oregon motor carrier registration & tax manual - Oregon Department ...

oregon motor carrier registration & tax manual - Oregon Department ...

oregon motor carrier registration & tax manual - Oregon Department ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Oregon</strong> Motor Carrier Registration & Tax Manual<br />

Apportioned (IRP) Fees<br />

Registration fees are calculated using the percentage of operation in a jurisdiction by the rate<br />

that each jurisdiction charges for <strong>registration</strong>. The basis for <strong>registration</strong> fees for each<br />

jurisdiction varies, but it is generally based on a vehicle’s weight, value, age, and other<br />

factors. The vehicle is legally registered in all jurisdictions that appear on the vehicle’s<br />

<strong>registration</strong> card.<br />

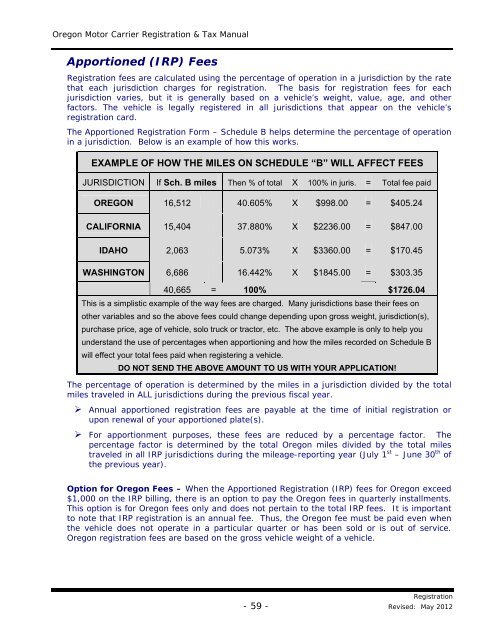

The Apportioned Registration Form – Schedule B helps determine the percentage of operation<br />

in a jurisdiction. Below is an example of how this works.<br />

EXAMPLE OF HOW THE MILES ON SCHEDULE “B” WILL AFFECT FEES<br />

JURISDICTION If Sch. B miles Then % of total X 100% in juris. = Total fee paid<br />

OREGON 16,512 40.605% X $998.00 = $405.24<br />

CALIFORNIA 15,404 37.880% X $2236.00 = $847.00<br />

IDAHO 2,063 5.073% X $3360.00 = $170.45<br />

WASHINGTON 6,686 16.442% X $1845.00 = $303.35<br />

40,665 = 100% $1726.04<br />

This is a simplistic example of the way fees are charged. Many jurisdictions base their fees on<br />

other variables and so the above fees could change depending upon gross weight, jurisdiction(s),<br />

purchase price, age of vehicle, solo truck or tractor, etc. The above example is only to help you<br />

understand the use of percentages when apportioning and how the miles recorded on Schedule B<br />

will effect your total fees paid when registering a vehicle.<br />

DO NOT SEND THE ABOVE AMOUNT TO US WITH YOUR APPLICATION!<br />

The percentage of operation is determined by the miles in a jurisdiction divided by the total<br />

miles traveled in ALL jurisdictions during the previous fiscal year.<br />

‣ Annual apportioned <strong>registration</strong> fees are payable at the time of initial <strong>registration</strong> or<br />

upon renewal of your apportioned plate(s).<br />

‣ For apportionment purposes, these fees are reduced by a percentage factor. The<br />

percentage factor is determined by the total <strong>Oregon</strong> miles divided by the total miles<br />

traveled in all IRP jurisdictions during the mileage-reporting year (July 1 st – June 30 th of<br />

the previous year).<br />

Option for <strong>Oregon</strong> Fees – When the Apportioned Registration (IRP) fees for <strong>Oregon</strong> exceed<br />

$1,000 on the IRP billing, there is an option to pay the <strong>Oregon</strong> fees in quarterly installments.<br />

This option is for <strong>Oregon</strong> fees only and does not pertain to the total IRP fees. It is important<br />

to note that IRP <strong>registration</strong> is an annual fee. Thus, the <strong>Oregon</strong> fee must be paid even when<br />

the vehicle does not operate in a particular quarter or has been sold or is out of service.<br />

<strong>Oregon</strong> <strong>registration</strong> fees are based on the gross vehicle weight of a vehicle.<br />

Registration<br />

- 59 - Revised: May 2012