enl commercial limited annual report 2011 - Investing In Africa

enl commercial limited annual report 2011 - Investing In Africa

enl commercial limited annual report 2011 - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

Year ended June 30, <strong>2011</strong><br />

32 RELATED PARTY TRANSACTIONS (continued)<br />

The sales to and purchases from related parties are made at normal market prices. Outstanding<br />

balances at the year end are unsecured, interest free (except for loans receivable and payable) and<br />

settlement occurs in cash.<br />

For the year ended June 30, <strong>2011</strong>, the group has not recorded any impairment of receivables relating<br />

to amounts owed by related parties (2010: nil) This assessment is undertaken each financial year<br />

through examining the financial position of the related party and the market in which the related party<br />

operates.<br />

The loans receivable from subsidiaries are receivable at call.<br />

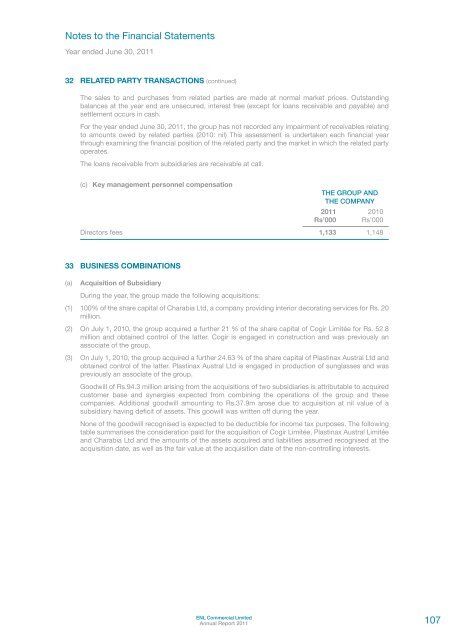

(c) Key management personnel compensation<br />

THE GROUP AND<br />

THE COMPANY<br />

<strong>2011</strong> 2010<br />

Rs’000 Rs’000<br />

Directors fees 1,133 1,148<br />

33 BUSINESS COMBINATIONS<br />

(a) Acquisition of Subsidiary<br />

During the year, the group made the following acquisitions:<br />

(1) 100% of the share capital of Charabia Ltd, a company providing interior decorating services for Rs. 20<br />

million.<br />

(2) On July 1, 2010, the group acquired a further 21 % of the share capital of Cogir Limitée for Rs. 52.8<br />

million and obtained control of the latter. Cogir is engaged in construction and was previously an<br />

associate of the group.<br />

(3) On July 1, 2010, the group acquired a further 24.63 % of the share capital of Plastinax Austral Ltd and<br />

obtained control of the latter. Plastinax Austral Ltd is engaged in production of sunglasses and was<br />

previously an associate of the group.<br />

Goodwill of Rs.94.3 million arising from the acquisitions of two subsidiaries is attributable to acquired<br />

customer base and synergies expected from combining the operations of the group and these<br />

companies. Additional goodwill amounting to Rs.37.9m arose due to acquisition at nil value of a<br />

subsidiary having deficit of assets. This goowill was written off during the year.<br />

None of the goodwill recognised is expected to be deductible for income tax purposes. The following<br />

table summarises the consideration paid for the acquisition of Cogir Limitée, Plastinax Austral Limitée<br />

and Charabia Ltd and the amounts of the assets acquired and liabilities assumed recognised at the<br />

acquisition date, as well as the fair value at the acquisition date of the non-controlling interests.<br />

ENL Commercial Limited<br />

Annual Report <strong>2011</strong><br />

107