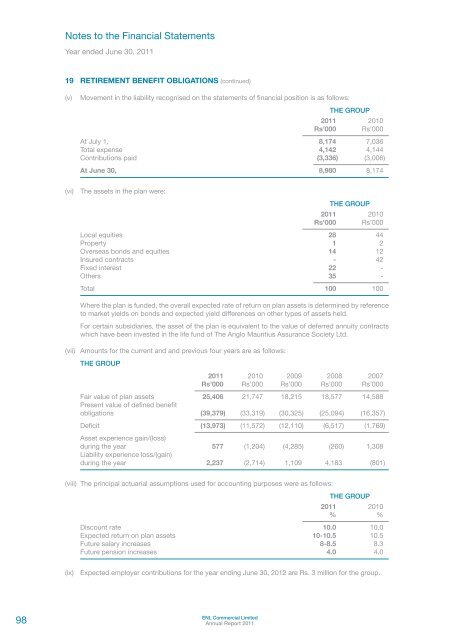

19 RETIREMENT BENEFIT OBLIGATIONS (continued)<br />

(v)<br />

Movement in the liability recognised on the statements of financial position is as follows:<br />

THE GROUP<br />

<strong>2011</strong> 2010<br />

Rs’000 Rs’000<br />

At July 1, 8,174 7,036<br />

Total expense 4,142 4,144<br />

Contributions paid (3,336) (3,006)<br />

At June 30, 8,980 8,174<br />

(vi) The assets in the plan were:<br />

THE GROUP<br />

<strong>2011</strong> 2010<br />

Rs’000 Rs’000<br />

Local equities 28 44<br />

Property 1 2<br />

Overseas bonds and equities 14 12<br />

<strong>In</strong>sured contracts - 42<br />

Fixed interest 22 -<br />

Others 35 -<br />

Total 100 100<br />

Where the plan is funded, the overall expected rate of return on plan assets is determined by reference<br />

to market yields on bonds and expected yield differences on other types of assets held.<br />

For certain subsidiaries, the asset of the plan is equivalent to the value of deferred annuity contracts<br />

which have been invested in the life fund of The Anglo Mauritius Assurance Society Ltd.<br />

(vii) Amounts for the current and and previous four years are as follows:<br />

THE GROUP<br />

<strong>2011</strong> 2010 2009 2008 2007<br />

Rs’000 Rs’000 Rs’000 Rs’000 Rs’000<br />

Fair value of plan assets 25,406 21,747 18,215 18,577 14,588<br />

Present value of defined benefit<br />

obligations (39,379) (33,319) (30,325) (25,094) (16,357)<br />

Deficit (13,973) (11,572) (12,110) (6,517) (1,769)<br />

Asset experience gain/(loss)<br />

during the year 577 (1,204) (4,285) (260) 1,308<br />

Liability experience loss/(gain)<br />

during the year 2,237 (2,714) 1,109 4,183 (801)<br />

(viii) The principal actuarial assumptions used for accounting purposes were as follows:<br />

THE GROUP<br />

<strong>2011</strong> 2010<br />

% %<br />

Discount rate 10.0 10.0<br />

Expected return on plan assets 10-10.5 10.5<br />

Future salary increases 8-8.5 8.3<br />

Future pension increases 4.0 4.0<br />

(ix) Expected employer contributions for the year ending June 30, 2012 are Rs. 3 million for the group.<br />

98<br />

ENL Commercial Limited<br />

Annual Report <strong>2011</strong>