Landeskreditbank Baden-Württemberg - L-Bank

Landeskreditbank Baden-Württemberg - L-Bank

Landeskreditbank Baden-Württemberg - L-Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

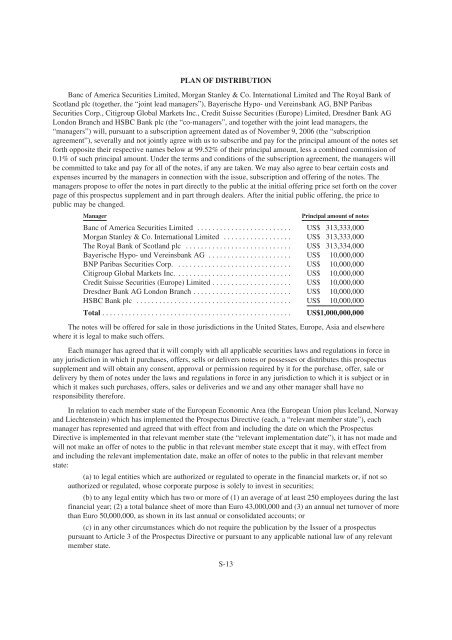

PLAN OF DISTRIBUTION<br />

Banc of America Securities Limited, Morgan Stanley & Co. International Limited and The Royal <strong>Bank</strong> of<br />

Scotland plc (together, the “joint lead managers”), Bayerische Hypo- und Vereinsbank AG, BNP Paribas<br />

Securities Corp., Citigroup Global Markets Inc., Credit Suisse Securities (Europe) Limited, Dresdner <strong>Bank</strong> AG<br />

London Branch and HSBC <strong>Bank</strong> plc (the “co-managers”, and together with the joint lead managers, the<br />

“managers”) will, pursuant to a subscription agreement dated as of November 9, 2006 (the “subscription<br />

agreement”), severally and not jointly agree with us to subscribe and pay for the principal amount of the notes set<br />

forth opposite their respective names below at 99.52% of their principal amount, less a combined commission of<br />

0.1% of such principal amount. Under the terms and conditions of the subscription agreement, the managers will<br />

be committed to take and pay for all of the notes, if any are taken. We may also agree to bear certain costs and<br />

expenses incurred by the managers in connection with the issue, subscription and offering of the notes. The<br />

managers propose to offer the notes in part directly to the public at the initial offering price set forth on the cover<br />

page of this prospectus supplement and in part through dealers. After the initial public offering, the price to<br />

public may be changed.<br />

Manager<br />

Principal amount of notes<br />

Banc of America Securities Limited ......................... US$ 313,333,000<br />

Morgan Stanley & Co. International Limited .................. US$ 313,333,000<br />

The Royal <strong>Bank</strong> of Scotland plc ............................ US$ 313,334,000<br />

Bayerische Hypo- und Vereinsbank AG ...................... US$ 10,000,000<br />

BNP Paribas Securities Corp. .............................. US$ 10,000,000<br />

Citigroup Global Markets Inc. .............................. US$ 10,000,000<br />

Credit Suisse Securities (Europe) Limited ..................... US$ 10,000,000<br />

Dresdner <strong>Bank</strong> AG London Branch .......................... US$ 10,000,000<br />

HSBC<strong>Bank</strong>plc ......................................... US$ 10,000,000<br />

Total ..................................................<br />

US$1,000,000,000<br />

The notes will be offered for sale in those jurisdictions in the United States, Europe, Asia and elsewhere<br />

where it is legal to make such offers.<br />

Each manager has agreed that it will comply with all applicable securities laws and regulations in force in<br />

any jurisdiction in which it purchases, offers, sells or delivers notes or possesses or distributes this prospectus<br />

supplement and will obtain any consent, approval or permission required by it for the purchase, offer, sale or<br />

delivery by them of notes under the laws and regulations in force in any jurisdiction to which it is subject or in<br />

which it makes such purchases, offers, sales or deliveries and we and any other manager shall have no<br />

responsibility therefore.<br />

In relation to each member state of the European Economic Area (the European Union plus Iceland, Norway<br />

and Liechtenstein) which has implemented the Prospectus Directive (each, a “relevant member state”), each<br />

manager has represented and agreed that with effect from and including the date on which the Prospectus<br />

Directive is implemented in that relevant member state (the “relevant implementation date”), it has not made and<br />

will not make an offer of notes to the public in that relevant member state except that it may, with effect from<br />

and including the relevant implementation date, make an offer of notes to the public in that relevant member<br />

state:<br />

(a) to legal entities which are authorized or regulated to operate in the financial markets or, if not so<br />

authorized or regulated, whose corporate purpose is solely to invest in securities;<br />

(b) to any legal entity which has two or more of (1) an average of at least 250 employees during the last<br />

financial year; (2) a total balance sheet of more than Euro 43,000,000 and (3) an annual net turnover of more<br />

than Euro 50,000,000, as shown in its last annual or consolidated accounts; or<br />

(c) in any other circumstances which do not require the publication by the Issuer of a prospectus<br />

pursuant to Article 3 of the Prospectus Directive or pursuant to any applicable national law of any relevant<br />

member state.<br />

S-13