enl commercial limited annual report 2011 - Investing In Africa

enl commercial limited annual report 2011 - Investing In Africa

enl commercial limited annual report 2011 - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

Year ended June 30, <strong>2011</strong><br />

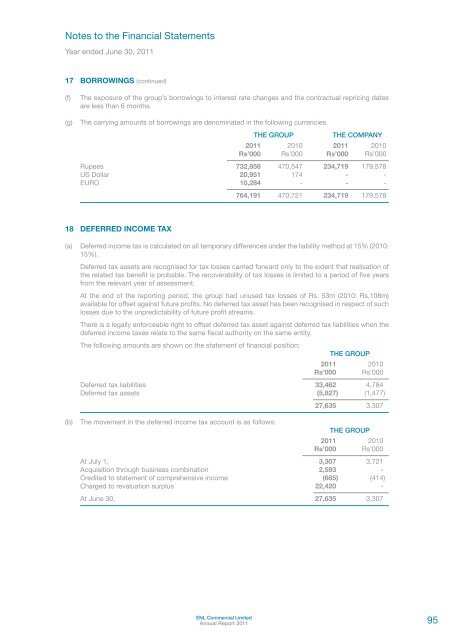

17 BORROWINGS (continued)<br />

(f)<br />

(g)<br />

The exposure of the group’s borrowings to interest rate changes and the contractual repricing dates<br />

are less than 6 months.<br />

The carrying amounts of borrowings are denominated in the following currencies.<br />

THE GROUP<br />

THE COMPANY<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Rs’000 Rs’000 Rs’000 Rs’000<br />

Rupees 732,956 470,547 234,719 179,578<br />

US Dollar 20,951 174 - -<br />

EURO 10,284 - - -<br />

764,191 470,721 234,719 179,578<br />

18 DEFERRED INCOME TAX<br />

(a) Deferred income tax is calculated on all temporary differences under the liability method at 15% (2010:<br />

15%).<br />

Deferred tax assets are recognised for tax losses carried forward only to the extent that realisation of<br />

the related tax benefit is probable. The recoverability of tax losses is <strong>limited</strong> to a period of five years<br />

from the relevant year of assessment.<br />

At the end of the <strong>report</strong>ing period, the group had unused tax losses of Rs. 53m (2010: Rs.108m)<br />

available for offset against future profits. No deferred tax asset has been recognised in respect of such<br />

losses due to the unpredictability of future profit streams.<br />

There is a legally enforceable right to offset deferred tax asset against deferred tax liabilities when the<br />

deferred income taxes relate to the same fiscal authority on the same entity.<br />

The following amounts are shown on the statement of financial position:<br />

THE GROUP<br />

<strong>2011</strong> 2010<br />

Rs’000 Rs’000<br />

Deferred tax liabilities 33,462 4,784<br />

Deferred tax assets (5,827) (1,477)<br />

27,635 3,307<br />

(b)<br />

The movement in the deferred income tax account is as follows:<br />

THE GROUP<br />

<strong>2011</strong> 2010<br />

Rs’000 Rs’000<br />

At July 1, 3,307 3,721<br />

Acquisition through business combination 2,593 -<br />

Credited to statement of comprehensive income (685) (414)<br />

Charged to revaluation surplus 22,420 -<br />

At June 30, 27,635 3,307<br />

ENL Commercial Limited<br />

Annual Report <strong>2011</strong><br />

95