Landeskreditbank Baden-Württemberg - L-Bank

Landeskreditbank Baden-Württemberg - L-Bank

Landeskreditbank Baden-Württemberg - L-Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PROSPECTUS SUMMARY<br />

The following summary should only be read in connection with, and is qualified by, the more detailed<br />

information and financial data presented elsewhere in this prospectus.<br />

L-<strong>Bank</strong><br />

L-<strong>Bank</strong> is the state development bank of <strong>Baden</strong>-Württemberg, one of the states of Germany. We were<br />

established by statute effective December 1, 1998, as a result of the separation of the state development business<br />

from the commercial banking business of the former <strong>Landeskreditbank</strong> <strong>Baden</strong>-Württemberg, whereby all assets<br />

and liabilities of the state development business were transferred to us. We are wholly-owned by <strong>Baden</strong>-<br />

Württemberg.<br />

We provide funding in support of the numerous development activities of <strong>Baden</strong>-Württemberg, acting as the<br />

state’s own development bank. Pursuant to our governing law, we carry out our business not as a competitor to,<br />

but as a supportive partner of, private, cooperative and public-sector banks operating in the open market.<br />

As <strong>Baden</strong>-Württemberg’s state development bank our main responsibilities and activities are:<br />

• the financing, primarily on a subsidized basis, of housing construction, trade, industry, agriculture and<br />

forestry, environmental protection, urban renewal and development projects, as well as improvements to<br />

the state infrastructure in the form of loans, grants, guaranties or equity capital, with special focus on<br />

providing support for small and medium-sized enterprises in <strong>Baden</strong>-Württemberg; and<br />

• administering the application of funds for a large number of state, federal and European Union financial<br />

aid programs, especially for family benefits.<br />

The government of <strong>Baden</strong>-Württemberg, the German federal government and other public authorities —<br />

including institutions of the European Union — all fund our activities by way of loans and grants. In addition we<br />

employ own funds.<br />

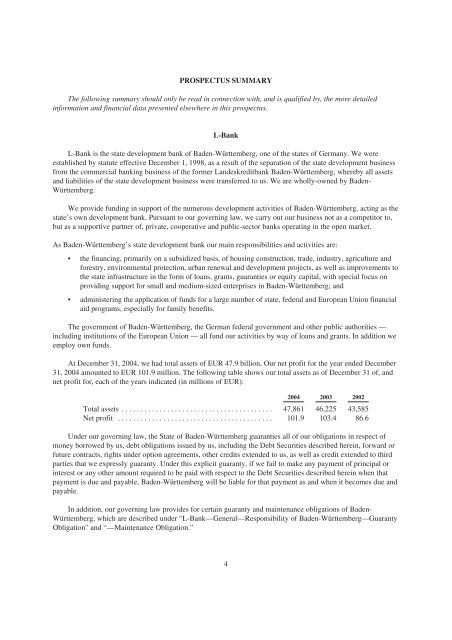

At December 31, 2004, we had total assets of EUR 47.9 billion. Our net profit for the year ended December<br />

31, 2004 amounted to EUR 101.9 million. The following table shows our total assets as of December 31 of, and<br />

net profit for, each of the years indicated (in millions of EUR):<br />

2004 2003 2002<br />

Total assets ........................................ 47,861 46,225 43,585<br />

Net profit ......................................... 101.9 103.4 86.6<br />

Under our governing law, the State of <strong>Baden</strong>-Württemberg guaranties all of our obligations in respect of<br />

money borrowed by us, debt obligations issued by us, including the Debt Securities described herein, forward or<br />

future contracts, rights under option agreements, other credits extended to us, as well as credit extended to third<br />

parties that we expressly guaranty. Under this explicit guaranty, if we fail to make any payment of principal or<br />

interest or any other amount required to be paid with respect to the Debt Securities described herein when that<br />

payment is due and payable, <strong>Baden</strong>-Württemberg will be liable for that payment as and when it becomes due and<br />

payable.<br />

In addition, our governing law provides for certain guaranty and maintenance obligations of <strong>Baden</strong>-<br />

Württemberg, which are described under “L-<strong>Bank</strong>—General—Responsibility of <strong>Baden</strong>-Württemberg—Guaranty<br />

Obligation” and “—Maintenance Obligation.”<br />

4