International Financial Reporting Standards_guide.pdf

International Financial Reporting Standards_guide.pdf

International Financial Reporting Standards_guide.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chapter 3 Presentation of <strong>Financial</strong> Statements (IAS 1) 33<br />

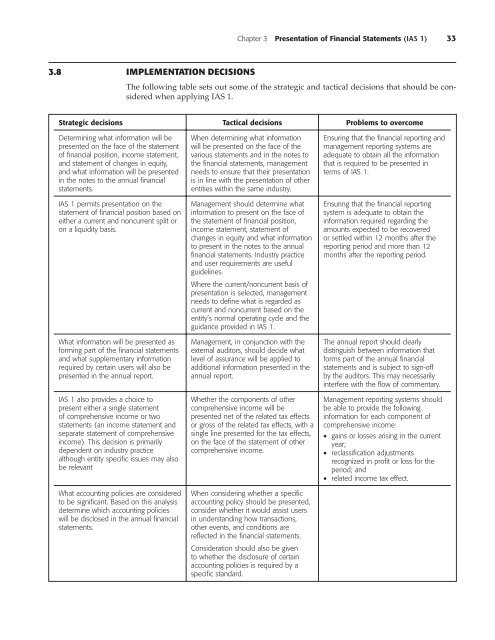

3.8 IMPLEMENTATION DECISIONS<br />

The following table sets out some of the strategic and tactical decisions that should be considered<br />

when applying IAS 1.<br />

Strategic decisions Tactical decisions Problems to overcome<br />

Determining what information will be<br />

presented on the face of the statement<br />

of financial position, income statement,<br />

and statement of changes in equity,<br />

and what information will be presented<br />

in the notes to the annual financial<br />

statements.<br />

IAS 1 permits presentation on the<br />

statement of financial position based on<br />

either a current and noncurrent split or<br />

on a liquidity basis.<br />

What information will be presented as<br />

forming part of the financial statements<br />

and what supplementary information<br />

required by certain users will also be<br />

presented in the annual report.<br />

IAS 1 also provides a choice to<br />

present either a single statement<br />

of comprehensive income or two<br />

statements (an income statement and<br />

separate statement of comprehensive<br />

income). This decision is primarily<br />

dependent on industry practice<br />

although entity specific issues may also<br />

be relevant<br />

What accounting policies are considered<br />

to be significant. Based on this analysis<br />

determine which accounting policies<br />

will be disclosed in the annual financial<br />

statements.<br />

When determining what information<br />

will be presented on the face of the<br />

various statements and in the notes to<br />

the financial statements, management<br />

needs to ensure that their presentation<br />

is in line with the presentation of other<br />

entities within the same industry.<br />

Management should determine what<br />

information to present on the face of<br />

the statement of financial position,<br />

income statement, statement of<br />

changes in equity and what information<br />

to present in the notes to the annual<br />

financial statements. Industry practice<br />

and user requirements are useful<br />

<strong>guide</strong>lines.<br />

Where the current/noncurrent basis of<br />

presentation is selected, management<br />

needs to define what is regarded as<br />

current and noncurrent based on the<br />

entity’s normal operating cycle and the<br />

guidance provided in IAS 1.<br />

Management, in conjunction with the<br />

external auditors, should decide what<br />

level of assurance will be applied to<br />

additional information presented in the<br />

annual report.<br />

Whether the components of other<br />

comprehensive income will be<br />

presented net of the related tax effects<br />

or gross of the related tax effects, with a<br />

single line presented for the tax effects,<br />

on the face of the statement of other<br />

comprehensive income.<br />

When considering whether a specific<br />

accounting policy should be presented,<br />

consider whether it would assist users<br />

in understanding how transactions,<br />

other events, and conditions are<br />

reflected in the financial statements.<br />

Consideration should also be given<br />

to whether the disclosure of certain<br />

accounting policies is required by a<br />

specific standard.<br />

Ensuring that the financial reporting and<br />

management reporting systems are<br />

adequate to obtain all the information<br />

that is required to be presented in<br />

terms of IAS 1.<br />

Ensuring that the financial reporting<br />

system is adequate to obtain the<br />

information required regarding the<br />

amounts expected to be recovered<br />

or settled within 12 months after the<br />

reporting period and more than 12<br />

months after the reporting period.<br />

The annual report should clearly<br />

distinguish between information that<br />

forms part of the annual financial<br />

statements and is subject to sign-off<br />

by the auditors. This may necessarily<br />

interfere with the flow of commentary.<br />

Management reporting systems should<br />

be able to provide the following<br />

information for each component of<br />

comprehensive income:<br />

• gains or losses arising in the current<br />

year;<br />

• reclassification adjustments<br />

recognized in profit or loss for the<br />

period; and<br />

• related income tax effect.